I wanted to put this out there and see what I actually have??? I have inherited some ORRI in Eddy County, New Mexico. I received a phone call from a company wanting to purchase this from me. I guess I do not know if what I have here is worth entertaining an offer to sell. The company that contacted me stated this in an email: “As you can tell from the source document, your mother owned in 8 federal leases and 2 state leases all in 23S-31E”. I am trying to gather information regarding my ownership and what it means really. Should I sell based on their offer or should I keep it??? Any help or advice would be appreciated.

We also own ORRI interests in t23s, r31e. It is a highly prolific area for oil and gas reserves and I believe is in the Delaware basin which has multiple plays.

Don’t sell is my advice. We turned down over two million dollars for our interests which bring in substantial royalties.

Which sections are you in? We are in 10, 13, 14, 15, 22, 23, 24, 25, 26, 27, and 31. These are all producing. Also own interests in 19 and 30 which OXY recently filed a pooling order on for several wells planned.

Here is a link where you can search your interests by Section, Township, and Range in the State Of New Mexico:

http://ocdimage.emnrd.state.nm.us/imaging/WellFileCriteria.aspx

Some of 23 31 is pretty good. Some is under potash and less good. Selling may or may not make sense. I think typically if you negotiate a bit with multiple parties you end up finding somebody who will pay you today for a reasonable portion of what you might see in the future. A lot of offers are requesting a license to steal, but others are likely pretty fair if one would rather have a lump sum payment. There can be something to be said for letting somebody else carry the risk of oil price, spending, timing etc. Your mileage may vary.

It looks like perhaps you inherited something passed from somebody named Carey to somebody with your last name in the 90s. Carey was assigned a .00748% ORRI in a multitude of leases in 23S 31E in the 1980s. Some of those leases may have expired, I didn’t check. In which case that ORRI is gone. But that would be pretty easy for someone to check.

I have no idea what to make of a .00748% ORRI. But that is what it says. That’s tiny. Tiny. Even if it applies to all 4720 acres of leases that were listed, that amounts to 2.8 NRA. That’s probably around $50k.

Maybe that ORRI % is incorrect. Figure out what you own. Get a copy of what was conveyed to you. Get a BLM O&G plat for that township and see what leases still exist. You should be getting checks from somebody (Devon, Oxy, etc), take a look at the decimal and see what it says. Does it match what you expect? Ask whomever offered you how many net royalty acres they show that you own, that’s at least a starting point.

Good luck.

Thank you for the great information. Carey was my grandmother who passed them to my mother and when she recently passed away they conveyed to me. She did not have a Will so it has been a process to get it sorted out. All I know is my mother was receiving a small check monthly from Devon but I am not aware of any other royalties. I recently was contacted by Chevron because they are doing something on this area too. The company that reached out to me about buying this has told me that it appears I have a total of 4.04 NRA and they are willing to offer $17,500/NRA. If you think I can get more then maybe I should reach out to other interested parties. Thanks again for your help.

Thank you for the information. I am gathering information to see where I am in Eddy County in addition to this. All this is new for me and I do not have much to go off of. I appreciate your information.

I have no idea what Chevron would be doing in 23S 31E. Its pretty much all Devon and Oxy except for the far NW corner that is XTO. I think.

In the end, I don’t think $17.5k/NRA here is terrible across all the sections in which you own. Getting $70k up front vs keeping track of a slew of sub $100 checks may be a win. But you will feel kind of silly if you convey all right title and interest in everything and then find out that its bigger than 4NRA. I’d ask for a lease-by-lease breakdown of your interest from whoever offered you. Then I’d start doing leg work to reconcile that with your check stubs.

fwiw, I only see two instances in Eddy County where June Carey was granted anything. Other is an even smaller amount in 24S 31E Sec 2.

Hi Ronnie, the company offering you 17.5K wouldn’t be Pony Oil & Gas would it? They have been hounding us to sell 23s, 31e. Calling repeatedly. A real nuisance.

Yes, Pony Oil from Dallas I believe. It was strange because they said we owned 404 NRA and it was amounting to millions. Now, they said after some search it is 4.04 NRA. I am still not too sure how to even calculate an NRA… I just thought if I put some information out here on this maybe collectively I can get some good feedback from some of you that have some experience. Everything seems to check out and because I live in South Texas I can’t just easily run to Eddy County and do some research. I am learning as I go though.

I went home and checked some paperwork. The Chevron is in T24S R31E Sec2 and not in 23S 31E. My mistake. I am trying to learn the geography and the way this is determined. I agree that a bird in the hand is probably worth two in the bush, but like you mentioned, I do not want to sell myself short. I appreciate your help and offering up a little advice.

I can easily see how they changed their NRA tune by a factor of 100. A lot of times the conveyance is a fraction, like 1/640. Well in this case it’s a fraction…and then says % afterwards. Thus 100 times less.

A NRA is the equivalent % of the revenue that you would get if you had an acre getting 1/8 royalty (12.5%). So if you had a 1% ORRI, each of your acres would be 1/12.5 of an NRA.

If your ORRI decimal is .0000748, each acre is .0000748/.125 NRA. Check that decimal vs your Devon checkstubs.

