What you think you know is probably far from the truth. Can you tell us how long we have been fracking wells? Or the depth of the fresh water acquirers vs the depth of hydrocarbon holding formations. We in the industry share your concerns about the environment-always have and always will. Respectfully, Todd M. Baker

Well, I believe we have been fracking for about 40 years, maybe 35 years now, with only excitement at first, then growing concerns about quakes. The depth of each type of resource is not in my bag of tricks - I’m a retired CSP and CMLSO who had a career in healthcare. I’ll listen if you’re willing to educate me! Sharli

You should avoid making assertions that you know things to be true and then have to walk them back because you admit that you have not done any research or know the facts. This is the danger of simply repeating crowd “chants” or believing everything that you read on the internet or hear from the uninformed.

Fracturing has gone on as long as wells have been drilled because it is the way to allow oil and gas to move into the lines. First started in 1860’s for shallow hard rock wells. Hydraulic fracturing started in 1940’s. Fracturing is designed to largely go parallel to the surface, to get the oil and gas within the targeted depth zone. Horizontal well have much shorter fractures going toward the surface in order to not penetrate unwanted formations where there may be more water. I hear estimates of 300 feet as to “sideways fractures”, but an engineer can be more specific.

Texas requires groundwater protection. Well completion reports filed on RRC website report the depth of fresh water and the depth of the frac job. Example of recent reports. Amoco-Holt (API 42-317-41853) horizontal shale well, Groundwater protection at 350 feet and vertical depth of frac at 9,192 feet. Landlubber 94 (API 42-103-36682) shallow vertical well - Groundwater protection 500 feet and fracture depths from 5,930 to 6,190 feet. Nothing but saltwater down there.

As far as earthquakes, it is most likely due to saltwater disposal. But concerns are localized and I do not know the range. Industry is monitoring and gathering data to determine activity and what limits to place on volumes.

Kenny Dubose did a nice summary of the capital budget cuts. Oil bouncing around in the low $20s today. I saw $8 in 1981 and was not really hoping for a repeat.

A federal judge rejected an attempt to block the Permian Highway gas line, which is going through some parts of the Hill Country, under the Endangered Species Act (golden cheeked warbler). The City of Austin was a plaintiff in the case. Apparently they don’t need additional gas supplies in Austin.

A 2012 Texas A&M study found the warblers population to be 19 times earlier estimates that got it on the Endangered Species List. Environmental groups are attacking the accuracy of the study. Attempts to de-list it have been unsuccessful.

Kinder Morgan now sees the line as on track and completion date of Early 2021. Any relief to the gas differential in the Permian is welcome.

Two important threads have been started on the NARO Group site people with Permian interests should be following. One on Force Majeure clauses and shut in efforts, and a second a single thread following producer bankruptcies.

1Q20 earnings season now unfolding for Permian players. Dates of investor online presentations:

Last week, Concho and SM Energy announced 1Q20 results. May 5, Diamondback, Parsley, Centennial. May 6, Devon Energy. May 7, Pioneer, Apache, Cimarex, Laredo. May 8, EOG, Ovintiv. May 11, Oasis. TBA, WPX, Callon.

This round of investor presentations may reveal companies that failed to extend their bond maturities last year. Not sure if bond agreements contain debt/equity covenants.

Anticipate huge, noncash impairment losses. Indebted E&P companies may be in technical default on bank revolver loans due to 65% debt/equity covenant, but banks will likely renegotiate these revolvers, e.g., SM Energy entered third amendment with reduced base. Most E&Ps don’t borrow against their revolvers, use them for backup needs.

Majors Exxon, Chevron announced last week. Exxon $610MM loss, $3 bn impairments. Chevron profitable, but more CapEx cuts.

I hate to do this, but I need to consolidate my postings on industry news between this thread and a similar thread set up under the NARO group. The NARO group has three main threads set up, one for Industry News, one for Bankruptcy News, and one for Legislative and Regulatory News. The one for Industry News is here - Industry news Legislative and Regulatory News is here - Legislative and Regulatory News Oil Companies Bankruptcies are here - Oil Company Bankruptcies and Info

While it has been a lot of fun (and the Permian boom was a great ride), there are too many overlaps in topics. For example, big news on a Permian operator probably belongs in both threads, and it takes too long to switch back and forth and post duplicates.All future posts on Permian news will be in one of those three NARO threads. Join us there!

Earnings webcast dates for Permian E&P companies, Q&A with sell-side analysts. Financial reports released previous evening after markets close. Oil majors not shown.

