Hello! I am new to the forum and to the overall topic. I have recently been notified that, through an inheritance, I am a part-owner (3 heirs) of mineral rights and have received an offer from a company to purchase the rights. How can I find out more about this particular section, whether there is drilling on or around it, etc. Thank you for any guidance you may be able to provide.

Laura,

Surge Operating has 1 approved permit for a horizontal well(API 227-39721) beginning in Section 9 and ends in Section 16.

Encana Oil and Gas has 6 approved permits(API 227-36920-21-22-31-32-33) for horizontal wells beginning in Section 9 and ending in Section 16…a lot of activity and several good producing oil/gas wells in the surrounding area.

The major operators in this are are Encana Oil and Gas, Sabalo Operating and Surge Operating.

http://webapps.rrc.texas.gov/DP/publicQuerySearchAction.do?countyCode=227&apiSeqNo=39931

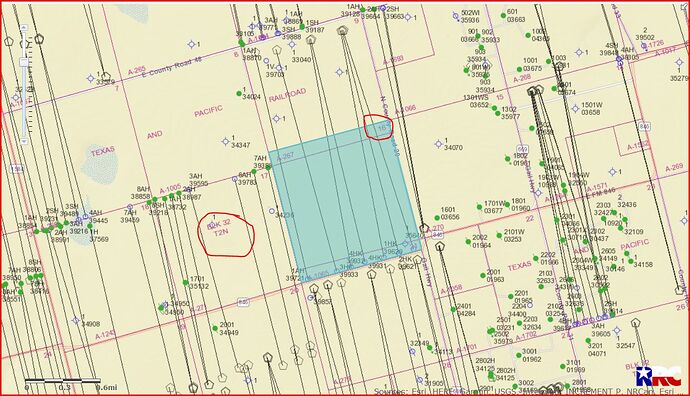

GIS map of Howard County Section 16/Block 32 T2N/A-1065 and surrounding area:

DOUBLE LEFT CLICK ON MAP TO ENLARGE

Clint Liles

Laura,

Clint_Liles gave you some very helpful and valuable information, but there is more to know. 3 of the permits are on StateWide Rule Hold, which means there is a problem with the permit paperwork. Sometimes that is rectified very quickly, sometimes that takes a year or more if there are parties contesting the permits. All that said, what you know today is that there is activity in the area. The rest of the story is that it usually takes about a year from the time a permit is approved to getting your first royalty payment. If, and only if the well gets drilled. A permit is not a guarantee that a well will be drilled, while it’s a good indicator, it’s not an absolute. With oil prices in the tank and pipeline capacity strained in West Texas, I suspect a good number of permits won’t get drilled, but that’s a personal opinion only. The activity level in your area does bode well for a higher valuation if you are inclined to sell. It’s a fairly easy math problem to figure out if it makes sense to sell, but first, you’ll need to understand exactly how much you own in the Section. I hope this information is helpful for you.

I’m a lessor on section 16, part of Grandpa’s old cotton farm. Don’t know where your property is. Might be the Scott unit on the east.

The west part of sections 9 and 16 comprise the JONAH UNIT A 09. 640 acres, about. So can take four horizontal wells. Surge has two wells permitted here to the west, without problems.

Encana applied for the other two in December and yesterday submitted a revised version of one of Surge’s wells http://webapps.rrc.texas.gov/dpimages/img/4200000-4299999//PR0004283072_0001.PDF

Other than this, I can find no evidence that Surge has transfered the Jonah unit to Encana. Possibly, they are in some sort of partnership, explaining why two different companies are submitting permit applications on the same unit.

Or perhaps Encana is the drilling contractor. Encana has some really fancy technology. and claims to favor drilling several wells together as a unit. They claim incremental costs of about $7+/barrel to produce oil on the Permian. Which means their wells are going to be profitable at fairly low oil prices.

Allegedly, one of Surge’s wells (1AH) was spudded-in August 18. Haven’t heard anything more about it. This is some pretty hot acreage. I regularly get offers to buy my rights for $25K/acre, which I consider far too low for property which (allegedly) has a well on it. .

