If I am getting offers from interested buyers. To determine value, is it based on actual acres, net acres, gross acres, royalty acres? I have seen all of these terms. What is the difference between these terms. What should an offer be based on? My family owns mineral royalty interest in 86 acres in the C.M. Jones survey. I am not sure if there have been or there are leases involving our tract. One document I found in public records from 1964 states …"reserved unto the above grantors, their heirs and assigns forever, an undivided (3/8) interest in and to all of the oil royalty, gas royalty and royalty due and to become due upon the production of any other minerals from the above described lands and premises. I don’t understand how some of the offers are calculated. I know I need to consult an attorney before we sign anything. I simply want to get a better understanding of what we actually own. If someone is offering me $110,000 is that a fair offer? I am getting offers ranging from $50,000 up to $110,000 for our NPRI. I don’t know how to get a rough idea of value on the portion we own. I was told that some offers will be low ball offers. How do I determine if they are?

My opinion lease dont sell…

You can only be paid on the net acres that you own or an override. Many offers come before the bit, so be cautious about selling anything until you know what you have and what is about to happen. Gross acres are often the larger tract of land that was granted at statehood. Over generations, acres might be split between different relatives or sold, so the net is what you own now.

Many buyers “know something” and will send out teams to lease up acreage before the rig comes. Many of them only offer a discounted value on the current producing wells. The discount accounts for the time value of money for the future prices and declining volumes of production. They will not tell you about any future drilling as that is how they plan to make a profit. As you can tell from the wide range in offers, everyone has a different equation for what they offer. More offers means more folks “know something”. You can simply hold on and wait to see if there is more drilling, sell some or sell all.

Definitely talk to an attorney if you choose to sell.

I am still not clear…should I be negotiating the sale of my royalty interest on net mineral acre or net royalty acre? What is the difference?

Net mineral acres is the actual amount of physical acres. The net royalty acres is normalized to a 1/8th royalty. For example if an original patent grant was for 160 acres, then that is the gross physical acres. Over generations, a family might end up with 1/16th of that, so 10 net mineral acres. Many offers say NRA or Net Royalty Acres. If you have the 10 acres leased at 1/8th royalty, then you have 10 net royalty acres. If you have the 10 acres leased at 1/4th royalty, then you have 20 net royalty acres.

The equation is: NRA= (net mineral acres) x (lease royalty rate) x 8.

In the example, NRA=10 x 0.125 x 8= 10 NRA (1/8th royalty)

or if a higher royalty example,

NRA=10 x 0.1875 x 8=15 NRA (3/16ths royalty)

NRA=10 x 0.20 x 8=16 NRA (1/5th royalty)

NRA=10 x 0.25 x 8=20 NRA (1/4th royalty)

If they own an NPRI, then you don’t have the right to lease, just the right to participate in production if a well is drilled.

I’m a total newbie & idiot on this stuff, but if your rights are in A-449, that looks to be close to the new well permits Comstock applied for last week. I would try to get a good lease with Comstock/Surprise Valley. I assume your purchase offers weren’t coming from Comstock?

If they are contacting you regarding a NPRI (non participating royalty interest) then you dont own the minerals nor the ability to lease them. So, if you own a 3/8ths NPRI on 86 acres, thats leased at 3/16ths in a 640 acre unit (using 3/16ths and 640 to make it easy, have no idea how big or small your unit is nor what its leased at, can sub in your specifics) the equation is 86 (net acres) x 0.1875 (3/16th lease royalty) x 0.375 (3/8ths NPRI) / 640.00 (unit size) = 0.00944 interest in the unit. So a well would have to generate over 11mm to break even on the $110,000.00 offer. Youd have to look around your offsetting area to see what wells are generating/how many wells per unit are being drilled/who the operator is to determine if its a fair offer or not.

As a side note, the Comstock Leon County wells are monsters, both in expense and production. It’d only take one well to hit that metric, but it’s a risky game with gas prices fluctuating since it may never get drilled. I’ve seen some “stupid money” offered to some folks around here but I’d hold on if I could afford to. It’s very much a personal finance questions at that point though.

Interesting thoughts. Sounds like you’re saying the gamble is that when/if more wells actually get drilled & start producing, Leon County mineral rights will be worth more? And I guess that depends on what happens with the natural gas prices? If it was you, would you gamble & wait for better prices?

