My dad got an offer in June of 20K/nma for his mineral rights in this section. He countered with 25K and they accepted so he sold. He is 84 and this sale enabled him to pay off two mortgages so seems well worth it for him as he is low income. Just putting the price out there as an FYI!

Probably an excellent decision for his situation. Do you know what the royalty was? 3/16ths, 1/8th?

wow…that’s a great offer in general… and if he had no real income it may end up being tax free.

That’s a great price and he did NOT take the first offer.

But Continental hit a big well in the Springer there.

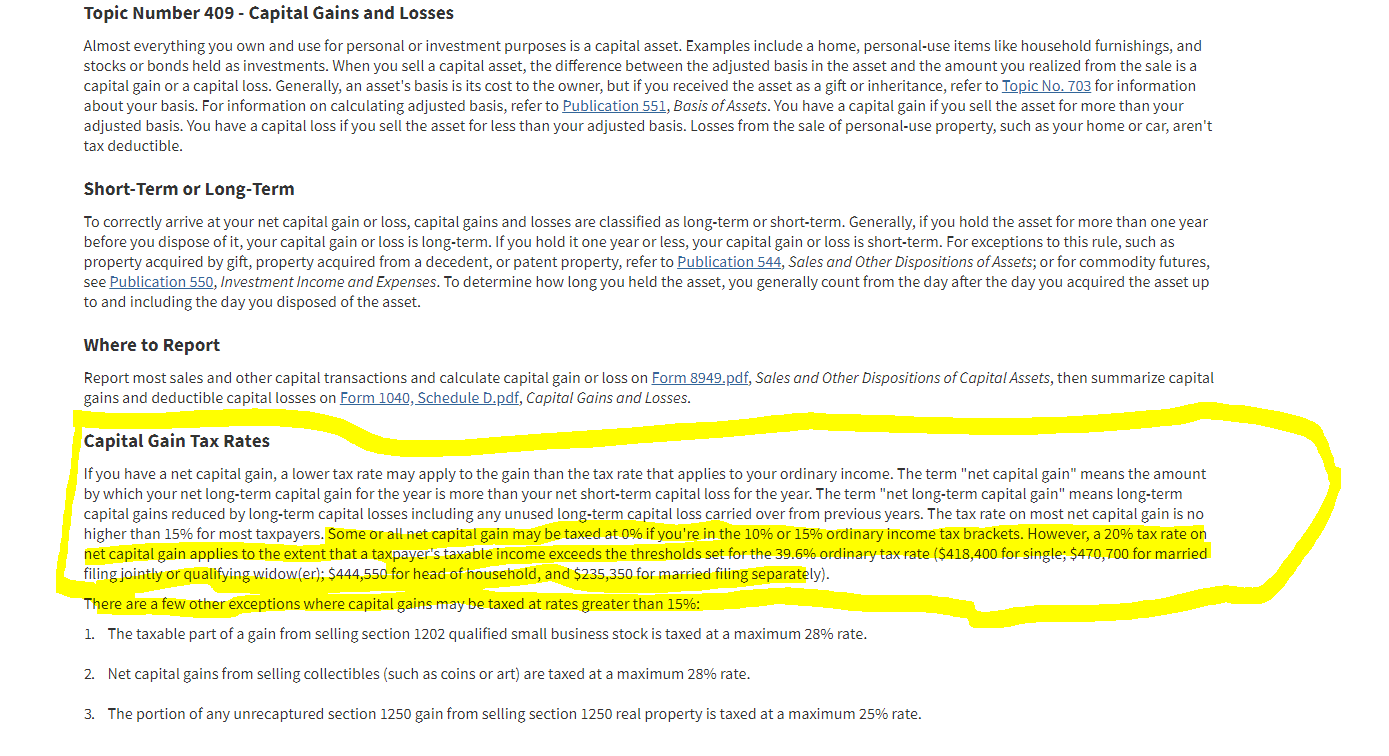

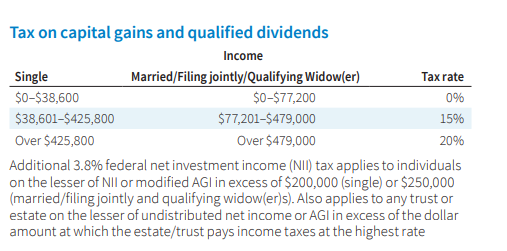

And I’d be real surprised if he did not owe Capital Gains taxes of at least 15%.

if he had low ordinary income, his capital gains could be materially lower than 15%…here are some links for you

Do you mean the royalty on the lease he had with Continental? I found a lease from 2010 that noted 3/16ths. Would that have stayed the same as the lease was renewed. I am pretty clueless how all this works ![]()

Debra, I cant access the images you posted for some reason–I just get a meassge that “the image could not be loaded”. Would love to know what they show! We were aware that they were planning more wells in the area but selling seemed to be the thing to do for my dad at this point.

Jeffrey, thanks for the links. My dad is not so low income that he will not owe capital gains but hopefully he can minimize them.

CodieRae, Just interested in the lease royalty rate as the buying offer dollar per acre is usually tied to the royalty rate.

If the lease had an option to renew, it is usually at the same rate. If the lease expires and a new lease is offered, a new royalty can be negotiated.

That is the Completion for a big Continental well in that section.

You can look it up here.

Curious to know what offer was in section 21-07N-05w - I’ve had offers ranging from $23,000 to $25,000 per mineral acre in Section 17-07N-05W

You can follow the comments on that area in the Springboard topic line. CLR just came out with the Q1 2019 investor presentation update.