BTW, my preferred approach to this situation is not to sell, but to lease. Unless you need the money right now. The real money to be made is not from the bonus, but from royalties, whihc can be substantial. . In fact, I took less than I likely could have gotten as a bonus in return for assurances that the well would be drilled soon.

Thank you so much for your reply. Being completely ignorant on these matters, I understood very little of what you said LOL but did take away that I should probably speak with an o&g attorney. I figured there must be something going on since they are offering $25K each for our shares of the mineral rights. I will continue researching – not in a hurry to sell. Is there a map where I can see exactly where this property is? Thank you!

Thank you so much! I am not in a hurry and need to understand all of this better so I will continue to research.

Thank you so very much - this has come as a big surprise so I don’t even know where to begin. I am legal guardian to the minor child of a deceased heir so it’s a little complicated (I think). Anyway, I have seen your posts on several other forums and am glad you responded to mine. I’m not in a hurry and just now beginning my rsearch so not sure of next steps right now. Thank you

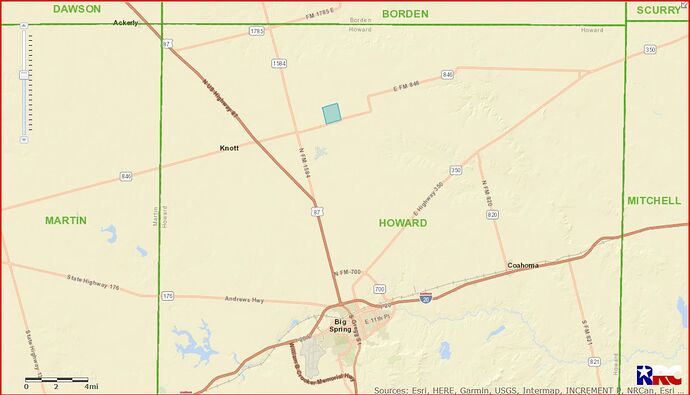

Howard County

Section 16/Block 32T2N/A-1065 is the blue square North of Big Springs.

DOUBLE LEFT CLICK ON MAP TO ENLARGE

Clint Liles

FWIW-- According to this plat http://webapps.rrc.texas.gov/dpimages/img/3900000-3999999//PR0003963254_0001.pdf , Encana and Surge (Mosscreek does their leasing) are in cahoots in both the Jonah and Scott units. Which is why Encana is applying for permits on what I was orginally led to believe is Surge’s Jonah production unit. We shall see if they also apply for a revision of Jonah 1AH, Surge’s last permitted well.

We have 30 royalty acres on section 16 on the Jonah unit. Basically, the toe of the '721 well. (S/3 section 16, blk 32, T-2-N, the west 30 acres)

The money here is from production, not the bonus. So, in August, we leased this to Surge at a real discount on the basis of a promise to drill on the Jonah production unit within a few weeks. Still unclear whether this happened or not. I would be happy if the well is “drilled, uncompleted”. Surge is being a little vague on this. In any case, should immediate commencement of drilling be used as an inducement to sign, it is a good idea to write it into the lease.

However, more recently, we have received an offer to buy “1.07 Net mineral acres”, using the same property description. It is unclear whether this is included in our original parcel or is a separate one. The offer seem to be to me and my brothers as descendents of Lee Proctor, rather than to my wife and I, whose name is on the 30 acres. This makes me wonder if it is an entirely different parcel, snooped out by some landman. Is there some way I can find this out?

Publius, you are using “Royalty Acres” and “Net Mineral Acres” interchangeably in your post and they aren’t. You may very well have 30 royalty acres and only have 1.07 net mineral acres. Royalty acres are just the income side of the mineral rights (you can’t and don’t lease royalty acres), while net mineral acres include executive rights (the rights to lease and receive lease bonuses) and may include royalty, but not always. FYI, you can always ask the person that made you the offer to send you their chain of title so you can verify it. That would tell you a lot. Surge is THE worst Operator to deal with from my experience.

