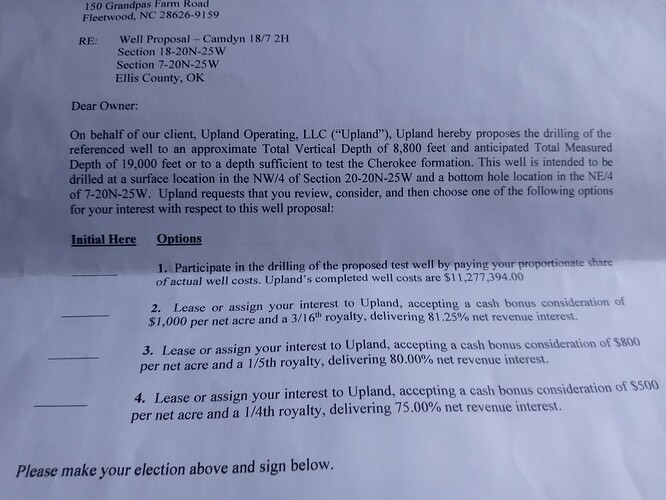

Help we received this offer and don’t know what to do.

Most savvy mineral owners opt for the highest royalty. This is fishing for a response. You don’t want to sign anything that is binding. If interest aske for a proposed lease.

When reviewing a lease, in addition to the royalty and the bonus (which is a one time payment) the following are key items to review:

- Whether there is a depth clause, this protects you if there are formations that the lessee does not develop.

- Top lease clause. Many leases provide cumbersome procedures in the event that you wish to lease different formations to new lessees.

- A Pugh Clause. This protects in the event of certain spacing issues.

- No Deduction Clause: This maximizes the royalties by requiring the producer to bear to cost of transportation, dehydration, and other expenses. Some modern leases have things titled “no deduction” but really do not protect the landowner.

- Special warranty. Owners do not want to warrant that they have title to the property, the special warranty limits the owner’s liability in the event failure (or partial failure) of title to the minerals.

- Cessation, Drilling and Reworking. Places time limits for the lessee to rework the well after production has ceased.

- Free use or oil, gas or water: Clarifies how a lessee can use those items and possible royalties if used for production of electricity, crypto currency. etc.

- Commencement to drill. Should require a rig on site.

- Shut in royalties. Best to limit term that shut-in royalties can be paid.

I recently ran into proposed lease with the following language:

It is agreed between the Lessor and Lessee that, notwithstanding any language herein to the contrary, all oil, gas and other proceeds accruing to the Lessor under this lease or by state law shall be without deduction for the cost of producing, gathering, storing, separating, treating, dehydrating, compressing, processing, transporting and marketing the oil, gas and other products produced hereunder to transform the product into marketable form**; however, any such costs which result in enhancing the value of the marketable oil, gas or other products to receive a better price may be deducted from Lessor’s share of production so long as they are based on Lessee’s actual cost of such enhancements.** In no event shall Lessor receive a price that is less than, or more than, the price received by Lessee.

I view this as a fake non deductions clause.

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

Okay thank you. We also have received 2 court orders in the mail for a pooling order. I know we should probably hire an attorney but would like to see what all we could do without one. We live in NC though and honestly know nothing about mineral rights.

Pooling orders are confusing. They typically offer several options ranging from a 1/8th royalty as the lowest. There may be the ability to elect a higher royalty. Most people on this forum almost always opt for the highest royalty. The problem is that there are only 20 days from the date of the order to make an election for a higher royalty.

If you fail to make a timely/proper election then you will be stuck with the 1/8th royalty. If a well is drilled, this can last for years & decades. Neither you nor your heirs will be able to “renegotiate” the terms.

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

If it comes to a difference of 500/acre for 25% vs. 18.75% go for the higher royalty, my two cents. Participating could result in the highest return, also highest risk. The well would need to make about $15MM in revenue for this to be the best, ie payout and then some, @75 oil and 3 gas that’s 1MM boe. I don’t know what a good Cherokee well does here, having a hard time finding production data, but it seems viable. There’s a Herber lease in this area with three old verticals that has done that. You’d have to front your share of the $11MM, totally dependent on how many acres you have in the unit. The other option is to participate and let the expenses net out against your revenue. Don’t take this as legal advice though, because they can place a well lien on you and maybe take your interest. Not sure how that works in Oklahoma. The final option is to shop it around to non-operators that want to participate for a higher bonus with the royalties stated on the paperwork and take a lease with them.

