What are leasing rates, bonus per acre, and royalty % now (04/22/22) in Wattenberg weld county: Township 5 North. Range 66 West of the 6th P. M. Section 32:W/2SW/4, SE/4S ?

After six months of negotiations by our very experienced attorneys, we just signed with a major company at $800 an acre and a 20% royalty for our tract in Township 9 N Range 61 W. It is our belief that this is fair and typical.

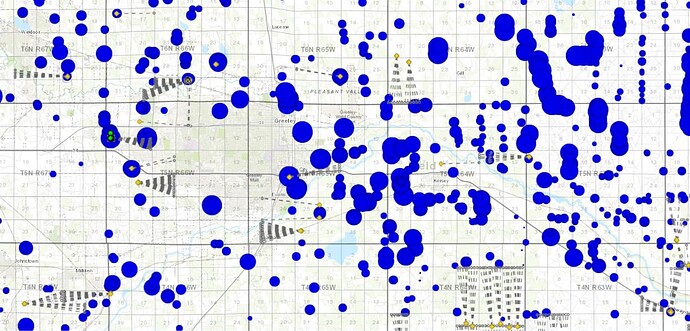

I have 80 acres in Township 10N Range 62.W. Interested in leasing. Who should I be speaking to?

The operators or their contract landmen will contact you when they are looking to lease.

a 20% royalty is great, actually the royalty rate is above what I’ve seen over the last 18 months - usually 15% - 18.75% - a key point would be what type of deducts are permitted from your royalty stream.

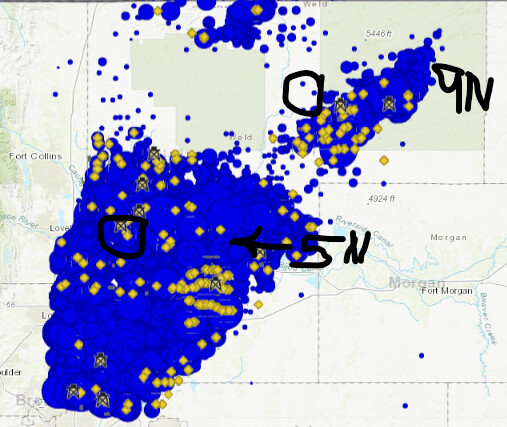

9N 61W is quiet difference from 5N 66W as far as geology, production potential, or lease value.

9N61W has only a handful of HZ wells drilled and lies on the north west edge of the North Eastern extension. Wells can be very very good out there, but 61W is a bit unproven

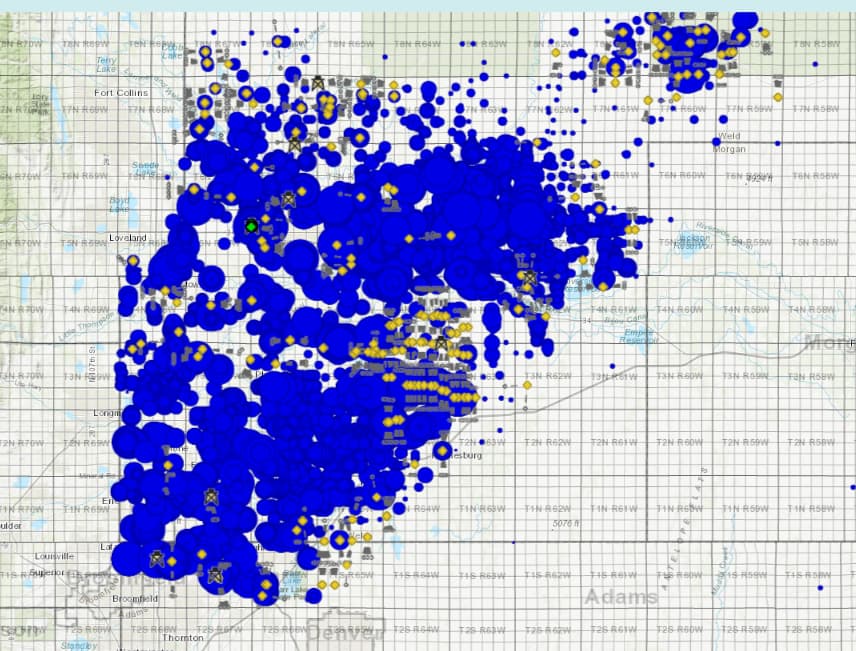

The size of the bubbles on the following map provide a gauge of the 1st 6 months production

5N 66W is near the inner core of the Wattenberg, geology is well understood as the area is surrounded by wells

If its PDC that’s trying to lease you in 5N 66W, (they are the dominant operator in that township), I could for see you getting 3/16ths (18.75%) with a much higher bonus $2-$3000 per acre, maybe better. try to get Gross (no deduction) language in your lease as that area should have a lot of natty gas and NGL production

Thank you Jeff! With the price of oil per barrel doubled lately I would think the bonus price per mineral acre should be much higher. I received bonus of $10k per mineral acre in 2018, so why do you not think a much high bonus is appropriate? If the price per barrel has doubled it makes sense to see offers of $20k per mineral acre in my mind. Now, the need is much higher and safer to drill in proven areas. Can you contribute some thought here?

Pam, Leasing is picking back up to a certain extent but things are materially different than they were in 2018. While the price of oil is higher, the activity level and pace of development is significantly lower now vs. 2018 and not likely to change significantly. For example, there were 30 rigs running at the peak of 2018 whereas there are 15 rigs currently operating in the DJ as of 5/6/22. As far as pace of development, companies are only really able to reinvest what they make in free cash flow vs. in 2018 they were highly leveraged and generated negative cash flows (hence the slew of operator bankruptcies in ~2020).

The lease bonus amounts you mention seem quite high (maybe you are referring to purchase offers of $10k/NMA?) but in any case you may be able to negotiate similar lease terms in areas where there is near term development like operators filing spacing order in your section or pending well permits. Also, it takes much longer for the COGCC to approve well permits now vs. pre SB 19-181 so it is important to temper expectations.

It is still important to negotiate favorable lease terms and as high of a royalty rate as you can get but I don’t think anyone is leasing for $10k/NMA bonus.

In any case, you can monitor the Weld County Clerk & Recorder website for recent leases in your area to see what terms others have been able to negotiate (except for the lease bonus).

Good luck! Thanks, Matt Sands

There doesn’t appear to be a lot of leasing activity in 10N 62W except by a company called EXOK, INC. for what appears to be less than ideal terms. You certainly don’t want to sign a lease at a low lease rate and long lease term and be stuck with that if a company eventually drills a well. The value of your minerals are directly proportional to the royalty rate you negotiate.

Good luck! Matt Sands

This topic was automatically closed after 90 days. New replies are no longer allowed.