Does anyone know the status of the well XTO is drilling in 29-4S-4E, Johnston county, Oklahoma?

Newfield on the stock market:http://www.investopedia.com/stock-analysis/2012/newfield-exploratio…

Continental’s Conference Call is late this morning. Still have time to click in!

Last month I granted a 1/2 mile right of way easement to DCP Mainstream in Section 20, 10N, 7W which is just south of the Canadian River in Grady County. The pipeline runs north - south through our property. What surprised me was that it is supposed to be a 16 inch line which will handle lots of gas. The landman would not give me any details on where the pipeline was going. Anyone have any ideas about the addition of this significant pipeline capacity?

I don’t have any idea where it started and where it is headed but they are putting pipelines going north and south all the way through several sections in NE Stephens Co. and on up through Garvin Co. I don’t know the size either but it looks BIG to me!

By ROD WALTON World Staff Writer

The new Canadian Valley plant in Canadian County should process up to 200 million cubic feet per day of natural gas. Completion is expected by the first quarter of 2014.

ONEOK Partners also plans to spend another $160 million on upgrading its gathering and compression infrastructure in the Cana-Woodford. Once completed, the company’s gathering and processing capacity will reach 390 million cubic feet daily in the region.

“Additional natural gas processing infrastructure is necessary to accommodate increased production of liquids-rich natural gas in the Cana-Woodford Shale where we have substantial acreage dedications from active producers,” ONEOK Partners Chief Operating Officer Pierce H. Norton said in a statement.

“The new Canadian Valley plant will be located in the center of the prolific Cana-Woodford Shale and in close proximity to the partnership’s existing natural gas and natural gas liquids pipelines.”

David you are right I should have said WEST not east. gees

Ha! No worries!

From Devon’s 3rd quarter report:

We began the third quarter with 15 operated rigs at Cana. After initially moving 3 rigs to the Mississippian oil play in Oklahoma earlier in the third quarter, we later made the decision to move 5 additional rigs to the Miss and ended the quarter with 7 rigs at Cana. The Cana rigs were a logical choice for redeployment in the Miss because of close geographic proximity of the 2 plays makes for a relatively easy and inexpensive move. However, given the strong performance of the 2012 drilling program, it is likely we’ll add additional rigs to Cana in 2013.

ONEOK is going through our place north of Calumet in Canadian county with a 16 inch line. Gary I thought the gas plant was just west of town? Am I wrong?

Has anyone on here had experience dealing with Calvin Energy and only signing a lease for 3 years with no 2 year option?

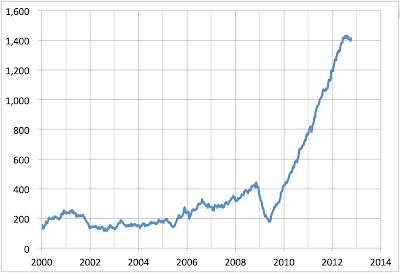

This is the number of oil rigs in use in the U.S. per Baker Hughes.

Thats one way to get $200 oil. Now that we’ve taught the world to frack they can hold us hostage while we continue to subsidize “Green energy”!

Ever see an 18 wheeler with Solar Panels?

Lori,

I’m interested in how the ownership was established. Was title transferred as the result of proper deeds being filed or did Continental accept affidavits of heirship?

Yes, 12% is due if you have marketable title. However the term “marketable title” can be tricky and an AOH should not apply.

Rick, we had the mineral rights deeded to us. My husband’s step father filed bankruptsy in the mid 90’s and found out all of his assets had not been distributed, so filed an abandonment of unadministered property which was granted by a judge ordering all mineral interests be returned to husband’s stepfather. Several years later, mineral rights deeded to us. The bankruptsy case number appears on all of the mail outs we received, so CR has had access to this information all along.

Hi I’m looking for advise, ideally legal advise. I have been in discussion with Continental Resources for two months regarding a title conflict. A well began producing Nov. 7 2011. I called in March of 2012 to ask about royalty payments (I know, pretty eager, but I’m new to all this) and they told me 6 months, call back in May. I called in May, June and in July was told should be ready in August. Nothing happened in August and called in Sept. only to find we were not listed as owners. Contacted Division Order dept. and was told they need two items to clear title. I provided those within two days and was told title had been cured and would start receiving royalty in Oct. I then asked about 12% penalty interest and was told we could get 6%. I wrote back explaining I believe we are entitled to 12% because our title was good, their land people missed a couple of things. Was then transferred to supervisor who told me there were “multiple” errors and land dept. was going to research again. In Nov. I was told title search completed and new division orders would mail out that week. Ten days later I still don’t have division orders so I call to see if they were mailed. After two months of emailing back and forth, I get the following response. " I have completed setting up the new deck for the Schulte well and I do not have you in it as an owner. Is there possibly another name?" I was floored. I feel like I’m in the movie “groundhog day”. It appears the land dept. made the exact same mistakes they made the first time. Is this a legal issue, or do I just keeping fighting by myself? Thanks for your time.

Just to clarify, I’m not a professional.

In some of the title research I have done, the court orders are filed with the property descriptions in the county land records. I have seen instances where probate documents, and civil court documents were filed in the land records but that does not always seem to happen.

From what you describe they at least know it is held by the bankruptcy. But the bankruptcy did not dispose of the mineral rights. Unless the “abandonment of unadministered property” was part of the actual bankruptcy document or filed as part of the land records, I could see where they could claim it was not marketable title. (I doubt it was part of the bankruptcy because of the timeline). They could then argue that only 6% was due. Once they are made aware of the court order, the 12% should start. I think you will eventually get it worked out, but having an attorney to send a letter may speed the process. The threat of paying 12% plus all the attorney fees may speed it up.

Again, this is only coming from someone that has been through some of this and have followed experiences of other going through similar ordeals.

Rick, thanks for your responses. I feel I get good insight and valuable information here from folks like you. I did get an email from one of the board members I contacted who said he would be involved with checking the status and get with me the first of the week. Thank you again