I recently received an offer of $13K per acre for 20.5 mineral acres I inherited outside of Carlsbad. This came as a shock to me because the royalties I have been receiving are around $200 per month. My grandparents signed an oil & gas lease back in 1972. I’m thinking why would a mineral investment company want to pay me that much for this. Can someone give me insight into what is going on in that area? I live in CA and other than inheriting this I know nothing about what is going on there.

Hey Ron our family was going through same thing last year in Lea county right next door to Eddy Co. they are looking down the road we had 186 NRA and got 13,000 but sold less than half we had 1% ORRI depends on your situation how many kids you have to split things up . WE wanted to keep skin in the game and money to boot about 1 million good luck but do not get in big hurry you can get more.

Thanks Tim i definitely am missing valuable insight and appreciate your response. My grandparents had a total of over 160 mineral acres so the 20.5 are my piece. I do want to hold onto it. I read an article in Bloomberg recently addressing the developments in the Permian Basin and improved techniques. Don’t want to miss out on the potential. I was given a month to accept the offer so that made me more suspicious. This is a good time for me to learn more so any advice is appreciated.

NM Oilboy is the best to learn from on this sight I believe , he could give you real close to what its worth is but would need township range and section to evaluate he is awsome!

Prob not all that awesome. ![]()

Besides township range and section would also need to know the royalty rate on your 1972 lease. Cheers.

Thank you so much for your help. It is Township 23 South, Range 28 East, N.M.P.M. Section 10: SW 1/4. The offer states, “Seller believes this acreage is leased at a weighted average royalty of 12.5%”. The rep for the buyer also stated to me on the phone that mine is a 1/8 lease. Is there more that you need me to provide you with?

The mineral investment company sees that Chevron is drilling east and south of your lease.

A rig just showed up to commence drilling the east half of section 10 and section 3, it will also drill south on section 15 and section 22.

Thank you so very much! I haven’t been to that area in over 30 years so I only know what I hear from family that still lives in the area. I definitely need to learn more.

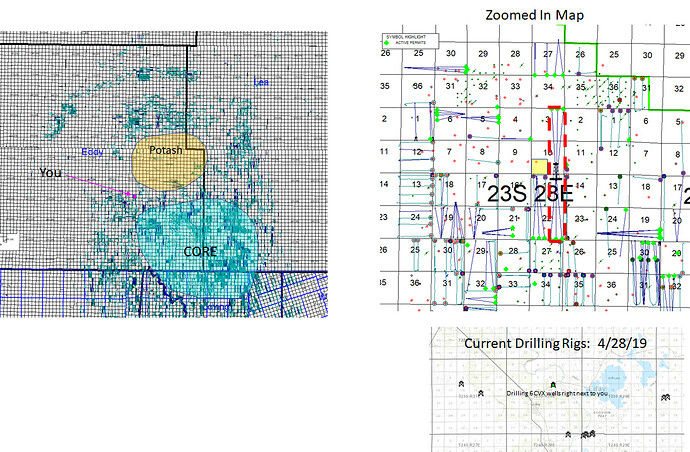

Map on bottom shows where this is located. A lot of the drilling is going on in the “Core” but its pushing out in all directions. Heading your way there is more development going on to the west of the “Potash” area where development will be hampered due to difficulty in accessing oil/gas below the potash.

CMC15 is correct. Chevron has a rig on location (since Apr 25) to drill a 6 well pad going N/S and covering the E/2 of Secs 3,10,15,22. (dotted red box below). At 30-35 days each to drill, that is going to take a while to see any volumes from, but that is going to push up the value of that red acreage.

Unfortunately your lease in the SW of Sec 10 is not pooled in those wells. So you are looking at waiting longer for development and get nothing from the Chevron wells. Right now you should, as you say, be receiving small checks from the vertical Urquidez Com 1 gas well, operated by Oxy. Oxy is not very active here, most of their drilling is further SE. But if the Chevron wells are good, you’d think that will speed up development here. There are a lot of horizontal wells permitted (green diamonds) near here, and possible development is pushing up to the NW here.

In short, you should have economic Bone Spring and Wolfcamp wells under your acreage. Timing is always the tough question. If you think its going to take a while, which could be the case, I’d say a $13k per 1/8 royalty acre is not a bad offer. A reasonable price for the acreage under the Chevron wells is probably $18k or so. Those #s are subjective, but there is some math behind them and are intended to be balance between pro-seller and pro-buyer. Having an old lease with lower royalty is not ideal, a 25% lease would make things worth twice as much per mineral acre, but not much you can do about that.

In the end, 20.5 acres isn’t going to make you rich. But it’s nice to have. Whether or not you want around 1/4 million now or wait and see what happens would seem to be totally dependent on your own situation, taxes, risk aversion, etc. Good luck.

