Recently, have been offered quite a bit for my fractional mineral rights on the above area in Howard County. I am not selling but am curious how to read the recent map as it looks like there is a lot of wells about to be drilled in the section below that would go through my section up to the fracking well just above me. Is this why the offers are so good? I still am so new to all of this and just do not understand it.

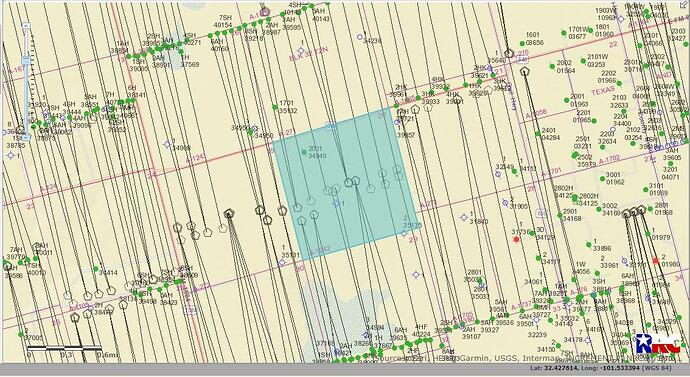

Hi Judy, your holdings appear to be in a very active and productive area. Map attached shows the section and many of the green dots above and below are existing wells that are connected to your section. (A-1242)

I am so confused. I pulled up the map that I have always used and it doesn’t look like the one you posted. The wells on mine are Hughes, Bradshaw, Williams…the producer is Ovintiv. The map I have only shows one horizontal well going from 20 up to section 17. I cannot figure out how to post a picture of the map. Thanks so much for responding and helping me figure out what is what.

I think I figured out the mistake I made. It is in T-1-N! Abstract 1199

Hi Judy, OK here is the map for A-1199. Yes, as you noted

there are 4 newly permitted wells planned to come through this

section from the south along with several other existing wells operated by Ovintiv.

Thank you so much Pete for responding. So my question is this: Those new permitted wells…I am guessing they are being fracked from below in Section 29 but I will get royalties from those wells as they go through my section??? These horizontal wells, are really confusing to me. I wish I understood it better. Thanks so much for your time!

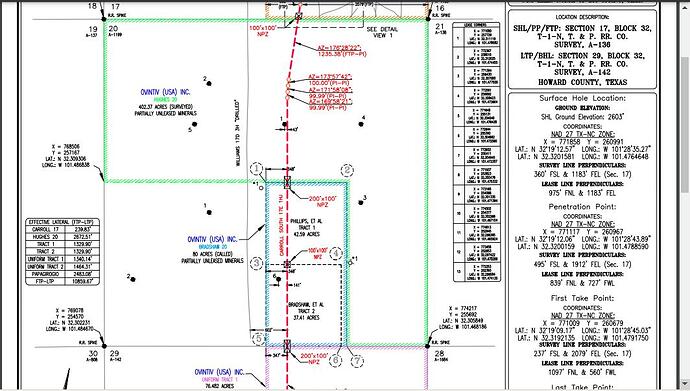

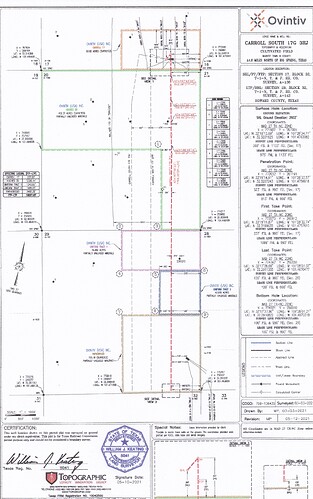

Hi Judy, it does depend on where your actual acreage is. Attached plat drawing for one of the proposed wells shows allocated area covers most of Section 20, but not the SW corner.

In general, if the well line passes through your property you stand a good chance of being included. This can sometimes be misleading since it may have to be a productive part of the well for it to count, and this doesn’t account for any depth restrictions your holdings might have.

Wow! Thanks so much Pete!!! I had no idea what all was involved. This is so interesting to me but have not figured out where to find resources to figure it all out. Thanks so much for your time!!!

Judy

Your participation in those wells will depend which part of Section 20 your mineral interest is located in.

The three wells Ovintiv permitted, called the Carroll South 17G 1, 2 and 3HJ, are allocation wells. If you aren’t familiar with what that means can use the spy glass feature at the top of this page, just to the right of the New Topic heading, to search for previous discussions about them. Enter something there like ‘rules for allocation wells in Texas’ and you should find a lot of previous comments.

Below is the plat that Ovintiv filed with the permit for the 3HJ but it also shows the proposed path of the for their #1 and 2 wells. Maybe you can figure out from that whether the path of the horizontal leg of any of those wells will cross your mineral interest.

Thank you Dusty! I did as you suggested and searched “Well Allocation Permit rules” and evidently a ruling came down May 12 that according to the oil and gas attorney that posted…could turn everything upside down. I have no idea what this means but I am even more confused. Ha!

Yes, that ruling a couple of weeks ago could change things. So far the speculation seems to focus on the possibility it will be appealed, questioning whether it will apply only to the drilling permit involved in that case or to hundreds of others already approved and completed, and on it forcing the Railroad Commission to deal with the allocation well issue rather than leaving it for the courts to decide.

I’d like to hear others opinions on this. My totally non-legal guess is already permitted allocation wells will continue (subject to their own potential lawsuits) but permits for future allocation wells will become slower and more complex, if not impossible, to obtain.

In simplest terms allocation wells, rather than being based on the number of acres each mineral interest has in a pooled unit, allocate royalties based on other factors than acreage, the most common being the percentage of the productive horizontal wellbore that actually crosses each mineral interest (feet of the horizontal leg crossing your interest versus total length of the horizontal wellbore).

You didn’t say whether your mineral interest is under lease, or if your interest is only on one side of that section, which would make a difference. If you can estimate from the well path shown on that plat how much, if any, of your mineral interest the horizontal leg of those wells will actually cross, then you would have a rough idea on where you would stand on royalties from those wells assuming they continue as allocation wells.

This topic was automatically closed after 90 days. New replies are no longer allowed.