The easiest thing to to is ignore the letter and take the highest royalty in the pooling. You only have 20 days in which to answer so be speedy and send by certified mail return receipt. Most basic mineral owners should not be working interest owners unless they have deep pockets, a really good oil and gas attorney and a really, really good accountant. if you already have a pooling order, then the time to lease is probably too short at this point.

Here is a good reference for mineral rights in OK.

0_Royalty-Owners-Booklet-112020.pdf (6.8 MB)

Okay thank y’all for the information. I’m looking into all this on behalf of my uncle and after speaking with him just now he told me they checked off the last box and mailed it in ![]() . They had tried to have our local lawyer call the contact numbers listed to no avail. What is sending this back in going to mean for them? They’ve had this letter (referenced above) for over a month. The pooling orders we received were postmarked Feb. 16th. I don’t want them getting involved in anything that is going to require money out of their own pockets.

. They had tried to have our local lawyer call the contact numbers listed to no avail. What is sending this back in going to mean for them? They’ve had this letter (referenced above) for over a month. The pooling orders we received were postmarked Feb. 16th. I don’t want them getting involved in anything that is going to require money out of their own pockets.

Those letters don’t usually mean anything binding, but they could-hence I never sign them. They have to actually sign a lease or answer the pooling. I would not sign the draft lease sent by Overland as it needs some edits. There are other groups leasing in the area that may give better lease clauses.

What is the number of the case on the top of the pooling order? Is it 2023-000723? If so, then the hearing date is set for March 21, 2023 and you do not have to do anything at this time. If you want to keep things simple and not hassle with a lease, then just wait for the orders from the pooling which should come a few days (to weeks) after the order date. Make sure that their name and address are properly filed in the county courthouse and that they are receiving the mailings.

Yes, that is the correct number on the pooling order. Thank you so much.

What kind of bonus and royalty would you think we would get from the pooling order? I do think keeping it simple is the way to go since we have no connections there or knowledge of how this all works.

Usually, the pooling order bonus/royalty pairs are very similar to the letters that go out ahead of time.

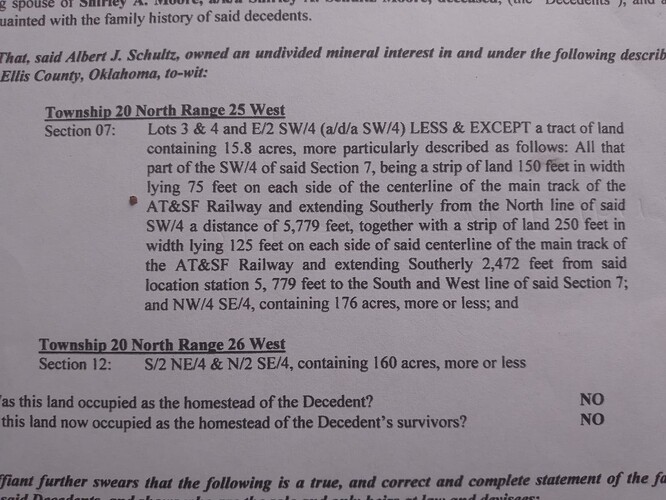

I am also one of the heirs of these mineral rights and have received the the same offer as you Emmylou. I’m not fully convinced that we are actually heirs, even though our names are listed as “Sole Heirs At Law” on the affidavit of death and heirship of the descendent which was my Aunt. Would we be getting lease offers if we were not heirs? Any help on this would be greatly appreciated.

The leasing title opinions are given to the leasing agents by the attorneys or landmen that they hire to trace title. You can go ahead and lease (but do not warrant title) or you can wait for pooling. If a well is drilled and is successful, then the operator will run a more rigorous title opinion before issuing the Division Order as the money involved at that stage is much higher.

So you are pretty confident that I am a title holder?

Companies make mistakes. That is why Martha Barnes said to not warrant that you have title. It is likely that a probate or other title clearing procedure will be needed.

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

Not having access to the title opinion, I would not venture to comment on your title. I would lease or pool, but put the funds in a savings account and not spend them until the title is clear.

Thank you both for the advise and information. My Aunts will was never probated in Oklahoma, Would you recommend hiring an attorney and have it probated?

Speaking as a mineral owner, I would go ahead and probate the will now. This will save you time later. HIring an attorney us always wise when probates are concerned.

Could you recommend an attorney?