Thank you! I greatly appreciate knowing more now. Fortunately, I’m in a position where I can wait and see. It certainly is, as you say, “nice to have”, so I’m going to hold it. How would I go about finding out what develops there over the coming months and years and the potential for my acres?

How would I go about finding out what develops there over the coming months and years and the potential for my acres?

The NMOCD has a pretty good public GIS map. Has all wells, existing and permitted, on it. It just does not (as far as I know) show the wells as anything other than dots at their surface location. Thus you can’t see where horizontal wells go easily. Wells will be identified by their API number 30015XXXXX. 30 = State of NM. 015 = Eddy County. XXXXX = unique 5 # ID. That’s the basic way to search for more info on any given well.

To each his own, but I would kind of use the GIS info to find a map of the surrounding area. Print it out or get an e-copy. Then check occasionally to see if additional wells have popped up. You can either see the wells on the GIS map or you can search for wells in an area using permitting database (Google: NMOCD permitting).

If you want to know more about a particular well, look at its well files (Search via API #) which will have a lot of garbage but should have a plat to show where a well is located (surface and bottom hole). (Google: NMOCD Well Files).

I guess. Something like that. It’s a lot easier to know what is going on if you have a more expensive subscription service, but I doubt that makes sense for a single property owner. But somebody who is doing it the hard way can maybe give you better advice.

Thanks again. I’ll take your advice and start my own research. This certainly has been an education.

Do you know how I can go about determining the fair market value of my mineral rights when I inherited them in October 2017? I believe this information will be valuable if I ever do sell them.

IMO, the best way to do that is have a registered petr engineer, or something close to that, do a NAV estimate of your property with an Oct 17 effective date. Won’t bore you with the details of that. That may run you a few grand. You don’t want to go with county tax records for a value as you basically have no production.

That all sounds pretty complicated, but I am pretty confident that a flexible engineer could get you to a cost basis relatively close to your sales price, which would seem to be the objective. In general P.E. dork trumps IRS dork. Thus, I’d just wait until you are considering selling at a certain price. I don’t know enough about inheritance taxes to know if a higher cost basis will retroactively bite you on the probate side.

If it turns out you don’t want to bother, and might have a big cap gain, you can pretty easily roll it into a 1031 exchange and buy real estate etc with no tax burden.

Hi RonInCA and NMoilboy…your message string is very exciting to me because it’s the first time I am finding information (Ron’s plot) that is very close to my family’s.

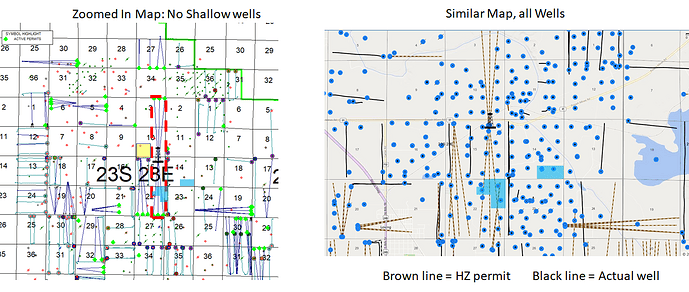

NMoilboy, we are currently getting offers for this plot: E2NE, S2NW4NE4, NE4NW4NE4 of Section 22, and S2SE4 of Section 14 all in Township 23 South, Range 28 East, New Mexico Principal Meridian, Eddy County,

How do I locate that on the map that you have previously posted. We know we have leases with Chevron and BK, but we’re wondering how to figure out if we have other active leases on the site that we might not know about and might not be receiving royalties on. We are getting purchase offers for less than Ron’s offer and we’re sure we will not be selling, but we don’t have whole lot of information either.

Thanks for any help you can provide. Margaret Howard

Here is where those legals you listed are (light blue). Map on right includes the Queen sand wells and is slightly more zoomed in, map on left does not. Your Sec 22 minerals should be included in CVX pooled unit. Would need a landman to look at Eddy records if you want more info on those or other leases, not my forte.

Thank you for your quick reply. I really appreciate the assistance!

Thanks for your suggestions I do appreciate your help.

Good decision but you got less that you should have.

Carlsbad is a good area with a activity increasing. It is not the hot spot. It is a tough seismic area and good seismic is an absolute necessity. You are on the west edge of the Delaware Basin. The Bone Spring will be the best play in this area. I would not lease to anyone unless you need the money. If you do, make it 75% NRI and short term (2 years) and double the lease bonus with every lease extension. start at 3,000/ac. Sit on this and it will more than double in value in the coming years. Do not ever sell your minerals. Always remember, New Mexico is a “force pooling” state, like Oklahoma. This will work in your favor greatly in these shale plays if you are not leased. look that up on the net.