I don’t know how to turn an ORRI into an NRA either. Say we have 1% of section 23 t23s, r31e. A section is 640 acres. Why wouldn’t my 1% be 6.4 NRA? Or am I giving myself less than what I would actually have? Math is not my forte so please bear wth me. Would that mean NMoilboy that my .01 is equivalent to .01/.125x640=51.2 NRA? Using your equation of .01/.125?

Rick, yes, that would be 51.2.

Thanks NMoilboy. I learned something new today.

I have interest in 20S, 28E Sec2. Is that near any activity?

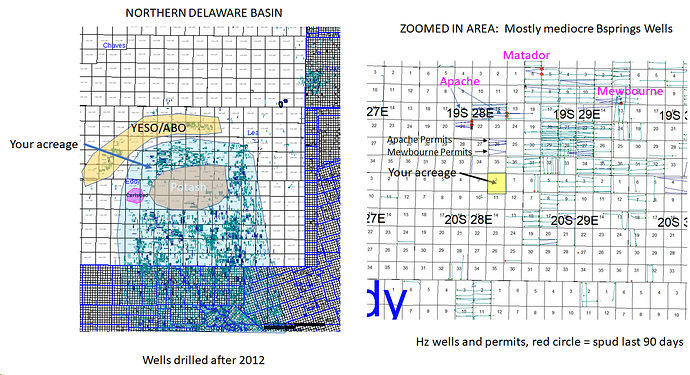

Here is some sort of map for 20S 28E Sec2. On the NW edge of the Basin. Offset wells are not great, but this type of acreage should get drilled eventually at some oil price, IMO. Apache, Mewbourne, Matador are active up here. Some wells permitted a few miles north of you. Again this is only horizontal wells, you have 40 year old vertical Morrow wells on your acreage.

You seem very knowledgable on this stuff and my husband I are needing some advice. He inherited mineral rights for about 18 acres in section 23, township 22 south, range 27 east. They offered us 5k per net mineral acre for a 3 year lease. The letter also says they will send us a check for 57k upon receipt. Could u help me better understand this please? And if it’s worth it, should we go for it, turn them down? We are both lost.

Let me correct that 80 acres, not 18.

If their offering you a bonus of 57k at 5k per net mineral acre, then you would own a little over 11 acres. The area they are leasing may be 80 acres but your acres owned, based on the above monetary figures is not the entire 80 acres. You can check the deed/lease history of the interest at courthousedirect.com

I would guess that means that you own a portion of the 80 acres. That’s typically how it goes, the original person owned the whole 80 acres, and through inheritance etc it ends up getting passed down with the beneficiaries each owning some % of the 80 acres. In other words, if you ended up with 10%…you may own 10% of the whole, rather than a specific 8 acres.

So…I would assume that they ran title on this section and determined that you own 14.25% of the 80 acres, or 11.4 net mineral acres. They are offering you $5k/nma for a 3 year lease. Or $57k total.

As Rick5 said, beat me to it.

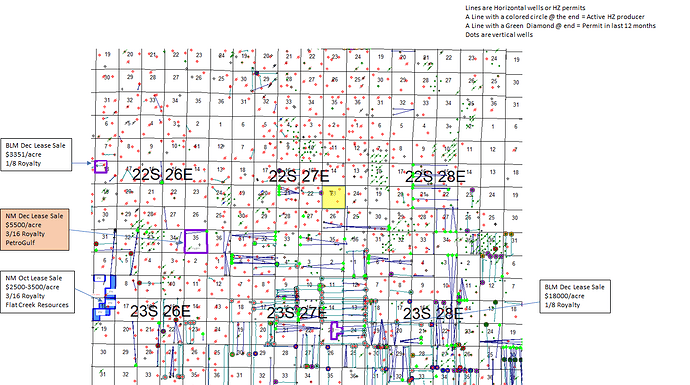

How good of a lease is depends on the royalty rate. On the surface $5k/nma doesn’t sound too bad to me. I used to keep track of the State and BLM lease sale results to have some idea of what going lease rates could be. Fed leases go for more $ because they have the lowest royalty rate and longest term. State leases are closer to what one might expect to get offered. Map below shows where your acreage is and some lease sale results nearby. Was a $5500/acre state lease a bit to the SW that seems comparable. That’s at 3/16th (18.75%) royalty.

For some context, on that map…things are better are you move SE (away from your acreage and down toward where there are a bunch of lines indicating horizontal wells). Your acreage is kind of where people are hoping that the BoneSpring and Wolfcamp productivity keeps extending to the NW. There are a lot of people who have permitted horizontal wells near you, so a lot of folks are hoping that good well results will extend up your direction.

In light of that, $5k/nma sounds ballpark reasonable to me. I’d try to get a 20% royalty rate, I’d guess they offered you 3/16ths. Oftentimes the lease will come with a 2 year option to extend as well. I don’t think that is terrible, but I’d make sure they have to pay you an extension payment for that. Maybe $2k. I’m not a landman or anything like that, this is just my thoughts on how that should work.

Mostly you want people to drill wells on your property and make $ via the royalty.