Dear All,

It's great experience for me to read and learn from the forum. Thank y'all!

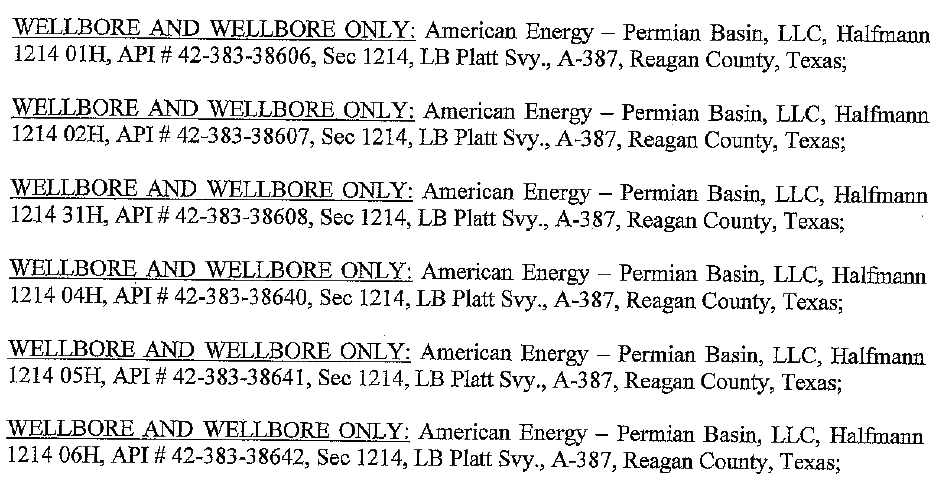

I'm a non-US citizen and I bought some "well bore and well bore only" interests by using a BVI(offshore company) and US LLC structure. My questions are:

1. Is the well bore and well bore only interstest can be considered as a carved out royalty interest? or something else?

2. For federal and state tax filings, because it's related to two levels of companies, i.e. BVI and Delaware LLC, how shoulld I file both taxes correctly?

3. Is there any tax burdens I should keep in mind before any financial year? Ad Valorem tax?

Many thanks!

Sam

Sam,

1. If you bought a royalty interest or over-riding royalty it remains so for tax purposes. If you bought a working interest I don't think it can be called a royalty interest. The difference is in passive vs. active (risked) for tax purposes.

2. Ask the person who set them up and understand the "pass through" terms of the LLC.

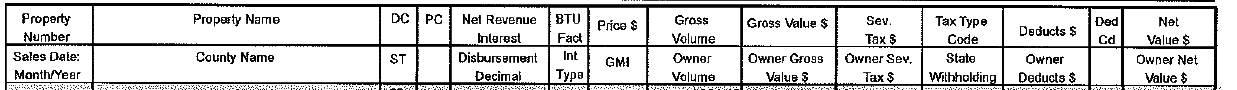

3. You actually bought a Division Order right. Division Order operator will deduct taxes related to production amounts. Tax burdens and incentives (depletion) after that depend on the net revenue and associated costs.

You are well advised to have an oil and gas accountant prepare the appropriate schedule for tax returns.

Gary L Hutchinson

Minerals Managment

Hi Gary, Many thanks for your reply. I attached detail of my property below and please kindlly help me to see if it's WI,RI or ORRI? Is division order right part of the above rights?

Thanks!

Sam

Sam,

Elsewhere on the pay stub you will find a group of codes showing the symbols for Oil, Gas, Condensate, Royalty, WI, ORRi to be used in the revenue description for each well. That will be the operator's designated code. The actual asset transferred will be found in the MINERAL AND ROYALTY DEED that shows you as the Grantee.

I sent you a personal message request if you want to get into more specific detail more efficiently. By the way you have acquired some great assets in a great location. I have no less than 14 requests to purchase land I manage in the area. You must know that the value of your purchase is to be found in the long term. Devise a business plan to follow that takes you to the horizon. You have what the real companies are looking for; PROVEN RESERVES. They warrant protection so get some good oil and gas accounting advise. I know a few if you need some names.

If there interests are producing, you should anticipate an annual ad valorem tax statement from Reagan County.

Here is the appraisal district (which determines the valuation):

http://www.reagancad.org/(S(f24ats55jxg4su45jq1442rc))/search.aspx?clientid=reagancad