Yes, I know the difference between royalty acres and net mineral acres. The point is that I just got an offer to buy 1.07 “net mineral acres” (sic) in a property we already have under lease. Just trying to find out why.

BTW, we own this property free and clear with no encumberances and it has not been leased since the early 80’s. When I called them, they told me that this is different from the property we already lease. Your suggestion of just asking them to show me their chain of title is the next step. But, still learning the ins and outs, I want to poke around a little first.

As for Surge: Arguably, they messed up the original permits for wells 1AH and 2AH on the Jonah unit and this is why the well was not drilled immediately, as they assured would happen.

Thus, Incana (who seems to have taken over the Jonah unit) just reapplied for the permit for the 2AH well, which has “unleased” property. So they need to send out the notices, etc. The plat says this “unleased” property extends over into the bore path of the 1AH ('721) well, which is listed as “proposed”. So presumably this one will also need to be resubmitted in the same manner. So it goes. BTW, I was told that the ownership of section 16 is “complicated”.

Good Morning Lisa. Could you provide me with the Section, Block and/or Abstract number? I will see what I can dig up.

Clint Liles

timmyd, minerals and royalty are considered real property and do qualify for 1031 Exchanges. However, a personal residence is disqualified from a 1031 transaction. I just completed a 1031 where I sold some minerals and purchased a rental property. I speak from experience on this. Make sure you run the numbers with your accountant, if you don’t have an accountant, GET ONE! It’s too important to try to do yourself. Sometimes the numbers simply don’t work out to make a 1031 exchange worthwhile, depending on your income for a given year, you may be able to do a straight transaction (not a 1031) and get the same net result with a whole lot less headache and aggravation.

I buy minerals when it makes sense and sell them when it makes sense. Unlike some, I don’t want to bet everything on Oil & Gas, with the sky-high valuations of today it makes sense for me to take some of that money off the table and put it somewhere that is a little more stable. All that to say, I am about as well versed as anyone when it comes to these types of transactions and I can tell you that a 1031 is not an easy process and you can find yourself making some really bad decisions if you don’t have a very clear plan from the outset. One more piece of advice, there are A LOT of 1031 intermediary’s out there and only a few that understand mineral transactions and even fewer than that that are really good. My advice if you are interested in doing a 1031 is to have a frank conversation with your accountant and talk with an attorney at your local Title Company/Abstract Office and ask them for recommendations on 1031 intermediary’s. DO NOT ask a realtor!

This is probably a lot more information than you expected but it’s a really important topic that can be really good or it can turn out to be a nightmare.

thank so much for all the insight I love all the help everyone has to give on this forum !!!

I have one other thought. While a mineral owner enters into a “lease” for the exploration and extraction of hydrocarbons, the lease is only signed by the grantor. Now the reason for that is that it is not a lease as we are most use to seeing one. it is actually a deed where minerals are conveyed for a period of time or until extraction is no longer economic (held by production) Upon expiration, ownership is returned to the grantor. I believe that is why mineral leases are recorded in the deed records of each county.

Based on your comments, I think we may have inherited from the same source – could we possibly communicate by private message (not that familiar with this site)?

Sure. BTW, I’m a grandson of Lee Proctor.

William, on the contrary, way back when and depending on the county the oil and gas leases were often recorded in the “Oil and Gas Records” or “Oil and Gas Lease Records” books, which are entirely separate from the “Deed Records”. In the 90’s there was an agreement to create the “Official Public Records” books which are all-encompassing and ceased the need for separate books depending on document type (separate books were causing unnecessary strain on the clerical and/or research side of things, so the switch was widely accepted as being more efficient). Also, on a lease the grantor is referred to as the “lessor”, so they aren’t conveying minerals but are rather leasing them for a certain period of time in exchange for a cost-free royalty share in production, which will expire either after the primary term or once a clause causes the secondary term to expire (e.g., production ceases).

LLC, has the offer come up from $25K/NMA? Did you sign a lease in the meantime or were already under lease before? Make sure bonus payment potential is factored into the price if you sell an unleased interest.