We inherited these wells and this is our latest statement. We’re getting about $28 per quarter. Can someone help us make sense of this?

Hi so we are dealing with the same issue. The only sense I can make of it is operators/leasee on wells are taking out deductions ten fold and not going by original leases. Hoping no one is paying attention and if you question it they just throw something at you wanting you to just be fine with it. Then someone comes and offers to buy them. Hoping you’ll just throw your hands up and sell because they are taken so much.

So I see no good sense in what they are doing and honestly the way I see it is people should pay attention and question them about it. Unless you has a royalty owners/ lessor of mineral rights like getting paid so little and then paying taxes along with all the time and effort you personally put in.

Just my thoughts

Your decimal interest amount is made up of several components-your net acreage, the spacing unit size, the royalty and the amount of perforations. Given that you are in WV, the post production charges are normal and fairly large unless your lease does not allow them. Many folks are stuck with old leases that are at 1/8th. In WV, many owners have very small net acres due to fractionation over the generations of splitting up the acreage amount many heirs. Do you know your net acreage and royalty? You can ask the Division Order Analyst for the equation that they use for your check.

I was at a NARO conference this week and one of the speakers commented that in Appalachia, it is common to have 50% post production charges, so that takes a gas price of $3.00 down to an effective $1.50 for mineral owners (depending upon the area).

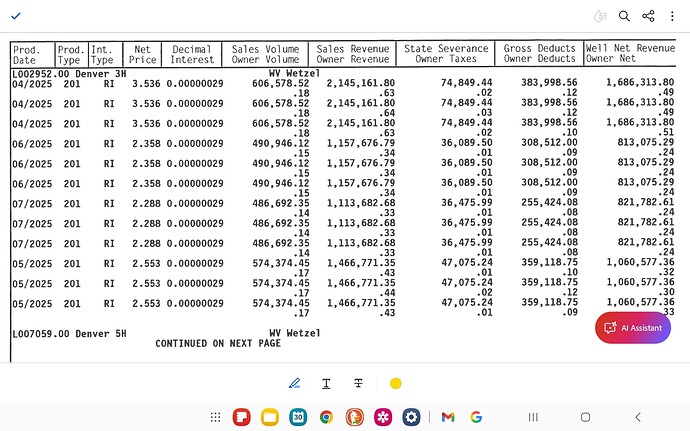

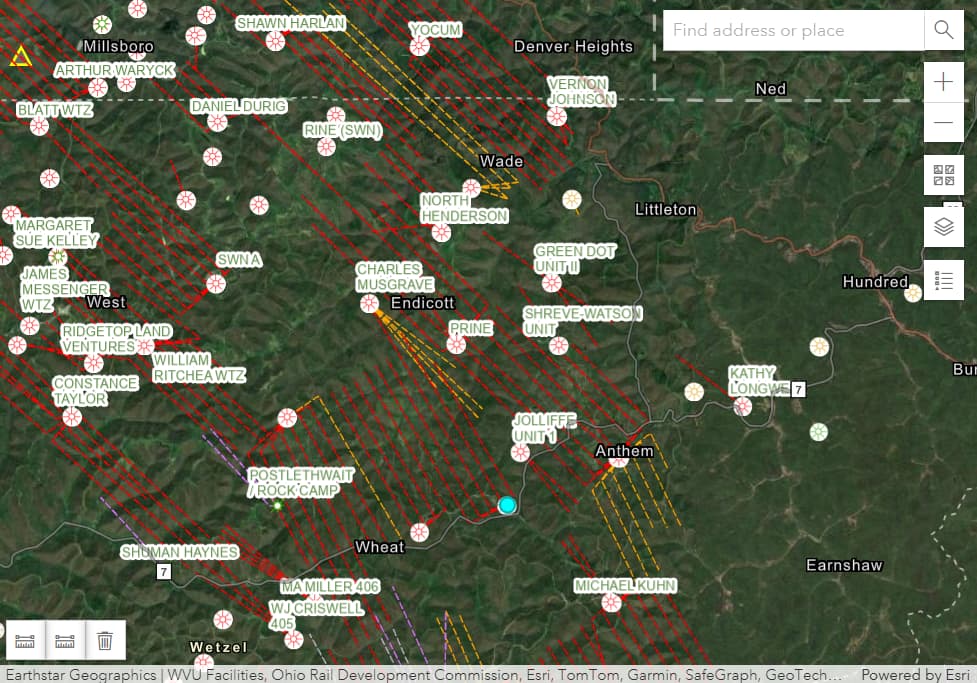

You have a royalty interest in the Denver pad operated by EQT in Wetzel county, WV. The 3H well unit is 837.45 acres so you own about 0.002 net royalty acres. You were paid for your share from April through July at the $/mcf net price.

Column: Prod Date: month of production

Prod Type: This is a gas well

Int type: Royalty Interest

Net price: $/thousand cubic feet (mcf) Note the price drop in the last year

Decimal interest: As a portion of 1.0. Your interest is tiny

Sale Volume/Owner volume: Total sales in mcf/ your share

Sales revenue/owner revenue: Total $ of sales/ your share

State severance/owner taxes: Total severance taxes/ your share

Gross deducts/Owner/deducts: Cost of processing & transporting gas/ Your share

Well Net-Revenue/Owner net: Sales-taxes-costs=net/ your share

This well is netting about $1 million per month but your share is so small that you are getting less than $1.

What part of this do you need help with? It is a very small interest percentage. It sounds like they have the minimum suspense amount set to $25. That means they hold the revenue until it reaches $25 and then release several months of revenue at that point. I would be happy to help you try to figure this out if you have more specific questions.

As I understand it, we have 53 net acres with 152 gross. The inheritance went to my Dad and his brother and sister. There are no others involved with that particular acreage. We have 220 acres in 3 counties that is split between me, my siblings and my Aunt and Uncle. What does it take to actually be worth something?

We have 53 acres that is under contract. What would it take to actually be worth something? I really don’t understand how this works. The 53 is our net acres while the gross is 152. I spoke with the WV Department of Oil and Gas and the wells are producing strongly. No one has been able to tell us any real useful information.

This topic was automatically closed after 90 days. New replies are no longer allowed.