Landman has offered $20,000 per NMA in an outright purchase of our mineral rights. Is this a fair deal? Please help, I’m not knowledgeable about this business.

Depends on a lot of things and your personal business. How many NMAs have you? How deep and in what formations are they going to drill and produce? What is the track record of production from that formation…how long will they be producing it and have income generated by it? IF it

makes them a million bucks per NMA over a 5 or 10 or 20 year production cycle…you can figure

if $20K/NMA one time purchase price is a good deal for you or not…and that also depends on

your personal financial condition…do you NEED the money ‘right now’ or not?

ANYTHING you want to do…I advise you to get a good oil and gas lawyer to negotiate for you…

and tell him/her your personal information/conditions.

, Reeves county, Tx ![]()

![]()

![]()

Thanks Lawrence. That’s very helpful! It’s only 10 NMAs, so that reduces it’s value. The offer came from a firm that is apparently trying to aggregate a lot of small parcels that resulted from several generations of bequests. I suspect the big operators aren’t interested in dealing with all the small mineral holders.

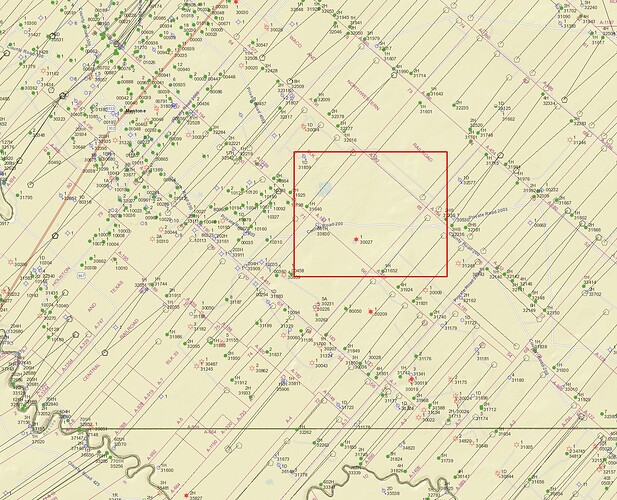

Are you currently leased, or do you know if you are held by production (HBP) by other lands? I would suspect you are getting offers to buy because there is not any production on the section and you are surrounded by a sea of pretty good horizontal wells.

http://wwwgisp.rrc.texas.gov/GISViewer2/Therefore, 1) if you’re unleased (doubtful - but it’s possible) you or your buyer will have potential to make a considerable bonus, as well as proceeds from what will most likely be multiple horizontal wells at some point. 2) if you’re HBP, you or your buyer will have to wait until the company holding the leases feels the need to drill up the section, upon which point you’d make proceeds from what will most likely be multiple horizontal wells.

SO back to your main point, is it a fair value? It’s not terrible by any means, but depending on your situation and whether you need the money now, it may not be the right offer.

Thanks. I was not able to get the GIS viewer to produce a map this good. It is leased until 2019 at 2,000 NMA at 25%. I don't really need the yet, but I am 70 and have been waiting for a long time for somebody to drill. At my age the net present value of the “waiting” option seems pretty low compared to the offer of $20,000/NMA today. Would you agree with my reasoning?

Collie…I’m about your age and catastrophic events seem to come in threes at this time in our lives…

10 NMA at $20,000 each…$200,000 cash to put into savings ‘for a rainy day’…is very tempting.

It’s still up to you, but given those conditions…you might want to put $150,000 in a savings account

and have some fun on the remaining $50,000. Have fun while you are physically able to still enjoy it.

I can understand the reasoning…and it is STILL ultimately up to you to decide. I recommend you

ask the Lord for guidance…He, being your Saviour, has your best interests at heart…You can depend

on Him giving you the right answer for you. But, still get a lawyer to represent you in the negotiations with the company.

, Reeves county, Tx ![]()

![]()

![]()

Seeing as it’s a primary term lease, $20,000 sounds low. If you’re set on selling, more power to you, and congratulations on holding out this long! I’m sure you’ve done well on your investment. One of my buddies sold a couple sections away from you a year or so ago, I’ll ask if he has pointers on the area.