Louisiana Caddo Parish T16 NR16 W16

We’ve verified our mineral rights on 6.6 acres

Purchased land 5 years ago.

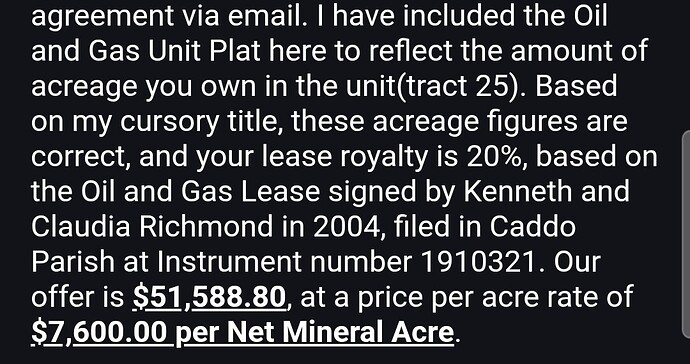

Have dismissed letters and not answered calls. Until recently. After call, received requesed emails with run down of our conversation which started with no Operator activity on our property.Also received docu sign contract with offer. $7800 per acre to buy rights. This is 1st actual offer. The man seemed to have done his research before calling.

I’m not sure how to research my area specifically to get an idea of anything going on or planned. I know our neighbor next door has Gas storage tanks on his property. They are fed with pipes from a well (or looks to be one on map).across the road thats in front of both our properties, down our property line to tanks. This happens before we moved here. There doesn’t appear to be many wells in our section. And my neighbor claims they havent been out to collect any gas in a while. Possibly that well isn’t producing as it was.

One question would be why they want it. With his assumption of no surface activity on our property. Am I wrong to assume the payoff would have to be from horizontal drilling or the removal of gas from under our property thats connected pool?

What’s a legitimate resource for getting more offers? Like list on a auction type website or just contact companies individually..

If we decide not to sell… other than just doing nothing and just retaining rights. Continuing to seek adviceand research. What other type offers could I ask for if any?

Theres no wells on our property and we do not receive royalties.

And information would be appreciated. We’re very new to this.