Hello, We currently have 80 acres leased by Continental, coming up for renewal in 2019, in the above section. Has there been any motion in this section?

Moved this over to Garvin County for you.

In the past 45 days, we have received offers to purchase the minerals for our 80 acres. 5 different offers from 5 different companies. first one was $1,500/acre…last one today was $5,000. Any idea what might be driving these offers. No plans to sell.

They have a new pad on Katie Rd started in 1-1-18. No sign up yet.

Continental is putting together a horizontal drilling play in the area. Lots of buying going on and lots of leasing any open acreage.

I’m in 33 & 34 01N-01W and we have been bombarded with offers to lease and purchase. Mineral Resources is offering to buy royalties: $9665 per NMA if you are leased @ a 1/4 royalty. $7733 per NMA if you are leased @ a 1/5 royalty and 7250/NMA if leased @ 3/16. Best leasing amounts I have received are @ $2000 at 20% for 3 year lease.

Mineral Resources is most likely representing Continental Resources and those offers are a strong indication that drilling is anticipated. I would take it slow, you’ve got plenty of time to see if the offers continue to go up. Once there are some producing wells the offers to buy will probably go up. If you lease see if they will make you an offer at 1/4.

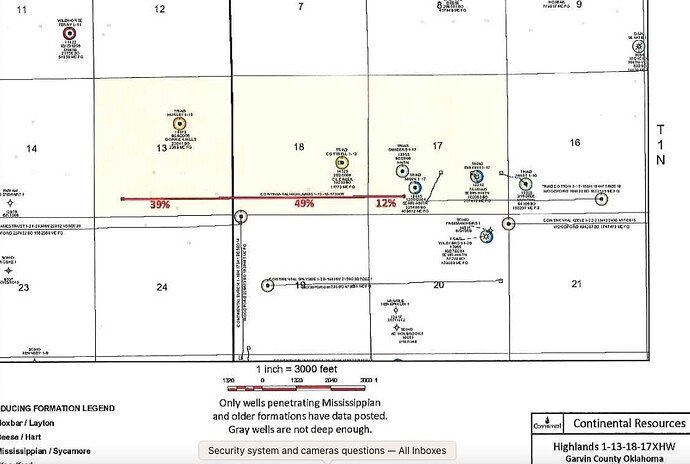

My best guess is that the pad is actually in the north end of Section 19, and is going to be used for the MUH in Sections 24 and 23 1N 2W.

Yes, I believe Mineral Resources, LLC is the subsidiary of Continental. I was told that they don’t like to purchase minerals where there is already another operator on a horizonal well on the section so they are probably intending on drilling on it I’d guess. They are really good people to work with but like any one else they will try to get it as cheap as they can. You can always make them a counter offer and don’t sell yourself short. (I’m talking to the one that started this post, of course). With oil headed way up since the drone attacks on the Saudi refiners and the President saying he intends on using some of our reserves I’d say your chances of getting better offers may increase. Like others have said “don’t get in any hurry” would be my suggestion.

I pulled the lease documents that my Dad signed in 2017. Unfortunately it was for a 5 year lease to Continental. He didn’t tell me he signed this one. Locked into it until April 2022. He passed away last year and wasn’t in the best of health when he signed it.

I’m new to Mineral Rights. Is there a resource so I can learn to read (and understand) the numbers on a lease offer?

Welcome to the forum. There are many good resources. You can start with the Mineral Help tab above and read about leasing. You can also find a book on Amazon called “Look Before you Lease” by Jim Stafford. You can also get it through the National Association of Royalty Owners. They have an introductory membership for $50 for a few more months. They have quite a few publications.

If you are trying to understand the descriptions, it helps if you ready from right to left. If you give an example, I can walk you through it.

M_Barnes, I just had a call from a Continental rep wanting to renew our lease, which expires in 2 months. His phone offer was $600 and 3/16 for 3 years. Based on his enthusiasm, I would guess that this is low.

Are you aware of leasing activity in 1N1W and what some of the lease valuations are?

Phil

Personally, I never renew a lease before it is up. I let it expire and then take my chances on whether there might be different offers at that time. A lot can happen in two months.

Also, I would rather have 1/5th or 1/4 if offered. I always ask. 3/16ths would be my minimum. Continental has been leasing at 1/5th in the area. Lease offers are not generally public. The closest clue are the pooling orders in the area within about a year. CLR did pool section 31 in Nov. 2021. $650 @ 3/16ths, $500 @1/5th, $0 1/4. So you offer was only part of the story. A few other lease agents were recording leases over the the last year, so might be other options.

Interesting. In his initial offer letter he did mention 500 at 1/5th. I think I’m going to do some counter-offering Thanks for your reply.

Question for you. Do mineral owners receive payment for Gas? I know it’s in the lease for oil, but not sure about the gas?

Most leases have both. Read your lease again. It is often in an adjacent paragraph.

Thank you very much. Phil

Hi Martha, on the ECF I found case number CD2022-002888. It’s our section with a multi-unit horizontal well. Filed 7/21/2022. Conservation Docket.

What does this mean? TIA, Phil

If you go through the exhibits you can see what is planned.

Test Type in HIGHLANDS in the Well Name box. The well has already spud and completed on Mar 27, 2023 . Permit is 1000 and spud is 1001A. Started in October. The completion notice will not show up for a few months.

You can find the active date (close to completion) on the OK Tax site. https://oktap.tax.ok.gov/oktap/web/_/

You do not have to make a login. Just scroll down to the HELP box and use the Public PUN search. Put HIGHLANDS into the Lease Name Box. Hit search.