7/29/20. Ovintiv.

7/30/20. Concho. WPX. Apache.

8/4/20. Diamondback. Centennial.

8/5/20. Pioneer. Devon.

8/6/20. Parsley. Cimarex. Laredo.

8/7/20. EOG.

TBD: Callon. SM Energy. Oasis.

I would like to share this link to a current rig count by county interactive map in your locked “Internet Resources for mineral owners” post. I am assuming it is current.

You would probably have to hit “reload” for the current dates.

Good catch.

I overlooked the reload button but have experimentally confirmed the map is updated.

I also forgot to mention that on my computer each individual county’s rig count is revealed by hovering the cursor over–but not clicking the mouse on–the county of interest.

Glad to see EOG Resources issued $1.5 billion bonds in 2Q20, not all E&P companies are shunned by the capital markets. EOG issued $750 million 4.375% due 2030, plus $750 million 4.950% due 2050.

Helps that EOG has arguably best balance sheet among independent E&Ps, $20.4 billion equity, $5.7 billion debt, $2.4 billion cash on hand.

That’s all good, but when it takes 3 or more years to recoup the cost to drill wells due to low commodity prices, no wells will get drilled. EOG is just in a better place to “weather the storm”.

Pecos, Texas can not locate property. Pipeline went throught on 2017. Legal: Acres: 10.000, Blk: 45, Tract: 48, AB 2276 BLK 45 SEC 48 PSLLOT 14

|R000026008 Geo ID: 01020-00250-00003-000000||

Reeves County Block 45/Section 45//////Block 45/Section 48/A-2276

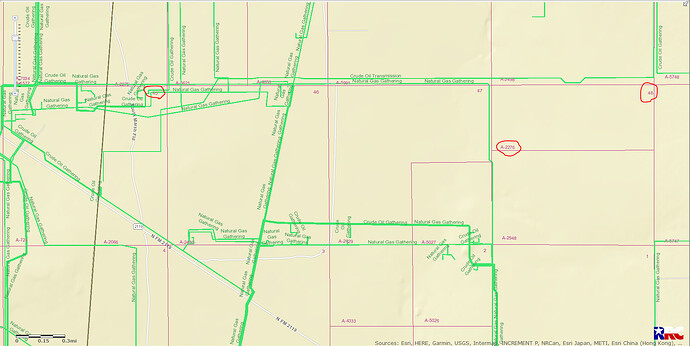

This map showing just pipelines:

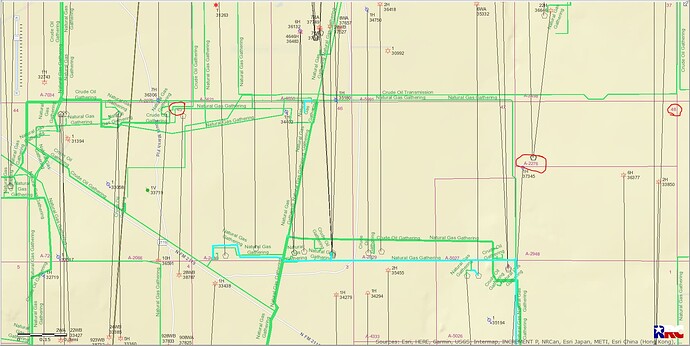

This map showing pipelines and oil/gas wells:

Where can I find these maps? We are looking for section 30 block 27

Sorry I forgot section 30 block 27 A -1744 winkler county Texas

https://gis.rrc.texas.gov/gisviewer/

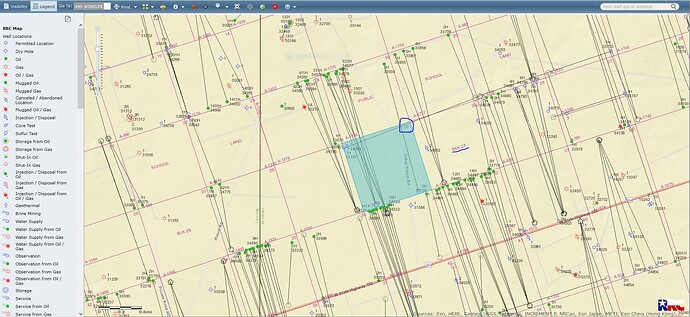

GIS map of Winkler Co. Section 30/Block 27/A-1744

CLICK ON MAP TO ENLARGEThank you but what did type for a search in the viewer