In general, many of the professional talks I have attended this past year are predicting higher gas prices in late 2024-2026 due to increased LNG trains coming on line. (Your results may differ…)

I had not thought of that at all, but it makes a hell of a lot of sense until carriers can go hydrogen or fully electric. I don’t know much about the North American rail industry. Do you think it’s possible that they could be significant users of LNG by the end of 2024? Or were you talking about the amount of electricity generated by LNG or the gas turbines used to maintain LNG liquification trains? Also, I think most hydrogen now is produced from natural gas. Either way, absent a global economic meltdown, it’s hard for me to see a scenario where the price of gas doesn’t keep increasing until at least 2030.

The info I’ve gathered puts me in on the same side as the info Martha shows. I think the gas plays are in a good position at the moment for some future growth, especially with short distance of Leon County to the coast for LNG processing compared to other big gas plays like Permian and Marcellus. Less bottlenecks to reduce the local price. My gut tells me there is activity happening under the surface along highway 79 there that only a few operators and buyers know about because public data isn’t lining up with some of the astronomical offers I’ve heard folks receiving. Again, it’s a personal decision that has a lot of other factors to consider, but all else equal I’d hold on to acreage in this area if I were already an owner.

You might find this article useful. Search for “LNG projects US” for many more

I met a retired geologist back in 2008 when eagle ford field was really kicking off. I was working with the USDA tracking cattle prices at the Navasota Texas livestock sale barn. He asked where i was from, I told him eastern leon county area. He said he used to review seismograph reports from our area from the 1970’s. He asked if we had any mineral interest on our property I said yes why. He said watch the eagle ford field and the gas field west of ft worth. Both these fields will start fingering toward leon county then head east into Louisiana and Mississippi. It will turn into one of the largest gas fields in the world. The only draw back of it is that its very deep and natural gas prices will have to hit 3 dollars+ to make money on it. And plus the technology needs improvement to bring in these well because of the pressure. So far everything he said has happened along with large gas pipelines that was built going through our area then a gas dryer plant just west of crockett texas was built as well. They also done test well on hiway 7 just west of the trinity river several years ago also. Companies know it there it just takes big money companies to get it. This geologist I talked to said if we hold out until all this develops it will be more money flowing though this field than anyone ever seen. So if it was me i sure wouldn’t sell my minerals.

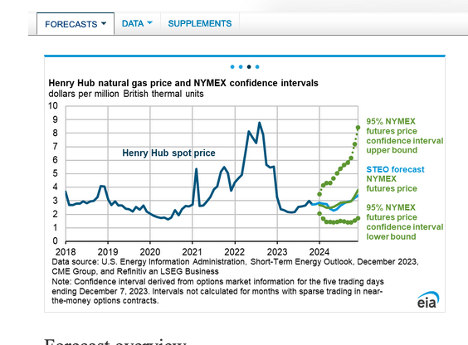

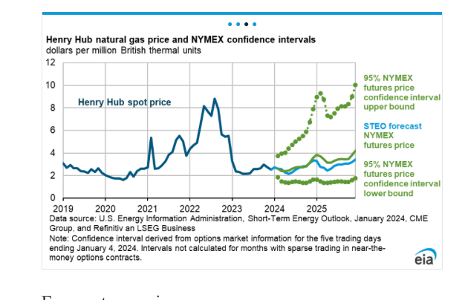

New forecast for Henry Hub to 2026 out recently.

Lower boundary hugs $2, mid-level flirts with $4, upper bounds back at $8-10. Most speakers have touted sales to Europe and other countries.

Thanks for the information. Yes, I realize with NPRI, I cannot lease or have any executive rights. I would hold on to the royalty interest, but my family is considering selling and I can’t be the only hold out. It is in an area of lots of activity and I have been reading about the permits for drilling and the potential for the wells. I am not quite clear on a few things that is why I am asking questions.

Wow. That’s a ton of new capacity. Thanks for sharing. So much to learn.

I would tell your family we sellout now for a million dollars or make a million dollars per year depending on the interest you own.

You can sell or keep all or part of your interest in the mineral rights or royalty independently of your other family in NEARLY most cases if it is currently in your name.