Does anyone know of any recent activity in T24S 36E sections 29 & 30? Thanks

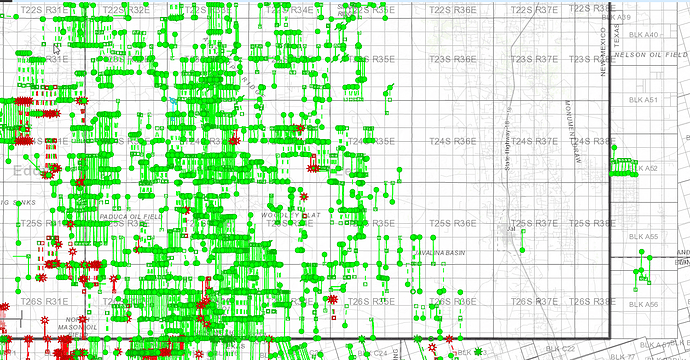

Sorry, no activity. Map of horizontal wells drilled is below. Edge of the Delaware Basin is more/less the Eastern edge of the wells that passes a few miles to the West of you.

How would I go about finding out the value of our mineral rights? Right now it’s leased but we are thinking of selling. How would I find out what that area is called? Seems like all these different areas have names.

Ms. Susie, First, are you receiving any royalties from your lease? If you are not, how long has it been since you received your last royalty payment? Do you have a copy of your lease agreement? If you do not, you can obtain one from the New Mexico Oil Conservation Division, I believe. Also, do you have other family members that are also receiving royalties from your combined royalty split? These are simple things that will direct you to your next step in evaluating the true value of your mineral interest in the production formation. Your lease may or may not have other formations availible so I would suggest that you hire a “Landsman” to evaluate your lease from top to bottom. She/he will also be able to assist you in obtaining a copy of your lease agreement and possibly a lot more information about the depositional structure of your property, in case your property possesses multiple formations that have not been evaluated at. All of the issues that I have addressed are issues that are easily resolved with some initiative on your part. Just get started and “Keep on, keeping on!”

There is no production in Sec 29 or 30. Leases are all pretty new (2018 mostly), hopefully they have a copy. I don’t know of any reason why the NMOCD would have a copy of a lease agreement.

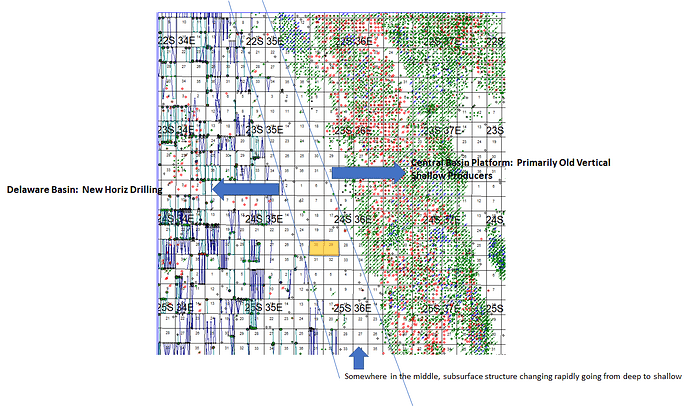

In terms of what the area is called? Um…“right on the boundary between the Delaware Basin and the Central Basin Platform?” Something like that. Kind of in No Man’s Land. Maybe at some point somebody figures something out here. But right now there are a lot less challenging places for people to drill. Ameridev is drilling some wells close to the Basin margin south of you.

How would you go about finding the value? IMO, this would just be based on whatever you could get somebody to pay you. All you need is one person willing to roll the dice. Trying to do a technical analysis of it would just involve nothing but guesses and would likely result in a value pretty close to zero, unfortunately.

I replied earlier and apparently it didn’t come through. Google says it’s still trying to send. It was a rather long reply so I will wait a little longer to see if it comes through. I will say thanks for your help though.

Here is more info on our mineral rights… About a year and a half ago we leased to a company called Jetstream. We got a bonus at that time. About a year ago we were contacted by Jetstream. They wanted to do an addendum to the lease because they wanted to assign to another company…Matador. They were very urgent in wanting us to sign it and send back asap, as Matador was anxious to drill 4 Wells asap. Well that’s been about a year ago now and nothing is going on. Do you, or does anyone else know much about either of these company’s? We have called Matador in regards to them buying our mineral rights. We were told they are interested but the landman never calls when he says he is going to. We called them back once and our call was never returned.

Welcome to the nuances of the oil and gas industry. Sorry to say, but if I had a nickel for every time a landman told me “we’re - or they’re - in a hurry to drill”, I’d be a rich man.

Caution… free advice ahead (that is worth a lot of money) Never chase someone/somecompany to buy your minerals. Companies that buy minerals day in and day out who actually have real money (their own money), real staff, and real intelligence will find and negotiate with owners who own minerals that they think are worth buying. If they won’t return your call, they are not interested. They might take a flyer on calling you back if they think you are a seller at a far below market number. You don’t want to be that person.

Things have changed in a year. A year ago WTI price was $70. People were pushing the edges of the major Permian plays. The market was still providing capital to operators/producers. Now oil is $55, investors have backed away from operators/producers. Rigs are down and drilling is almost all in the core of the play.

Jetstream (small FW based company, an aggregate&sell type of shop) took a bunch of leases in your area. They assigned all of them to Matador, it appeared. Matador never, to my knowledge, filed any permits here.

In Sept 18 when oil was $70, Matador spent a huge amount of money buying BLM leases in the core of the Delaware for record prices. And now companies are faced with a tighter lending market and less cash flow to fund drilling operations. So Matador is much more likely to choose to drill on its new acquisitions than on speculative acreage. So it would not surprise me if they had little pressing interest in your minerals.

I don’t think there is anything wrong with marketing your minerals (particularly to multiple possible buyers), I just don’t think you will have much success doing it with these.

“Spot On” Kenny Wilson!

Thanks so much. Your info answers allot of questions and makes so much sense in the way this has been going. I’ve also felt Matador was busy with the BLM purchase. We are still going to put feelers out because we are interested in selling our mineral rights. Are you familiar with a company called petrovalues?

Am not familiar with petrovalues. Which doesn’t necessarily mean much.

Thanks again guys ![]()

![]()

Hey NMoilboy,

Where do you get these great diagrams?

Sid Stuart

Sid,

Those are from DrillingInfo and/or IHS. Subscription services that I have for other business.

PetroValues has an excellent interactive map which includes “upside” wells and seems to distinguish the productive sections of horizontal wells from the non-productive sections: a surface location is represented by a small black triangle with a thin black line tailing off of the triangle until it meets with a thicker, color-coded line. There is also the forward valuation feature mentioned in an earlier post. See the informational footnote “Risk factors per reserves category of the Market Value”