I have inherited mineral rights originally purchased by my grandfather. I have virtually no records of what he owned or what he has leased. I just have receipts from some companies paying royalties. I have reason to believe that he owns substantial rights in many western states but I only know about the ones that are producing today. I currently get checks from leases in Montana, Oklahoma, New Mexico, Texas, Virginia and Arizona. I am not even sure of all the counties where these mineral rights reside. And clearly, there might be mineral rights that I know nothing about . . . They aren’t producing today, but we may still own rights.

How do I go about finding out what mineral rights my grandfather actually owned . . . Producing or not producing?

Currently, the revenue from all leased properties is relatively small and virtually insignificant. But I feel like one important step is to determine what is actually owned whether it is currently leased or not. Am I wrong? I honestly don’t even know where to start. In my ignorance regarding this whole subject matter is downright scary! Someone suggested I need to hire a landman, but I am fearful that the cost associated with that would be well outside of my ability to pay.

What might you suggest? Where do I start? A part of me is just overwhelmed and wants to just sell whatever rights I really own to someone who is use to dealing with this.

1 Like

Welcome to the forum. Take a deep breath. You can do this.

You said you inherited. Do you have a formal probate of a will that lists the properties? Was there a will or did you inherit through the intestate process?

Put the checks in order by state. You probably mean West Virginia. There are oil and gas websites for each of those states. It will take some work, but you can put together a pretty good list starting with the properties that are producing and then work backwards to find the rest.

Here are two spreadsheets that will help you get started. They have the first line filed in as an example. You might want to turn it red to make sure that you don’t count it. Fill in the wells worksheet first and then you can use it to fill in the tracts sheet.

Master Wells List Template.xlsx (16.9 KB)

Composite Master Tract list template.xlsx (56.7 KB)

There are a ton of free to low expense websites to start looking in. Here is a list of useful websites for mineral owners.

Useful resources for mineral owners.xlsx (15.4 KB)

If I were you, I would start with Oklahoma and Texas.

www.okcountyrecords.com is a free site to look. You can pay a small fee to print. Search under your grandfather’s name. See what pops up.

www.texasfile.com is good for Texas.

If you inherited, it is your responsibility to file your name and address in every county where you have mineral rights. You will need a description of the mineral rights as part of the filing. You can ask the operators that are sending the checks to give you the description of your acreage and a copy of the lease that goes with each well. You need the division order or revenue department.

Also search the unclaimed funds in the state where your grandfather lived. And Delaware. Search under his name.

Start here and then come back with questions.

5 Likes

One approach is to just start collecting and organizing the data that you already know from the paperwork/receipts you’ve received (company and well names, section numbers, etc.) and especially any data from old signed Division Orders could also be useful. Just add to it as time goes on.

This is what I did, though I was helped by some extra mineral rights document data via one of my aunts.

Like you noted, ideally, a landman doing the tedious research is the best choice in giving you a complete picture of what you do (or don’t) own, but it’s likely to be very expensive. It can be a very time consuming task for them, which can add up quickly.

1 Like

As I mentioned to M_Barnes I only have saved a small number of receipts and no Division Orders! But I’m starting to do what you suggest now that I see my errors . . . throwing away all receipt information. I had one event that has shown me the advice I received from my past attorney was really bad advice. I’m going to try to straighten this all out, identify what I can, and then try and sell whatever it is our own! I just wish I had done this 20 years ago!

2 Likes

This is really helpful! Thank you so much. It gives me a place to start! I never got any listing of properties. We did probate my mother’s and father’s wills but there was never any listing of mineral rights. I did find some deeds there are are not that many. I know I do get small royality checks from a number of properties I have no deed for. When we were providing these wills, my attorney at the time advised we not address these mineral rights . . . income was greatly outstripping the cost to address the mineral rights by a wide, wide margin. He said to just cash any charcks that arrived and to personally pay the taxes. For years I threw away the information with each check . . . a huge mistake I now see. But what is done is done. I mostly have 1099s for past years and they have no property information.

Listing Virginia as a state was not a mistake. My grandfather had a coal mine in SW Virginia and he did purchase mineral rights there.

I will follow your suggestions as best as I can. Thanks again!

1 Like

Ah, the coal mine would make sense then.

You need to save all of your check stub statements for seven years for IRS purposes. Save every DO. You can get new copies from the operators.

Gather as much information as you can. You may be frustrated right now and want to sell, but you might find some very valuable acreage and decide differently in a few months. Either way, it is better to be informed so that you can make a better decision.

If you have particular questions in certain states, post them in that state and in the county and usually knowledgeable people will step in and help if they can.

Another good resource is NARO, the National Association of Royalty Owners. It is a nationwide organization devoted to teaching and helping mineral owners. They have either state or regional chapters that cover the states you mentioned. Most of them are holding state conventions either live or by webinar in the next few months. They teach classes on mineral management, have a variety of speakers and is a great place to network to learn more about how to handle your gifts well. www.naro-us.org. The Oklahoma convention is in May and the Texas one is in July. I have been attending them for years and always learn something!

2 Likes

A couple of things:

You may want to research your grandfather’s estate, specifically any probate orders. Start with the state where he lived. You also might get lucky with a searching Oklahoma counties. This site provides a way to search 65 of Oklahoma’s counties (they have varying historical coverage) Multiple Counties | OKCountyRecords.com | County Clerk Public Land Records for Oklahoma Works better with unusual family sir names.

