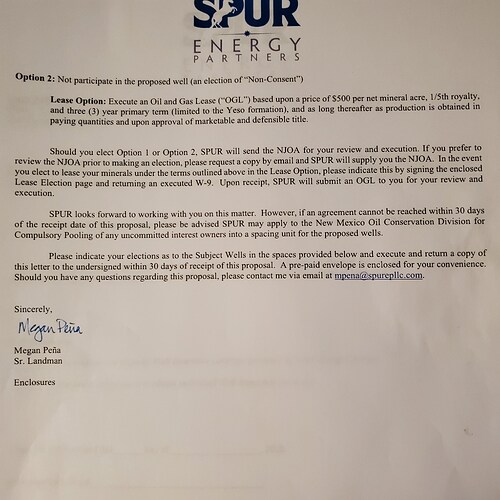

Hi all. I’ve been sent a proposal for unleashed mineral interest by Spur. They are going to drill 10 wells. E/2 Sec. 7, T-19S-R25E, Eddy CO. NM. The offer is $500 per net acre and 1/5th royalty. Is that fair? I know that on another well it has a stipulation of market ready. By the time they take out all the fees to get at market ready, I get nothing. When there were going to be Wells drilled on it a year ago, it was $1000 per net acre and 1/4 royalty. Of course if I don’t do something, I get the old threat of pooling. I would like to get 1/4 royalty again. Also, is there any way of getting out of the market ready clause? can you haggle with these companies or are they dead set on getting it the way they want it?

Yes, you can negotiate with them on the lease offer. If you can’t agree on lease terms, they have to force pool you. As a mineral owner, you can contest the force pooling and continue the negotiation. In the end, they will get the lands pooled, but you can steer the terms of the pooling.

They have 87 undrilled permits and are running one rig. No permits in Sec 7. I would guess it’s going to be a while before you have to do something here. If you really think they are going to drill 10 wells (they might), then you are on the right track, getting the best royalty rate is where the rubber meets the road. Difference between $500 and $1000 and zero on bonus isn’t much once wells hit. I own a tiny bit in the E/2 of Sec 27, which has 5 SEP wells, and those in total are churning out $600/mineral acre per month and they’ve been online for 2 years.

Is $500 and 20% fair? I don’t know. Its not ridiculous. Like you said, SEP signed leases here a year ago at 25% royalty. But a year ago today oil was $56 a barrel.

You can contest force pooling. In my experience it’s banging your head against wall unless you catch them where they just can’t afford to deal with a contested hearing due to timing, but your mileage may vary. You can and should negotiate, and threatening to contest a force pooling is a way to negotiate. So is just asking for 25%, maybe at a lower bonus. If your interest is large enough it might be worth having a professional negotiate on your behalf.

Thanks so much guys! I really appreciate you.

I just want to do the right thing. I have about 11 acres but I don’t know what that amounts to.my $0.02

Yeah, they are bullying you. Give Megan a call and tell her you would like to discuss the terms. I hate long protracted offer/counteroffer dances as much as anybody, but IMO you’ll feel better if you don’t accept the first offer and I’d guess she has some flexibility. Dig in your toes if that suits you. According to them, they are planning on drilling 10 wells there. Most of their leases are 25% royalty. The implied logic is that they think wells at close to 25% royalty are economic, why should you take a lower royalty rate than the other folks? You can always say you were advised to reach out to somebody at Hinkle Shanor to represent you if it goes to a forced pooling hearing. At some point if they don’t blink at all you take their lease and sleep well at night. If they drill wells you will be doing fine.

11 acres is a decent amount.

Thanks. What about the clause about charging for making the oil or gas marketable? Someone told me that I could get that taken out but I’m not sure that’s true. They said they will charge for every little tiny thing until you don’t get much. Is that true? They know we don’t know if they are getting to us.

I received the same offer from Spur this week for 18-T18S-R27E, 4 H wells named Smashing Pumpkins. I’m told these wells haven’t been permitted.

I’m not sure what marketable portion you are referring to. The letter you showed above mentioned “marketable title”. They are just saying they need to confirm that you own the land to lease. Was there something else?

Hi there-

Always counter an initial lease offer with your ideal desired terms. The worst that can happen is the leasee will refuse to change any terms but more often than not they will agree to much of what you request or at least counter with revised terms that are somewhere in the middle of where they started and you asked.

Some of our standard counters include:

-An increase to the bonus offered- reasonable to just high of reasonable- never hurts to ask as they usually have some wiggle room

-1/4 royalty (always, always ask for this)

-A shut-in rate of $xx (not sure of going rate in Eddy at present- anyone have thoughts?)

-Royalties paid at the well head with no deductions for anything (see our standard lease language below)

-Inclusion of our standard Pugh clauses (also see initial language requested below- this often gets edited by the leasee in some way but ends up being more fav. than operator lease language which usually ties up all minerals if they can)

-No lease extension/Or a 2 yr lease extension but only with a re-negotiated bonus

We have a standard lease document that our lawyers put together and we usually request that it be used. This ensures that all language has been vetted by our side rather than having to review an operator lease template. Not everyone has this of course so using the Operator lease is fine but would recommend having an O&G lawyer review as it will ensure unwanted language doesn’t slip through.

Good luck!

-Example Deduction language:

Price shall mean the net amount received by Lessee after giving effect to applicable regulatory orders and after application of any applicable price adjustments specified in such contract or regulatory orders. However, Lessee shall not deduct from the royalty paid hereunder any charge for compressing, treating, purifying, or dehydrating such gas (whether on or off the lease premises) or transportation of gas off the lease premises, or for the separation, stabilization, manufacturing or measuring of oil, gas or other hydrocarbons covered by this Lease. It is the intent hereof that Lessor’s royalty on oil and gas produced hereunder shall be free of all costs incurred with respect thereto by Lessee or any third party beyond the wellhead connection.

Example Pugh Clause Language:

Notwithstanding anything herein to the contrary, on the expiration of the primary term this lease shall expire as to all lands not committed to the proration unit for a well producing or capable of producing oil and/or gas in paying quantities and as to all depths within such proration units lying 100 feet below the stratigraphic equivalent of the deepest producing depth, and 100 feet above the stratigraphic equivalent of the top of the deepest producing formation, in such proration unit unless Lessee is then conducting actual drilling operations on the lease premises or lands pooled therewith. In such event, this lease shall continue in force and effect for as long as Lessee continues to develop the lease premises with not more than 120 days elapsing between the completion of one well and the commencement of actual drilling of the next well. Upon the conclusion of Lessee’s continuous development operations, if any, this lease will terminate as to all lands not within the proration unit of a well producing or capable of producing oil and/or gas in paying quantities and as to all depths below 100 feet below the stratigraphic equivalent of the deepest producing depth, and from the surface down to 100 feet above the stratigraphic equivalent of the top of the shallowest producing formation, in each proration unit.

BP11,

Thank you so much! That is tons of help! Thank you everyone for your help and time!

This topic was automatically closed after 90 days. New replies are no longer allowed.