This is my first time on this forum so please bare with me . I have recently inherited mineral rights in martin county and I am so lost and clueless to all of this I would like to understand what it means and what is going on . It is all so overwhelming and I am confused. Please help !!!

Welcome! It can be overwhelming when you first start.

First of all, get oriented. Find out the description of what you have inherited.

Scan the forum for keywords and read the posts for your county and nearby counties.

The Mineral Help tab above is quite useful.

There is also a NARO topic area that has good information. The NARO website is also quite useful. www.naro-us.org. Once Covid passes conventions will begin again. In the meantime, there are useful webinars on particular topics of interest to the mineral owners. There is a Texas NARO chapter.

If you have wells in production, then you need to inform the operators that the title has passed to you.

A useful website is the Texas Railroad Commission. This is the link to the GIS maps so you can see where you are and see what drilling is around you. http://wwwgisp.rrc.texas.gov/GISViewer2/

Ask questions.

The title has already been changed over to me it is in martin county Hughes #43 . I just get frustrated because I don’t understand any of anything I read about any of it

I also don’t know if I have to pay taxes on the money I receive or if there is anything I should be doing other than drawing a check thank you so much for responding I am so excited about finding this forum

Welcome to the forum. You can find out your tax status by contacting the Martin County Tax Assessor, Marsha Graves at 432-756-2823. You can also search for your property yourself here: http://www.martincad.org/(S(bcpcisrmqzykti2x431oiwvq))/search.aspx?clientid=martincad

A quick search of the Hughes #43 shows it has several wells on it. You need to make sure that you are getting paid on all of them.

I`m not sure what taxes your referencing but you may have a filing impact from the following. Any royalty received is taxable for federal income tax purposes and since the State reference is TX there is no State income tax. Additionally since you mentioned inheritance there could be other Federal taxable income paid to the Estate on other holdings you may have inherited. Lastly, TX has County mineral taxes if the entity has production with an assessed value of more than $500.

I am tickled to death that I stumbled across this forum I havent been able to put my phone down since I discovered this . There is so much useful info here .

I am I get a check every month how do I find out more info on what is to come .

So people located their minerals by Block, Townership, and Section. In your case, your lease is in Block A, Section 43 (Martin County)

From there you can add up your ownership if you know your “Decimal Interest”… The easiest way for someone to locate that is for you to let us know who you inherited this from. The appraisals are all public info and can be used to calculate your ownership in this lease. By Net Royalty Acres or Net Mineral Acres.

As far as Taxes, yes you will have to pay taxes on the royalty payments you receive.

Typical wells decline in volume in a fairly predictable way, so the deciding factor for your checks is the volume and the price. Prices for oil and gas can vary due to world wide politics, demand and supply, COVID etc.

Generally, the first check you get is the largest one since it usually has six months of production in it and high volumes. You might get a second check for interest (if you request it) if they were late on the first payment. From then on, the production volumes typically decline predictably and price is the main factor, but most checks get smaller every month due to the decline in volume.

How do I pull up a map of where my wells are located

Share the description and someone will provide a map.

Hughes43-47 martin county tx

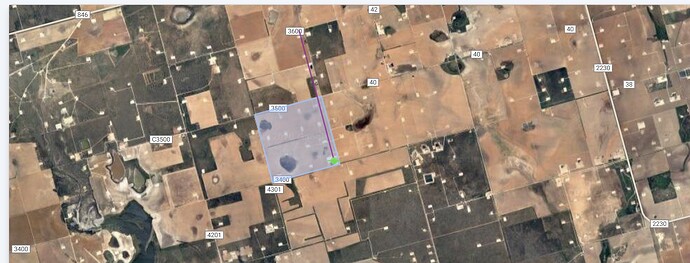

Here’s what I found. Looks like there are 4 wells with that name, currently shut in but have had production before. Here is a map of one of them. The others are real close to this one.

Thanks! Lana

Thank you very much for the information

I purchased a book titled Primer on the Texas Law of Oil and Gas (fifth edition) It is written by two attorneys but is easy to understand and filled with basic information that will put you well inside the ballpark as you read it. It is available from Amazon.

This topic was automatically closed after 90 days. New replies are no longer allowed.