I’ve received high offers for my tiny NPRI in Reeves County Section 19 Block 5. I haven’t received a production check from Noble Energy since early 2019. From what I can find out there hasn’t been another well drilled. Any idea why there is interest in this parcel?

Dear Txpaki, Reeves is a hot play currently, so your small acreage is in high demand. Be on the look out, as CCG and DAWSON GEO are trying to have a peek at open land, so they are offering $25 an acre, they only need one percent to sign. No lease, no peek. Since I know this, you need to converse with oil and Gas Attorney, best bet would be one working in Reeves West Texas. He can get you the best 25% and even more Bonus money, he can help you insert clauses that help your interests vrs. not getting the best deal should you try to do it yourself. If if do this, Call yourself a Sucker and remember each month that the Oil Company who has been doing this a whole lot longer than you and your brother made out on you and your getting less cause you didn’t consult with a Pro. We have several here on site. Let me tell you how an Attorney saved me and my Family $1,050,000.00 with couple of Words? I had oil and Gas company tell me we owned some land that was not in the inventory of my GF, I took contract to Attorney and told him what they said, he did the contract, we got paid the first time, 3 years passed, paid again, 3 years passed paid again, then they came back and said we had them in a barrel, but their weren’t going to pay $350,000, just $47,500.00 for the next 3 years. I said thanks, don’t sound like a bind. Little later on, my aunt died and her attorney had the oil and Gas company run the title again, and low and behold they found another couple that owned that land. But because of the what the Attorney we hired put in the lease, we weren’t held responsible to repay the over million dollars they had paid us back. I promise you will get enough savings from Hiring a Good Oil and Gas Attorney, that you can afford him, and if you use one once for the Nice Piece of Mind they bring, then you will use one each time. God Bless and continue Success, Chris Wilson

I only have a royalty interest, so no bonus or lease signing. I’m surprised that my .005 interest in the entire 640 acres is attracting several offers that started at $300k and are now above $400k. I have an attorney, but he’s just looking over the top 3 offers I’ve received and making changes to the contracts. He’s not researching a value for my royalty. I haven’t decided whether to sell yet, as I am not in need of the money right now. But it’s hard to turn my back on that kind of money when the one existing well is literally paying pennies.

Hi Pat,

I don’t have any charming family stories to share, unfortunately.

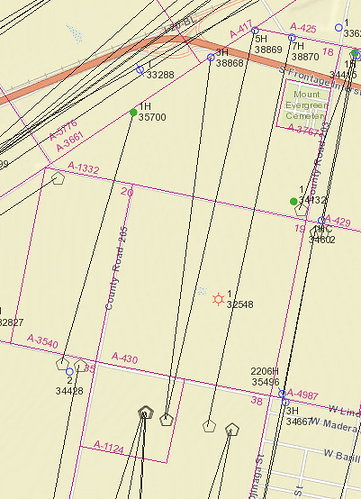

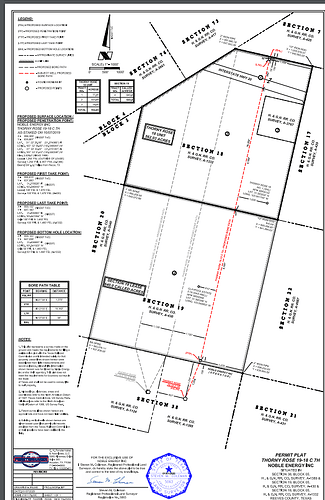

Noble had 3 permits approved there in Jan 2020. Thorny Rose 3H, 5H, 7H. In short, I am sure that is why you are getting more offers. Nearby new Wolfcamp wells have been good.

640 * .005 interest = 25.6 net royalty acres

Noble has 2 rigs running in Reeves. Their 4Q Investor presentation says they plan to focus on this area in 2020. They have 29 undrilled permits. People historically tend to drill about 70% of the wells that they permit. They may drill your wells this year, maybe next. Maybe they never drill them. Maybe $47 WTI freaks them out and nobody comes to work due to the coronavirus in the 2nd half of 2020. Who knows. If they drill 3 wells in the next year, and they are pretty good, then those wells will payout a $400k offer before 2030 if oil stays around $50/bbl. Best case scenario for someone who buys your NPRI is that they drill more than 3 wells and then they start getting a better deal.

Balancing risk and time value of money, $400k for 25.6NRA in this situation doesn’t seem like a bad deal (for you). My amateur $.02

Thank you. That is good information.

Oil royalties in the Reeves county area rival those in Saudi Arabia. And the royalty interests are forever into perpetuity. I would not sell unless you really, really need the money.

Always remember, the mineral buying game is the wild west. Any particular deal is served best by making sure that a number of (high quality) parties have a chance to see and evaluate the transaction. And even among those, on any given week, they’ll see substantially different value in the very same widget.

I’ve received offers ever since I inherited a few years ago. I’ve received independent confirmation that the companies I’m looking at are all legit and good companies and they’ve upped their offers once they knew of the competition, so I think we’re getting reasonable valuations. Now I just have to balance 3 current permits which may or may not ever get drilled against cash that can be invested now. I’ve always had it drilled in me that you never sell royalties, but the oil industry isn’t ever getting back to its heyday of $100/bbl.

I’ve been in the oil industry for 40 years as an engineering tech. I remember back in 1985 one of the engineers I worked with was saying that we could never rival the oil of the Middle East. We would always be at their mercy. He was a great engineer. What he said was true based on what we knew at the time. Over the years it seemed he was right BUT once the new fracing technique came along it totally changed reality and as we all know what we thought we could be sure of back then was only what we knew then. Although we can’t guarantee that we will ever have $100 oil back I think we should allow that there might be a scenario we can’t envision now that would push prices sky high again. Basically I’m of the mindset that if I don’t need the money I’m going to hold onto mine and although I might not see it in my lifetime my heirs might.

