My Dad received an offer to buy his mineral rights in North Dakota. We are new to this with very little knowledge of its worth. Sections 2&11, 3&10, 4&9, township149N, range96W. What is this possibly worth? Thanks!

Welcome to the forum!

When you get an offer to buy, someone wants to make a profit off of you. Those sections have quite a few horizontal wells in them with a very long life predicted. It looks like you might have some new wells in Section 4/9 that may be about to go online or just did (Saddle Butte and Curtis wells). That might be what they want. There is room in that area for a few more wells, so that might also be what they want. One thing to consider is that if your dad sells, he may be subject to capital gains tax. If your folks pass the minerals to younger heirs upon their death, they get to enjoy the revenue from the wells while they are alive and the heirs get a new value set to the minerals rights upon death.

Thank you for your response. To be honest, my parents could really use the money as they struggle financially. Any idea of what a fair offer would be?? How do you find out how many acres these sections are? And yes, the well names are Curtis and saddle butte.

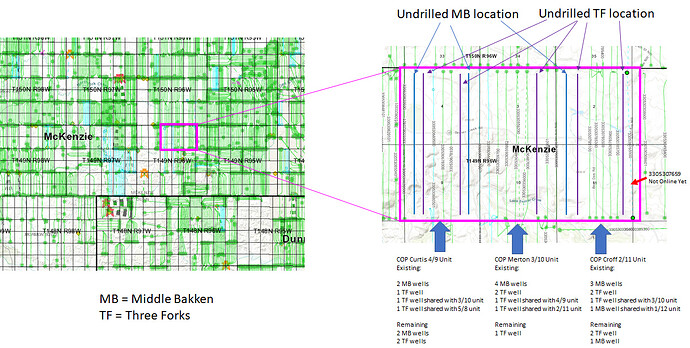

From what I see they should have interests in the Curtis, Merton, and Croff Units if the legal description is correct.

I’m not sure why, based on the description, that they would own anything in the Saddle Butte wells as they are spaced to sections 16 and 21 (they go south from a surface location in Sec 9). There is a single DUC (drilled but not producing, in effect) well on the east leaseline of the 2/11 (Croff) unit. The remainder are all reporting production.

See map below. At the end of the day, each of these mile-wide units should get 4-5 Three Forks and 4-5 Middle Bakken wells drilled in it. As Mrs. Barnes said, there are some undrilled locations here still. They are shown as Blue/Purple thick N-S lines on the map below. This is a pretty good area, I would guess that COP will drill these eventually, though right now they are running 2 total ND rigs so it may take a while. Your value (per acre) should be some combo of the current cash flow plus the remaining undeveloped acreage.

In terms of how many acres these sections are…I assume you want to know how many acres your parents own? The sections themselves are 640 acres. If you have their check from COP you can figure out (more or less) their acreage from the fraction that they have in the wells.

First thing I would check is to make sure they are receiving revenue from COP.

If not, well then need to contact COP and see what is up.

If they are getting a check, see what wells are on it, as that should clear up where COP thinks they have ownership.

Then look at the well decimals for each well.

Somebody here can help you figure out what that means in terms of ownership.

Hello! Do you know what they are leased at(1/8, 3/16, 1/4)? That will effect the value. What is the company offering. If your parents could use the money now, selling may be what they want to do if the offer is high enough. As for capital gains, they would be taxed at capital gains rates. Depending on their income, I believe that is either 0%, 15% or 20%. If they are married filing jointly, and their income is under 78k for the year, it’s taxed at 0%. Over that to like 400k somewhere it’s 15%. Keep in mind, they won’t pay tax on the total sale. It’s the sale price minus the price they paid for the minerals(or the value of the minerals when they were inherited.) now I’m not an accountant, so please discuss this with one, but that’s how it goes from my experience. Let us know the answers to what I asked above, and hopefully you can get some insight of if it’s a good offer! Best of luck

Yes, they are receiving checks from COP and they make less than 78k jointly on income. Therefore, I’m assuming they won’t have to worry about capital gains. I will find out the other things listed from their check and write back. Thanks so much everyone. This is all very helpful!

Some of the Saddle Butte and Curtis wells go south into 16, they have 21-16… in the name. The other two go north into 9 & 4. They have 24-9 TFH and 24-9 MBH in their names. (Unless they changed the naming convention). Those will be the highest paying wells on their check stub-most likely.

Your parents could sell part and keep part. It does not have to be an all or nothing thing. They could sell part and get a cash influx now, but keep a smaller royalty stream coming in. Offers to buy are going to be low to start with, so always ask for more. NEVER hand over a deed without getting paid!

Hi there. Your family owns minerals under some of the best wells in North Dakota. In addition to the diligence below, I’d suggest soliciting more than one offer so you can weigh the options and get the best price for your family.

He found out that he owns 6.2 acres. His 4 other brothers own the same amount. He is being offered 5,500. an acre. Is this a fair deal?

Good morning. Even without knowing the allocations of those 6.2 acres across the three separate drilling units, he could do much better on a price per acre basis. I’d suggest getting a second offer and let us know how else we can help!

NM OilBoy - Hi there! where did you get those maps you showed in response - the ND state site / ArcIMS viewer?

I tried like heck on that site to replicate what you showed, but can’t get there. I’m trying to do the same thing - determine what “undrilled” locations there might be in nearby sections 1, 10, and 11 in 153N 97W. Where does one go to find that out, please?

That is all from Drillinginfo, subscription service

Thank you for the information!