It looks like I’ve inherited some mineral rights in Cove District, Doddridge — Tax Map No. 13, Parcel No. 11 — after being passed down to several family members I’m sure it’s very fractional, like between 10 & 20 acres worth. We received an offer, but want to do due diligence, explore our options… Does anyone know if there are plans for development in this area? Or a ballpark of what’s reasonable $/acre?

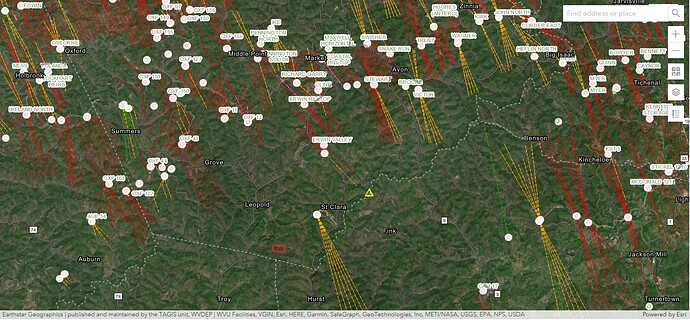

See drawn roughly where you are, southern end of the play - you can see what’s coming towards you. This is very much a wait and see at this point, but there would be competition for leasing between Antero / EQT / HG, and a number of other non-operators. Are they trying to buy your minerals? There’s competiton for that as well, but it would be heavily discounted for PV.

Thanks for the visuals! That helps put it into perspective. They are trying to buy out our mineral rights, yes.

We are weighing the options, submitted details for a couple quotes to gauge reasonable value — we’re not in a rush or anything, and it seems like production is kind of low for that area since the pandemic, so debating if there’s any downside to just waiting, see what happens…?

I would think any mineral offer is discounted at best and highly speculative at worst. If you inherited, there will be additional discounts for the cost of probate / title work ie worth doing yourself. Could they all pack up and leave without producton, maybe, but the possibility of that is less than the possibility of the $/acre going up first at least. Really shooting from the hip, but historically something like this would be 5-10K/acre. You could always lease it out, maybe multiple times if you stick to a shorter term, and divest the minerals later on when the value is being brought forward or keep the royalty stream.

I recommend to all my clients that they hold on to their minerals. They should be worth more in the long run than they will be in a one-time sale. Your mileage may vary, of course. You can’t predict if or when leasing will occur. nop_llc’s map (thanks for that, by the way) shows that it’s likely to occur, but not when.

My analysis of the situation goes like this. If you’re in a financially stable situation, keep the minerals. If, on the other hand, the money that you can get out of these minerals in a sale will be life-changing for you, then a sale might be the right thing. Even then, if you can scrape by, keep the minerals.

Before you make any decisions you should find out how many net mineral acres you control. There’s a big difference between 1 acre and 0.1 acres. Between those numbers there’s some gray area where you’ll have to do some thinking about whether to keep or whether to sell. Anything over an acre I’d keep. Anything under 0.1 is probably not worth the hassle, but it’s worth considering keeping.

Hey Kyle — Thanks so much for your input!

Our net amounts to 12.5 acres.

I assumed it would be worth it for some people to hold onto, but not sure if my familiarity with mineral rights, and distance (I’m between NYC/DC) mean it’s worth it for me. (As in, some people could probably make more on the rights, but that doesn’t mean I could…)

So that’s essentially where my uncertainty is. I am not hurting for the $, and I would be fine to hold, but I’m trying to gauge how much it would actually be worth it, and how much information I’d need to ramp up on for things like leasing, royalties… This forum is so helpful, I’m so glad I found it.

12.5 net mineral acres is worth taking care of, and keeping. If someone approached you with a lease right now, they’d probably offer about $3000-$3500/acre for the signing bonus, and you could expect it to get drilled up within the next few years. Royalties vary a lot, but the old rule of thumb is that once all the acreage is producing you could get between $100-$500/acre/month. The old rule of thumb does not hold true in all cases, though, and I’ve seen some people get a lot more. The wells are likely to produce for 20-30 years, and longer if re-fracing becomes a big thing.

Your distance from the physical property doesn’t change how much money you’ll make from it. I have clients on the West Coast, down in Florida, up in Canada, and it really doesn’t change the amount of money they get from it. Everything can be done remotely. The huge majority, say 95%, of my oil and gas clients have been and remain entirely phone contacts.

Leasing has picked up a little bit in Doddridge County, but that doesn’t mean that you’ll be offered a lease anytime soon, or that if we were to market your property for a lease anybody would be interested.

