Did anyone receive royalty statements/checks yet from this well? Thank you.

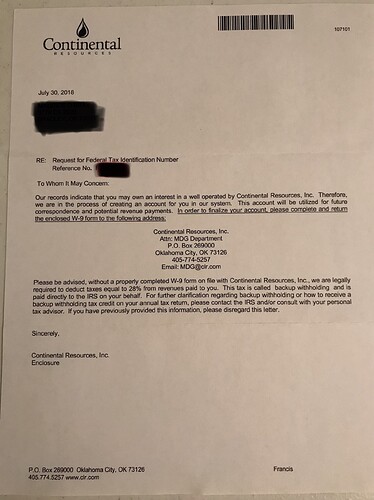

My dad did get a letter dated July 30, 2018 from Continental requesting his Federal Tax Identification Number, which seemed odd since he already has a Owner Number. There was no reference to any well in the letter. Chances are it is related to the Bovine well. I plan to call them tomorrow.

The owner number is the personal code that Company has for an individual or entity so that they can identify them in their company software. Unique to the company. And they change them when they change their software. They need the Federal Tax ID in order to pay royalties. Two completely different numbers.

Yep, I failed to mention that Continental has a W-9 form from dad related to his first well. Anyway, talked with Continental and gave them dad’s Owner Number and the Division Order Department is supposed to call me back to see if they want the W-9 form again. The person I spoke with said that the Division Order Department does not always get current royalty owners cross-referenced with the new wells coming on line.

Another thing that happened to me last year was the the Feds revised the W-9 and a whole bunch of companies wanted new ones on the new form for their accounting departments even though they had been in production for years. Go figure… Now if accounting would just talk to legal… who would talk to land department…

They are using the TIN (EIN or SSN) to insure the correct Owner Record is located and used to make payments on the new well. Using a. name only or even a name and address is not an unique identifier.

Yep, their letter confused me. The last sentence said to disregard the letter if we had previously provided the information. So I did. ![]()

Did anyone else get a surprise in mail today looks like bovine well finally paying

Guess I need to go check the mail…

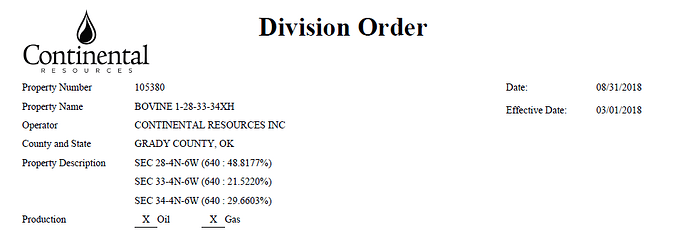

Yep, dad got a check on the Bovine well. I don’t remember seeing a division order.

I didn’t get any I wonder if when sign lease it was included

Quoting M Barnes, “The leasing title opinion is usually a less rigorous title opinion than the Division Order title opinion and can be done fairly quickly. Leasing money is so small compared to royalty money, any mistakes are not as critical. The Division Order title opinion is take much more seriously and is done in depth (but can still have errors-hopefully fewer) since the royalty payouts are in the millions of dollars. The Division Order is basically a contract and the operator really wants to make sure they are paying the correct people/entities.”

Well, I may be making a call to Continental to see their calculations if I can’t come up with their distribution decimal. They have three. Dad signed 2 leases in section 28… one at 3/16th royalty (TODCO) and one at 1/4 royalty (Centennial). And one lease in section 34 at 1/4 royalty (Centennial). So I am guessing one distribution decimal for each of the 3 leases.

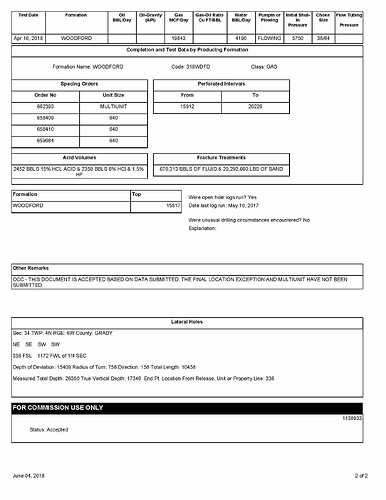

Note: The Bovine must have some very dry gas to sell for $1.94 (03/2018), $1.97 (04/2018), $2.13 (05/2018) and $2.09 (06/2018). And not a drop of oil. Wonder why they set those 4 tanks?

Additional: For those wondering why my dad wound up with 2 leases in section 28, it was because at the time TODCO was leasing my Dad’s minerals, we were also doing an Affidavit of Heirship on my dad’s dad who had minerals in section 28. I did call TODCO to let them know, but they never called me back. Hence, another lease and much better for dad.

I wonder about those tanks could be at later date they could go deeper and need them

Has you been getting anything from marathon on the well on kem ranch we haven’t got anything for a couple months I thought that was odd

Dad also has not received a check for a couple of months on Marathon’s KEM Ranch well. They may have it shut in while Gulfport is drilling and completing the MILLER 8-12X13H. The bottom hole location of the Miller is near the surface hole location of the KEM Ranch. Only thing is there is going to be 6 more wells (Well Name = Dale). Surely they won’t have it shut in that long.

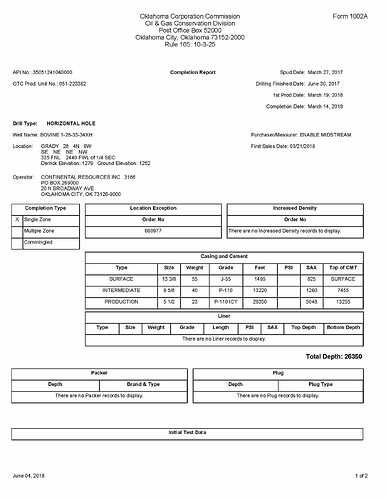

I am waiting on Continental to call me back to discuss the mineral interest calculation. A little off using the estimated allocation percentages on the permit to drill. Haven’t been able to find the document with the final actual allocated percentages.

I sent a email today inquiry about the well have not heard back

Continental emailed me a copy of the division order, but original should be in the mail any day. The allocation percentages is slightly different than the estimated allocation. Also, we were slightly off on the NMA I had for my dad. Looks like a legal description was left off a Trustee’s Mineral Deed about 10 years ago by mistake. Happy days…

I received the Division order. It has a number of title issues related to our tracts. Can I assume the ones affecting larger tracts (who sections) will be handled by the co-listed Oil and Gas companies? I know assuming is always bad, but initiating legal proceedings for old estates seems a little above the par for a signal interest holder. It does look like I will have to update some deeds though.

Thanks…