…I knew prices would be in the basement during the CV shutdown, but this is blowing my mind. Never thought I’d see the day…

If you have physical barrels of oil you have to sell today, you are screwed. Wait 2 days & it might be $20. Contracts are expiring tomorrow so this happens.

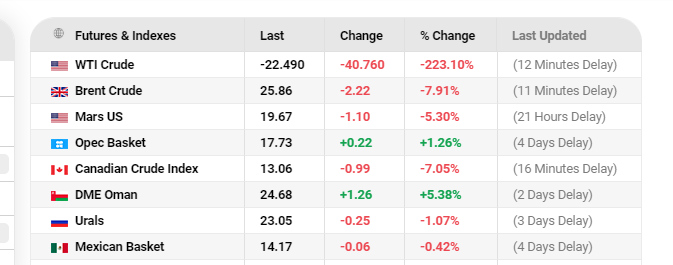

That is for May contract prices. June Contract prices still in the $20s.

However, we have seen gas go negative because of lack of capacity and too much supply. Certainly possible oil could go negative for intervals also. The difference is while they can flare gas, when they run out of storage places for oil, they have to shut in wells. They won’t dump it on the ground.

Just hit $0.10. Never thought I would see that. Take a deep breath and hold on. This is going to be an “interesting” few months.

@M_Barnes You are right about that, I hope it’s just the next few months that are “interesting.”

A question for the industry veterans among us: How long do you think this can really last?

All fundamentals now. No demand from Chinese flu shutdown of worlds greatest economy. When demand returns it will be up to Saudi Arabia. The capital intensive shale industry is going to dry up. It wasn’t that long ago we had $15.00 nat gas and for the last 5 years it doesn’t get above $3.00. IMHO, mostly the same will happen here with oil.

Yes, but for May contract only, which expires in a few days. June contract WTI is currently at $20.99.

Old oil patch saying - The best solution for low oil prices is low oil prices.

Spot is the price you are paid on not futures. Two WTI price series.

I’ve heard this oil fiasco is part of the US moving from the petro dollar to the gold standard. I know Trump is aware of the US oil prices. Something should turn around soon. Coronavirus has just about run its course. So, industries should turn around. Hold on. It’s gonna be a bumpy ride, but we will come out of this. I just don’t want the oil companies to get a ruling that they can shut-in their wells and make us adhere to the leases we signed. Important ruling to pay close attention to.

Hello,

I receive a check every month on two oil wells. The checks have been declining each month over the last two years which I’m told is normal.

Since oil is in the negative could this mean I won’t receive a check?

I’m assuming new drilling is also unlikely.

Thank you. Susan Titus

If wells are shut down, is it true that sometimes those wells can’t be started again?

The answer will depend upon the well and the operator’s overall ecnomic plan. Some will be started back up when it is economically feasible to do so. Some may never start up again if there is no economic reason to do so. Then you would have to consult your lease as to whether you get small payments through your shut in clause (or not). Some wells will be sold. Some wells may start up, but be a higher or lower volumes than before depending upon the recharge of reservoir pressure. Some wells may require workovers before they can open up again. The cost of those workovers may determine the time schedule. Some companies will go into bankruptcy and the value of the well to a new owner will be considered. Each well will have its own particular parameters which determine its fate.

I don’t know that wells can’t be started again, but depending on the type of well, it may be less productive upon restarting. My understanding is that shale wells don’t like to be shut-in. In other words, a very productive shale well, once shut-in and reopened, may only deliver a fraction of the product it did previously.

That said, unless parts of the country really do begin opening up and the coming weeks and moving about using O&G-consuming transportation, I don’t see how any shale well can continue to produce if the oil has nowhere to go physically.

If you own royalty interests, it’s a disappointing time, to say the least. Even if your wells do stay open, with prices negative, the short-term prospects of income off wells are grim.

Thank you M Barnes and nativedancer.

Susan- you will continue to receive checks as the information you are mentioning is only “paper”. BUT, oil isn’t selling for much so your checks you get in May and forward will reflect these reduced prices. And you can bet at this time, there won’t be anymore drilling. Rigs are being stacked in storage and service companies are filing bankruptcy so the industry doesn’t have a very positive near term outlook.

Thank you, Todd.

Hopefully, oil will rebound before long.

I still receive calls and letters from people wanting to buy the mineral rights at a very reduced price from last year.

Thanks again. Susan

@Barry_Manus; Some wells that are shut in actually initially come back stronger as well pressure build up enhances production rates for a period of time. Wells that were producing significant water or frac water may have issues trying to unload that water thus restricting production rates. @M_Barnes: hope is well with you. Enjoy your comments and excellent insight on this forum. Always good to hear from a past work peer! D. Stone

A very short period of time. Lost reservoir pressure & reserves can’t be made up under any natural circumstances.