That said, if it was me, I’d keep them.

I am typically a hold owner, but interests like this I think are worth exploring.

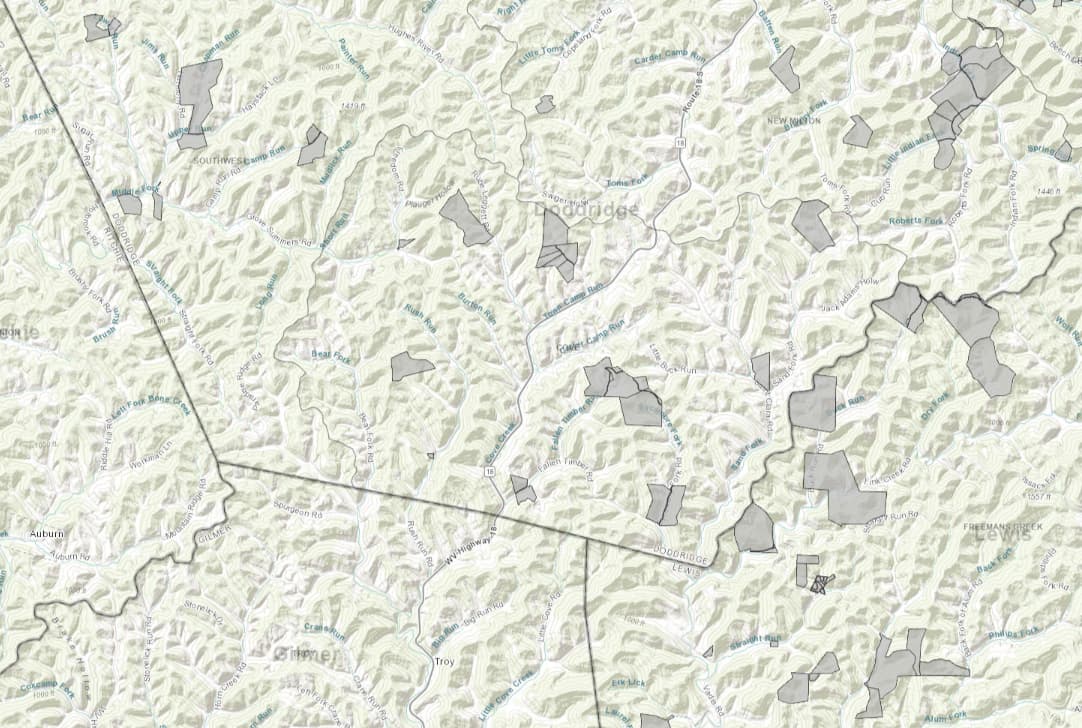

According to DI, there has been little to no leasing activity in this region/are since 2013. I have attached a lease map showing the last 6 years of leasing in this area. Its been incredibly slow. Southern Cove District is approaching the do-not-cross line for good Marcellus Shale geology & in my humble opinion I do not see this area getting developed anytime in the next decade, maybe two. People are welcome to disagree, but I have been in the basin since 2009 and have close relationships/intel with numerous operators. I would call Antero, SWN, EQT, CNX and North East and inquire on leasing. Unfortunately I am guessing they will all pass.

If you are not in need of the money, hold. If you have an investment you would like to make, I’d consider.

I was told by the agent repping the buyers that it was definitely more of a long-term bet for them — it’s hard to know in terms of property that was apparently passed down like five generations, how long “long term” is. That’s really helpful insight.

We’re debating selling half at 6-8k/acre, and seeing what plays out with the other half… 5-10years I’d be honestly fine waiting on, if it’s pushing 20, I guess I’m not sure what the difference is between selling now and making other investments…? It’s a lot of time to sit. Granted, we’ve had two offers on the land in the last two years and they’ve gone up substantially from the first offer…

Again, really appreciate all the maps and insight, it’s a lot of variables to sort out as a stranger to this kind of investment…

Thanks again for all your knowledge sharing! 12.5 sounded kind of puny off the bat, good to know it’s not nothing… — I responded to another commenter, I think it’s hard to gauge how long “long-term investment” is, since this is property that’s been passed down like five generations at this point. In general, hate asking for ballparks/hypotheticals, but those rough numbers are really helpful.

I hope this isn’t testing any board regulations, but if you rep mineral owners, I would definitely be interested in having a conversation?

This topic was automatically closed after 90 days. New replies are no longer allowed.