I recently received an offer to purchase 384.00 Net Royalty Acres in Eddy county. Would like to see if there is a way to find out what they are worth compared to the offer I received. Township 20 South, Range 30 East/ Section 05: N2 Township 21 South, Range 29 East/ Section 03: All

In Section 5 there are 5 permitted wells. One, in the NE section was drilled in 2015 and you should be receiving royalties, if you own the N/2. The name of the producing well is Solution Com Federal 3 operated by COG. COG has two more permits and another company has two permits. The name of the other company is CL&F Operating. All in the N/2 . You should have received a Division order for the Solution Com 3 as well.

COG’s full name is Concho. Their owners relations group number is toll free 877-201-5449 ask for Division orders.

Here is a link where you can search by location for New Mexico. A real handy and easy tool I use for my federal leases and minerals:

http://ocdimage.emnrd.state.nm.us/imaging/WellFileCriteria.aspx

There are no applications/permits for section 3 at this time.

My advice unless you need the money don’t sell. I’ve been offered up to 30K pnma (per net mineral acre) for some of my minerals.

Thank you for the reply and the information. I will do some more research, just did not know where to start. This land belonged to my Grandfather, and received this through an inheritance.

Even amongst people with all info at fingertips it’s going to be tough to get anything beyond a range of answers. Because it’s all dependent on educated guesses on things that we don’t know: what wells will get drilled and when will they get drilled? That pretty much drives the value.

Here are some educated guesses, take with as big of grain of salt as you would from any stranger on the internet offering advice/ino:

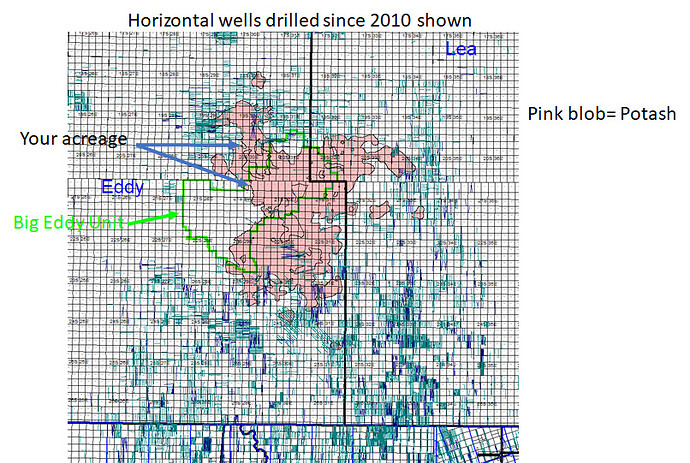

21s29e Sec 3: BLM lease LC-0069141. 941 gross acres. You have some fairly large ORRI presumably. This is in Exxon’s Big Eddy Unit (BEU). Because it is in the Unit this 1951 lease that your ORRI is tied to has not expired. Nor will it expire. On the surface, Exxon operating is good for you as they still have a lot of that money Rockefeller stole from widows and orphans back in the 1800s, so you would think they will eventually drill some wells. A good portion of Sec 3 is under Potash, so that makes it harder to get those wells drilled. That applies to a good portion of BEU, which is huge. The prior owner (BOPCO) didn’t drill many wells out there (see map below). Exxon has better acreage to drill in Poker Lake Unit and James Ranch and elsewhere, so one would think this is going to be a slow, slow burn. So there are no XOM permits around here. When/if they do drill here, you would think they will mostly target the 2nd Bone Spring, with some 3rd Bone and 1st Bone mixed in there. This far north the Wolfcamp is probably not a great target. That also hurts your value. The closest BEU wells were long 2nd Bone Springs laterals (BEU 277H and 254H) and were kind of mediocre, but they were 2014 vintage and would be better with a bigger stimulation I’m sure.

What does all of that mean?

- Well funded operator (good)

- Likely 8-10 wells at ultimate development per 1 mile wide unit (below average).

- Wells probably below average but not terrible

- Likely very slow development timing due to potash and huge inventory of Exxon locations in better spots

Put all of that into magic black box spreadsheet and I’d say Sec 3 is worth about $7k/NRA. That is low for the Delaware, admittedly. But that is what development and timing risk gets you. Could have Ocasio-Cortez as President before this is drilled.

20S30E Sec 5. This description seems a bit odd as it doesn’t seem to coincide with a single lease. Looks to be part of NM 114354 which covers all of Sec 5 other than SW4 SW4. That is a 2005 lease, I suppose could have gotten an ORRI when it was assigned to Marbob (Concho). Are we sure on the legals? For now will just assume we are talking about 20S30E N/2 of Sec 5.

As Rick says, there is an active producer in this section and four other permits. The two CL&F permits start in Sec 5 but head East and you would not own any of those. The other two Concho drill permits were from 2016. A good general rule is a permit that was approved over 18 months ago and has not spud…is not gonna get drilled. The existing lateral, the Solution Com 3, is not real great (declined very quickly) so I can see why they didn’t drill any subsequent wells. Bigger modern stimulations should help.

Assuming we have the correct section, you should be in pay on the Solution Com 3 which has been online since 2015. You may be in suspense. Like Rick said, call Concho and ask. It is still making > 30 bopd.

Sec 5 has Potash in it, but it doesn’t cover the whole section. As with the Solution Com 3, COG could…if inclined…find surface locations in the north part of the Section that are outside of measured potash, so this would be slightly easier to drill than Sec 3. It should also have economic Bone Spring wells on it. The existing well is worth a little bit. COG is a good operator, like XOM they do have a lot of places they could drill, so you would think this is not something they are going to rush out and do.

I’d say Sec 5 is a bit better than Sec 3. So I’d say $8k/NRA there.

The Delaware Basin is a very diverse place. Like Rick says, he was getting offered $15k/nra ($30k/nma) elsewhere. I have heard of offers in the very very best of Loving Cty going for twice that much where there are a ton of wells/permits. Having 384 NRA here is great, congrats. But it would be worth a good bit more if it were further South.

Not selling makes sense to me. Selling for the right price makes sense to me. This whole deal is very hot right now so odds of getting the right price has increased. Its all dependent on risk profile, tax situation, financial need, sentimental value, etc. If you are interested in selling, IMO one way to see what it is worth is to ask a number of different buyers what they would pay for it.

Good luck

Thank you for your reply. Here is more information on the Sections. Section 35, T-20-S, R-30-E, Eddy County, NM Section 7, 15, 17, 18, 19 and 27, T-21-S, R-30-E, Eddy County, NM

I appreciate your input and knowledge.

Is potash a problem? I remember reading somewhere that Carlsbad was known for Potash. Why could that be a problem for oil drilling? My minerals are in section 31 21s 27e. ![]()

They mine potash from shallower depths in portions of Eddy and Lea Counties.

The BLM manages the relationship between O&G industry and potash companies in those areas as you can’t have somebody drilling a well through a mine. For places where there is potash but is has not been mined the BLM approves surface locations (“drill islands”) from which operators can drill (go straight down then go horizontal far below the potash). In theory the surrounding potash could be mined eventually.

In short it’s a harder to get approval to develop oil under potash. And limited surface locations make it harder to get high well density. So oil and gas under potash can often be less valuable.

I am not looking at a map but 21s27e sec 31 should be well far away from potash. It’s just the oil and gas productivity there isn’t all that great.

I read an article that a deal was made between spc and the city of Carlsbad. Sounds like there should be oil. Right?

We have received offers for our clients in this area in the $7,500/NRA range, although there are not a lot of mineral buyers who will look at property this far north in the Delaware Basin right now. I think that might change as the other interests further south are bought up.