Hey Brenda, when you say that the royalty interests are forever into perpetuity, are you saying that you expect Reeves to be a productive county for oil and gas for quite some time? Perhaps a silly question on my end, just want to clarify.

My family has recently inherited mineral rights in Reeves, and it has been interesting to learn more about the area. Very interesting to hear your comparison to SA, I had no idea.

Update: I think I realize now what you were saying…that the interests do not expire. Well…now I feel really silly! ![]()

I’ve been following many sources that show regardless of the price of oil, the ebb and flow will not deter my stance. We have reserves in Reeves County that rival Saudi Arabia. That’s fantastic news. Selling an interest in a huge oil reserve that will make money with no expiration date, doesn’t make sense if you have heirs. Sure, the royalties will go up and down. But, since the discovery of the huge reserves in Reeves county, it’s best to keep all interests in this area. NEVER SELL ROYALTY INTERESTS - (Unless your destitute and have no heirs)

The big difference between US and Saudi Arabia is the privatized oil and gas industry. Sure, Saudi Arabia can pump oil out of the ground at whatever price because the oil is state-owned. In the U.S., it is up to private/public companies to make a profit. If the risk isn’t worth the reward, U.S. oil will not be developed in the same manner as in Saudi Arabia.

Furthermore, the recent boom was driven by the advance of fracking technology. Although the future is uncertain, it is hard to believe that such a technological advance will happen again. And if we do somehow unlock more oil in a very efficient way? The market becomes flooded with cheap oil.

Personally, I think it’s smart to hedge your investments and assets. Diversification of a portfolio is always a smart thing to do. Why not sell 1/2 for a fair price, invest it in a few different investment vehicles (stocks, bonds, etc.), allow that money to grow, and retain the other 1/2 of the minerals for future upside? What if that invested money grows to be twice as large as the retained 1/2 minerals in 40 years? That’s just my view and not advice for anyone. People need to read the market from a macro perspective and realize that the “recent” land grab, followed by slamming laterals everywhere, has come to a screeching halt. Now, operators are focusing on developing the core of the core, and anything else will go by the wayside until oil prices come back up.

My point? It’s not smart to tell people you should hold, you should sell, etc. There are so many variables that come into play; one section of land can be much more valuable than one next door due to development potential (think 10,000 ft laterals extending into multiple sections as the ideal development game plan). Everyone needs to make decisions for themselves based on analyzing all of the pertinent factors: current development, future development, alternative investment opportunities, the need for cash, etc.

I’m not an attorney or oil and gas professional, but throughout this topic people have been using the terms “mineral interest” and “royalty interest” interchangeably. They are two different animals and if you do not know the difference between a mineral estate and a royalty interest, then you need professional counsel to assist you in the sale of any of your interests.

Glad you edited your original post.

Brenda: Caution on what you read. They are probably selling you the sizzle. Hope the steak is that good. See Apache’s High Alpine “discovery”.

I don’t believe in giving others advice on what to do with what they own because I am not living in their shoes. Most people on this forum want information, not advice.

The advice given for generations is to never sell your oil royalties. The discovery of the Permian Basin’s rich oil reserve has changed the landscape for Reeves county. Saudi Arabia has an advantage in lower production costs. But, to have the royalty interest in a massive oil reserve is one of the best investments out there. For the US to have access to oil on its own soil makes the country less dependent on oil from other countries. Fracking will continue and oil will be drilled. It will be on track just like the stock market and real estate. Every investment has been devastated due to our current situation. Most of us have never lived through circumstances we face now. The oil reserves aren’t going anywhere. There will be drilling ongoing again. I’ll wait. And again, I say “Never sell oil royalties” unless you have to. If I had to sell, I wouldn’t buy stocks or bonds. Rental real estate - as many as I could afford. That’s the best return on your money - monthly income which rivals any stock market.

A majority of minerals are never sold, but you do not know their situation or their location.

Some of my Reeves County acreage was purchased by my grandfather for $0.34 per acre, land and minerals both included. I’ll hold on to my land until the end of time I told myself, then a man made me an offer on the ranch I couldn’t refuse. Held onto the minerals, just like my pap always told me. Then there came a day when I got an offer of $29,000.00 per NMA, I felt like my pap would have felt pretty good about the turn around from the $0.34 he paid.

The point is that sometimes, it does not make sense to hold on and other times it does.

And furthermore, the idea that Reeves county rivals Saudi Arabia is outright wrong. Saudi Oil is arguably more desirable than WTI. Not all oil comes out of the ground in the same condition, some is sweet, some is sour, some reserves are great for petrochemicals, others for gasoline. There is a lot at play. There is a natural level of “extras” in all oil, it varies all throughout the world, just as the dirt in my yard is different from that in your yard, but still dirt.

Aramco owns and operates the largest oil refinery in the country, Port Arthur, and we are refining Saudi Oil here in America as we speak. If Reeves was like Saudi Arabia, we would have no reason to bring Saudi Oil across the sea.

vaok,

I am curious but hopeful . . . . I hope that you have multiple formations in your NMA calculations. On our small holding we have two separate Wolfcamp & Bone Springs formations each and an Avalon shale formation as well. These were identified on the first verticle exploratory well drilled. However, all of these formations are shale and as such, are shared with multiple properties along with ours. We are now producing the deepest Wolfcamp formation with two wells and one Bone Spring formation.This topic was automatically closed after 90 days. New replies are no longer allowed.