I received an offer to purchase my royalty in Pecos County from Anthem Oil & Gas. Totally unsolicited and with a purchase price that seemed unrealistic at best. I realize there is a lot of fishing and prospecting going on in West Texas and this is not the first letter of this type I have received. But I am curious about Anthem and the possibility that their offer could be legit (which I doubt). The signer of the letter, Dustin Bell, is also the signer of a similar letter from Hill Country Mineral Partners I received in early March. Any input or suggestions will be appreciated.

Anthem O&G (www.anthemoil.com) is just another group that buys minerals. They appear to be well funded but their MO like all other groups like this is to buy as low as possible in anticipation of more drilling taking place n the future.

They are legit - now the question is "do you want to sell?"

Remember, you can sell a part of your minerals if you want - it does not have to be an all or nothing deal (unless they will only take 100% of your minerals and not do a split deal).

Where are your minerals? How active is your area?

Thats what I thought. I don't have access to the legals, but a general description/location is: Ft. Stockton Gas Unit 6 and the operator is Chevron. This property has been in my family for years and the royalty revenue is almost nonexistent.

I would definitely sell for the amount in Anthem's letter, almost $60K. But I realize that is their hook to get me to respond. Otherwise there is low/no expense to me and probably better to hang on to it and see what happens.

Thanks for your reply.

$60,000 for how many mineral acres? Or how much per net mineral acre (approximate)?

Things have been heating up in that part of the basin / Pecos County - and Chevron is doing a lot of horizontal drilling in other parts of the basin.

Let me look a bit more and get back to you on activity

Joe,

I took a quick look at the Fort Stockton area where you have your minerals. This old Chevron production (started back in the late 60's) is deep (17,000') gas from Ellenburger section. Dry gas and probably low royalty numbers - so Chevron likes it a lot for potential future drilling.

A quick look at the logs here show a lot of prospective section that could be tapped by horizontal drilling (i.e. shale plays). No guarantees that this would work but this is why Anthem is willing to pay you some big numbers for your minerals.

No idea when this could get drilled but if it ever is and it works ..................................

Great info, thanks!

As I noted, this has been in my family for many years. The royalty flow is so low that Chevron doesn't send out checks until the accumulated royalty goes over $100. Frankly, I haven't seen a check in several years. But your info is definitely interesting and gives me reason to be cautiously optimistic. I will try to find the legal description as that should pinpoint the area better.

Thanks again...have a nice weekend.

Joe …

If you’re able to post the Block and Section numbers of these minerals you might be able to get comments from other mineral owners who might be aware of activity happening in your area. You mentioned that you haven’t seen a royalty check for this area in several years. Is it possible that your minerals are no longer being held by production? If so, then you might be eligible to look for a new lease. If its a hot area, and depending on how many Net Mineral Acres you have, if you are able to get a new lease could you possibly receive a lease bonus that would be near what you’re being offered to SELL your minerals? Perhaps a nice lease bonus AND you’d still keep your minerals?

Concerning Chevron’s $100 minimum royalty amount before they send a check: I’ve had a similar situation and called the producer and asked for them to lower the minimum amount required for a royalty check to be sent … and that was granted. You might give that a try … nothing to lose … and it might be an easy way to tell if any production is still taking place.

Just some thoughts. Good luck.

Just looked at DrillingInfo.com site to check on Fort Stockton GU #6 production - well is still active and has been for decades with no production gaps. But latest rates on are only in the 15 to 25 MCF per day range (which is an increase over the 3-4 MCF per day range this well was making a few years ago). I’d attached the production graph PDF but no way to attach anything in this discussion site.

Thanks. I am trying to get the the Blk/Sec numbers and hope to have that info in a few days. And, yes, I have contacted Chevron and they indicated a check will be sent in July...well less than $100, however.

I appreciate your investigation and what you found. Very interesting and basically in line with what Chevron told me. At .002715 and low production, I don't plan to retire on the royalty. I will try to add you as a friend and will send my email and would enjoy seeing the production information you found. Thanks again!

Doesn't appear to be a block and section area.

May be "J Richards Survey A-762".

Thank you for this discussion. I “hear” from Dustin Bell, if that’s an actual person, on a regular basis. His last offer, today, is for almost 100K less than an offer from June 13th (that’s ten days ago), just FYI.

I don’t want to necessarily hijack a discussion.

It’s been my experience that many of the offer letters will come in unrealistically high. In the offer letter, they request that you send the last 3 months of royalty check stubs for them to examine.

After they examine the royalty check stubs, they almost always come in with a much lower royalty offer based on “projection and geologic interpretation” or words to that effect.

Royalty buying and selling is an extremely tricky business.

Best wishes and good luck,

Buddy Cotten

The letter I received today from Dustin Bell at Anthem was for $25K more than his letter a few weeks ago and $10K less than his letter in May. A waste of paper, ink and postage in my opinion.

