Don_Bray ============= Noticed you said you protested a 1st Pooling. How is this done.?? I want to take the highest Royalty but the first Pooling is for $0 at 1/4. ( sounds like second poolings can be more generous?) Is it a risk to protest? Can it not be granted?

A mineral owner or working interest owner can protest before or at the hearing causing it to go on a protest docket-These can go on forever. That’s the only available protest I am aware of.

@Bud This is the email I sent to the OCC where my brothers and I began discussions with the Red Wolf Landman…

"Hello, my brothers and I would like to have some input on the proposed options being introduced by Red Wolf regarding Pooling application CD No. 202100469.

My understanding is that you can advise us on the steps we need to follow.

Thank you for your time and assistance in this matter."

The email I received back from OCC…

"Mr. Bray—

I requested and obtained a continuance of this case to April 26th.

Between now and then, Mr. Drew Smith with Red Wolf will be reaching out to you to address your concerns. He is copied on this email as well.

Please feel free to reach out to me if you have questions.

At this point we will hold off on setting the cause on the protest docket until you and Mr. Smith discuss.

Thank you."

This was the start of many emails back and forth with the Red Wolf Landman. One brother and me eventually agreed to terms through a PPLA (Pre-Pooling Letter Agreement). The other brother did not agree to any of the options being offered and he was dismissed from the first pooling.

The OCC now has better defined guidelines for protesting or contesting. Here is the link:

Don_Bray ------- Thank you for this info!!! Sounds like one really needs an attorney that is familiar with current OG Market. Since my present lease/pooling is for less than 15 acres it may not be worth it. However, this is great to know information and can be very useful. What was your objection? Price of Bonus? and did you have other objections? Deductions, depth, ??

Thank you for this valuable insight.

You have 20 days from the date of the pooling order. Since today is the 31st, you don’t really have time to do much except answer. If it were me, I would take the 1/4 and $0. Or if you want a little bit of bonus, then the 22%. The royalty is usually far more important than the bonus. Like Don said, send by certified mail with your name, contact information, description of acreage, case number, order number and your selection. Return to the address of the operator listed in the pooling (any many folks also send a copy to the OCC). Keep a copy of everything that you send.

You have to return to the party & address listed in the Order. I have never seen one that says to return to the attorney. You can do that if you want to, in addition to what the order says, but is of no consequence.

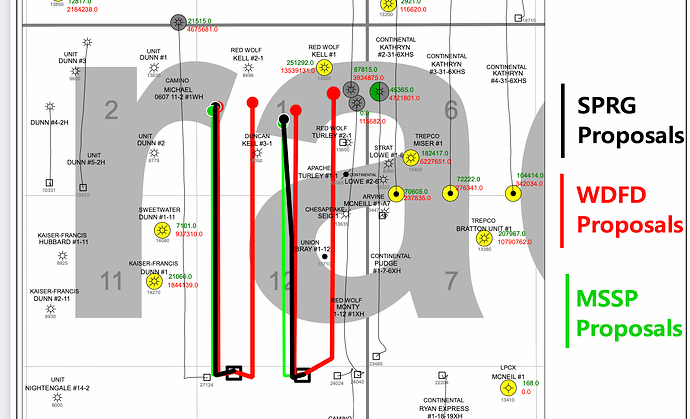

@Bud my objection (and my brothers) was that Red Wolf would not offer a 1/4 royalty option. One brother held firm for that option and was dismissed from the first pooling. After the first pooling Red Wolf merged with Camino and Camino filed the second pooling application. I helped my brother with his protest of the second pooling. That document is available for review under Case Number 2022-001100 on the OCC website. Before the scheduled hearing I convinced my brother to get an attorney. That attorney used his contacts to help my brother obtain a 1/4 royalty lease with a third party. He received a bonus that more than paid for the attorney.

And as we now all know the 1/4 and 22.5% options became part of the second pooling. Plus the bonus amounts increased for all of the previous options.

(Note: At the start, my brother did put up a retainer for the attorney.)

Thanks for the catch. I edited my reply.

Had an offer to buy…$12,000. We have 115+ nma there.

What royalty? Always have to pair the royalty with the offer.

20 percent is the lease.

Is that $12,000/ac at 20%? Multiple wells on the schedule to drill…

I saw where someone with an Oil & Gas lease for 1/5 royalty in section 12-6N-7W has sold them for $478,500. Effective June 1, 2022. Trying to figure out how many acres involved.

The offer is to buy the minerals. The lease is at 1/5th. It is being drilled to the Woodford only one well then to hopefully come back and drill 2-3 more at some future date.

Don, know anything about Robert Crain/Garret Crain Fossil Creek Land Company?

@Jimbo_Jonas Fossil Creek is the company that paid the $478,500 from my previous post. Still working on how many acres was involved. I am at 22.5 acres right now.

Most of us would go for the higher royalty as that usually pays out much better in the long run on the multi-unit horizontal wells.