You can also check unclaimed property with various states for your ancestors. Search for your unclaimed property (it’s free) – National Association of Unclaimed Property Administrators (NAUPA)

My guess is that your grandfather was an engineer or geologist who held overriding royalty interests instead of outright mineral interests.

As M_Barnes said, start with the information you have and work backwards from there.

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

2 Likes

if you have any deeds, then start your list with those. Copy the descriptions exactly. Do not change any punctuation as it is critical.

2 Likes

I have found over 50 deeds and records regarding my grandfather’s mineral rights. Should I make digital copies of each of these? Most are one or two legal pages but a few have probably 10+ pages. Since I have the deeds themselves, I have that as proof. But it kind of seems like it might make sense to have digital copies that I could send electronically as needed. That would be a terribly long boring job though!

1 Like

We made digital copies of everything going forward. Deeds, Division Orders, leases, etc. We have them stored on a backup hard drive in a fireproof safe and and also backed up in the cloud in case of further disaster such as hurricanes and tornadoes. We have had to use them to prove our ownership.

2 Likes

You might be a millionaire and not know it from what I have seen of your post! You do not have to spend hardly any money. You can teach your self if you will try. You have a computer already. The 1099’s will show the company name. DO NOT SELL!

Most likely you own mineral rights that are not in production and might be open that could possibly be leased in the future. Or it could be that a company or their landmen can’t find you. You are in a great position!

Also what may be helpful is getting information of earlier 1099s from the income received from the minerals. The Executor of the Estate can contact the IRS and order a “wage and income transcript” and see what what income was reported for back years.

1 Like

Well . . . that was fun!!! I’ve spent over 8 hours but I now have a digital copy of every deed and all old letters and other misc documents!! I’ve got to admit, I feel quite a bit better now that I have those files saved and backed up! Thanks for your advice!!

2 Likes

Good for you! Now back them up in about three different ways!

2 Likes

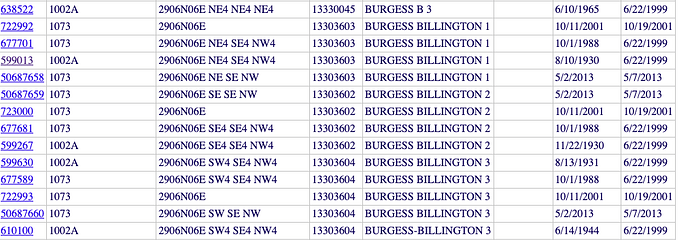

I don’t understand how parcels get named. I have deeds for 2 parcels in Seminole, OK: 1) SOUTHEAST QUARTER OF THE NORTHWEST QUARTER OF SECTION 29, SIX (6) NORTH, SIX (6) EAST, and 2) S1/2 OF 1/4 SECTION SIXTEEN (16), SIX (6) NORTH, SIX (6) EAST. But on a income statement form I see me property is called WELL 145470 BILLINGTON-BURGESS, SEMINOLE COUNTY, OK (I have no idea which deed this is from!).

How do I reconcile these so I can tie them together in my records?

It sounds like you have received some great basic advice. I have had this same situation occur with clients a few times over the years. Diligence and patience will be significant keys to your success. Since you have already established a list of known properties, counties, and States, I would suggest you also make a list from whom he purchased and dates. In many cases this can offer other places to investigate if he purchased from the same seller in various counties and States. Make sure to file an affidavit in each county stating your contact information you are willing to share. TexasFile.com is a good source of information since you can do a statewide search for $5. Be aware, some of those TexasFile counties have a limited search period. Make sure to check unclaimed property in each State where you know of ownership as well as each State where you grandfather may have lived. There are many potential areas to investigate, but try the easy options first since they can lead to big gains in information. Good luck in your efforts. Feel free to contact me for other ideas.

3 Likes

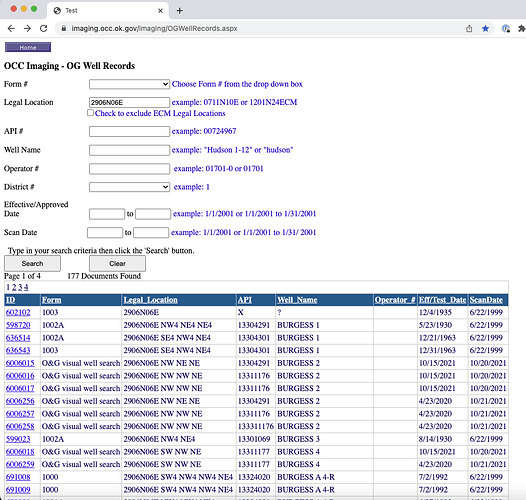

Now go to the OCC wellrecords site.

2 Likes

Thank you for the suggestions! I have already gone back and entered the persons my grandfather purchased each parcel from. As you suggested, he ended up buying quite a few properties from the same people.! Again, thank you for your thoughts and suggestions. I appreciate them so much. I am blown away with how helpful you and others have been.! I wish there was a way I could just respond to a few questions I have had regarding some of the responses. But I don’t want to clutter peoples inboxes needlessly.