I get the same thing, and in about the same amounts. He’s either a real bottom-feeder or it’s an assumed name. He also sends letters from more than one company. I sent a “leave me alone” twice… I just got another one, just signed using another name.

For what (little) it is worth: Dustin Bell has surfaced at yet another company making yet another unsolicited offer. This letter, representing his fourth different company, is from Northpoint Mineral Group in Cypress, TX. Also, Anthem Oil & Gas now has a female doing telephone cold calling on “behalf of Mr. Bell”. Asking to be removed from their contact list is pointless!

Does anyone have information about what is driving the increase in offers to buy mineral leasing rights in Block 118 of Pecos County? What are best benchmarks for deciding whether or not to sell when so many offers are coming in to purchase? Does that mean real probability of new/increased production?

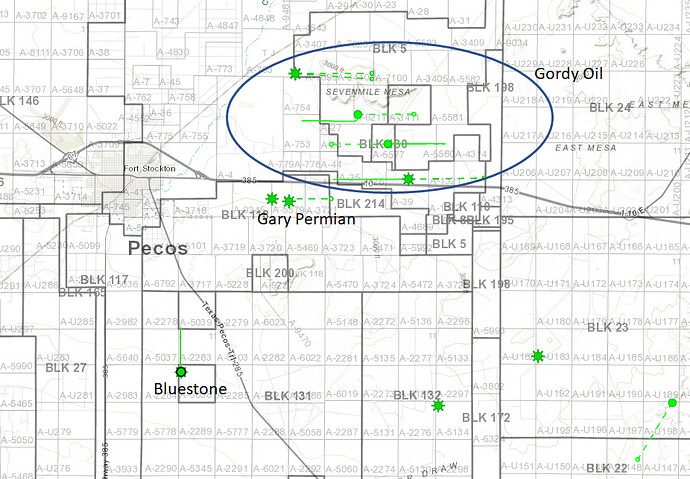

I assume any increase in offers is, like most places, just driven by wells/permits. Particularly in historically inactive areas. Gordy Oil is drilling wells just north of there and Gary Permian LLC is drilling/permitting in Block 118. The only Gordy well I saw production for was the Don Julio which is about 4 miles north. Its not fantastic but its good enough to drill more wells at reasonable oil prices.

With oil price contraction you would have to think that the margins of the play would be the first place to stop drilling. But who knows. Either way, yes, I would think your odds of new production are higher now then they were a year ago.

I don’t have any great advice on benchmarks. If you are in Sec 6 or 10 or 11 the offer should be more as that is where Gary is drilling. IMO, selling or not selling just depends on the price offered and your situation and risk tolerance.

Here are wells spud within the last year.

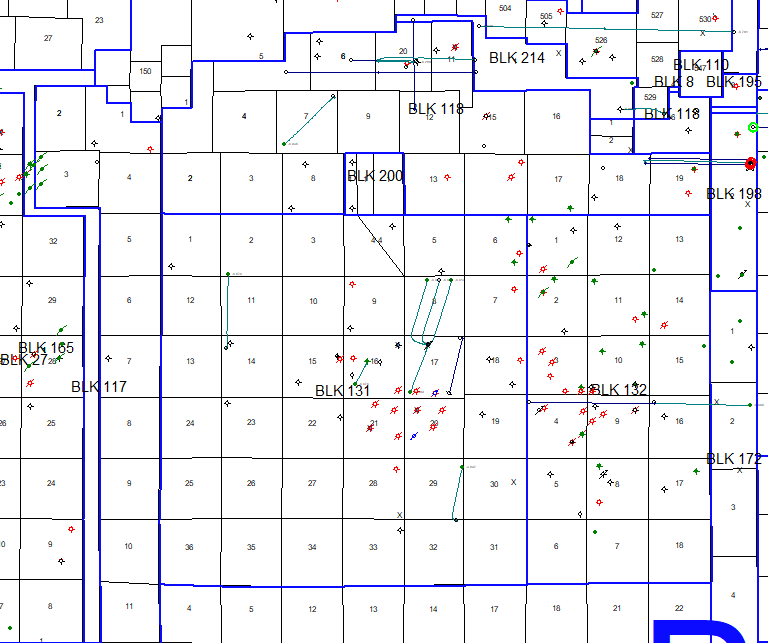

We own mineral rights in block 131. Can anyone tell me which section, on the map, that shows Bluestone. I assume the green star represents a well (producing)? In addition, is there a way to find out who might be producing in section 17 (HBP). Thank you!

That prior map (green stars, etc) was just wells that been spud within the last year. Here (below) is something showing all of the wells. Section 17 is HBP by the BlueStone Stallings 1H (API 4237139719).

Bluestone brought on the Huckleberry well in Section 11 (the one marked Bluestone in the above map) in late 2018 and it’s not real great. Gary Petroleum still seems to be plugging away down here, as are Periscope and Gordy, but overall I would expect this to be a place that doesn’t see much activity unless the oil prices gets higher.