We received an offer “out of the blue” from L3 Resources. They originally offered $150K. Then they got back to us and said after reviewing our check stubs, we had a 1/8th royalty and 29.18994 net royalty acres, so lowered the offer to $107K. We inherited this from my mother-in-law when she died several years back. My husband has been diagnosed with aggressive prostate cancer and we are trying to get all of our affairs in order so we can concentrate on the upcoming battle. I’m trying to determine if this is a fair price, how they determined our royalty from the check stubs, and if I would be better off to contract with someone like U.S. Mineral Rights to sell the acres in question. Their numbers were: 0.00285058 ÷ 1/8th x 1280 = 29.18994 net royalty acres. I’ve been trying to search through multiple websites to determine if there is any activity in Grady County that warranted this sudden interest in purchasing from us. Thanks for any assistance!

Welcome to the Forum.

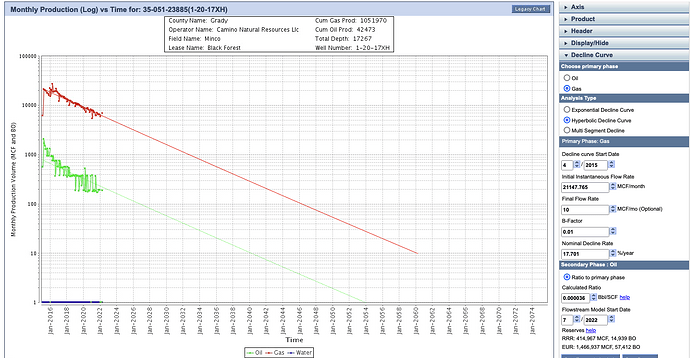

L3 is a buyer in the area-one of many. I cannot comment on the “fair offer”, but can say in general that buying companies often use the decline curve of the predicted production from a well to determine how much oil and gas are likely to be produced. They then apply a certain price deck to the future years and come up with a valuation. Many of them further discount their offers to account for the time value of money. 10% is a common factor, but varies from buyer to buyer. Most of the offers I have received have not offered for the potential future production of additional wells.

If you really are considering selling, then you need to find out the value of the acreage at the time of inheriting as you may have capital gains. If you do not have the value, the IRS may tax at the whole amount versus a stepped up value due to the inheritance.

Black Forest has produced about 1 BCF of gas and has about .5 BCF left.

There is a lot of OCC activity nearby with increased drilling cases for additional horizontal wells by Paloma, Citizen and Cimarex, so you could just keep getting your royalties and hope that the additional activity spreads to your section. Increased density cases have been filed in sections 2,3,4,9,11, 14,23,24,25,26. Many buyers buy “before the bit” as they plan to make a profit on those future wells.

If you decide to sell, it would be wise to get several offers. Never hand over the signed deed without getting paid.

This topic was automatically closed after 90 days. New replies are no longer allowed.