Sec 1 7 10 E in hughes. Well francene. Lease money has been great. Anyone know when the 6 month royality check will be released. I know its produced a while. Jw when the bonus money would be cut. thank you. Also the monthly royality amounts are usually what. New to all this

If you are talking about the Frances wells, there are five of them. They spud in section 12.

Frances 1-12-1H active 6-1-18 Frances 2-12-1H active 5-29-18 Frances 3-12-1H active 6-4-18 Frances 4-12-1H active 5-9-18 Frances 5-12-1H active 5-9-18

In general, the Division Orders come out about five months after first sales and statutory payment is six months after first sales. Each well will have a slightly different Division Order decimal and they have to calculate them for hundreds of owners, five times over, so could be a bit late. You should get paid in about November or December, but if late, you are owed statutory interest. Worth waiting for. Monthly payments will start high with about six months of production in the first check. The next check will be five times lower since only for one month. The decline will be rapid and then slow down and they wells can last decades at low rates. Check size will depend upon the price of gas and the amount they produce.

M Barnes: This is valuable information. Why? Because the dynamics described will likely pattern my Royalty payments on four new wells on DORA (well name) for Dora 2, 3 4, & 5) S21/07N10E. Am I correct M Barnes? …Leta C.

Leta, you are a bit farther to the west, but the stories could be similar. You have the same operator, so probably the same strategy. The Dora wells spud in August and September. They are two section wells, so may take four-five months to drill and complete. Probably a bit longer because they will drill them all first and then zipper frac them at the end. Then the Division Orders will take about five months or so. Payment after that. You can watch for first sales at the Oklahoma Tax Commission site.Gross Production

You can search by the legal location. I usually start with the bottom hole section and then work up to the surface. So start with 28 07N 10E. I just looked, but they are nowhere near finished.

I, too, have some rights in that section (12-7N10E). This is my first experience with new operations, and I’m having a little trouble getting understandable answers from Trinity.

I was told yesterday that they still had not got clear title (or something along those lines), but from what I’ve seen around this forum, I get the impression that these wells are already completed. Not sure how all that works.

Another thing I was told was that I already have a lease, but I have owned the rights for about 25 years now, and I haven’t negotiated any lease. At the time my mom signed the rights over to me, there were a couple of older producers, but from what I’ve seen, leases don’t seem to last that long. But again, I don’t really know how it all works.

Any advice would be appreciated. Especially if you know of a lease database on-line.

If your mother had royalties coming from producing wells and you are still getting royalties from those wells, the original lease from your mom or earlier still stands. Are you getting royalties from the Clara well?

Trinity has quite a few new horizontal wells in the section 12-7N-10E. The Grances wells and the Clara wells . You will get paid on them according to your old lease terms.

Thanks so much for the answer. Unfortunately, for me, we did get royalties as recently as 2016 on one of our old 1980s-era wells. I understand that we had 3/16 royalty, but no idea at all on bonus. Or rather, since the lease is already in place, we probably won’t even get a bonus.

But since the old wells were pretty well played out (thought both are still listed as active), anything at all that comes of this will be gravy. It’s just that I like gravy, and would like as much of it as I can get. ![]()

The bonus only comes once with the original lease. These wells will be the gravy!

Thanks for your insights, Martha. Between the awesome info you have provided in this forum, and some from a helpful Landman at Trinity, I have a lot more info than I had before; but that sparks another question for you.

One of my old royalty wells was listed as being NW4 of SE4 of Section 12. Looking at Trinity’s wells in the Permit / Spud records, that only includes one Frances well for me. However, the lease which Trinity apparently intends to use shows W2 SE4. I don’t think this was just a typo in the email, since it also says 80 total acres.

This appears to be good news for me, because in addition to the Frances 2 and 3 wells being included, the Clara 2 and 3 would also be included. I did want to ask you, though, if I am mis-interpreting something, before I bring this up to Trinity.

Thanks again for your willingness to help.

The original wells had their own spacing depending upon depth and product. Usually 80 acres for oil and 320 or 640 for gas. You only got royalties on the wells where your acreage intersected the spacing unit. The new horizontal wells have 640 acre spacings, so you will royalties from all of them according to the percentage of perforations in each section.

So the Section is 640 acres, so what you’re saying is that any well perfed within the section will pay royalties to all holding rights in that section? That would suit me just fine … if they’d hurry up and start making some product. ![]()

Thank you once again!

Yes, indeed. You will get payments on each well that is spaced at the 640. The new decimal amount will be calculated with the following formula: net acres/spacing acres x royalty x % perforations in your section. So each well is likely to have a different decimal amount.

After doing a little research, thanks to some links you’ve provided on this forum, I have to hope that the drilling isn’t finished. Based on what I’ve seen, all of the Frances wells, and 4 of the 5 Clara wells, have SURFACE location in section 12 - but none of them are producing in 12. Sections 1 and 13 have quite a bit, but 12 has none.

It is very common for the surface location to be in a different section so as not to “waste” acres on the turn from vertical to horizontal. They only perforate the horizontal section. Only those acres are assigned royalties.

I understand, it’s just disappointing to have started off with “we’re going drill a whole lot of wells in Sections 12 and 13” yet end up (so far - I haven’t given up all hope) with a big fat 0 production in 12.

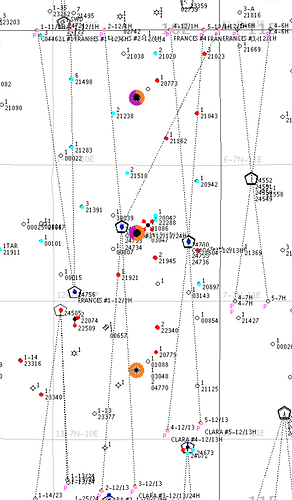

They are drilling a whole bunch of wells in 12-7N-10E. Some go north into 1 and some go south into 13. Have patience and you will have some nice production. There are three pads in 12. One in the SW corner and two mid center and east center. Looks like you will have partials of ten wells.

From your lips to God’s ear. Or, considering the technology, from your keyboard to God’s eyes. Either way, I sure hope so. ![]()

Martha, if you don’t mind, I would like to get a sanity check. You had posted that the calculation for payments includes: (net acres / spacing) X % of perfs X Royalty.

I have 2 leases in 1207N10E, each with 10 net acres, and each is 3/16 royalty. I have looked in the Permit files, and have seen something like:

EST MULTIUNIT HORIZONTAL WELL

X671020 WDFD, OTHERS

50% 12-7N-10E

50% 1-7N-10E

I am assuming that these are the perf percentages for each Section, yes? Then 3/16 would be about 0.188, and with the 2 leases, the last factor would be 20 / 640. Am I close?

One last question - when I see the Production volumes at OTC site, are those in MCF?

Thanks.

Roughly, until exact percentage per section is applied.

20/640 x .1875 x .50=0.00292969 is the decimal interest.

Your Frances wells can be found in section 1 on the OTC site. Code 5 is for gas in mcf and code 1 is for oil in bbls.

Oh yeah, Product Codes. I knew that (pretending).

So does it all work the same for Oil? Or is it a matter of Well Type rather than Product. Seems like I saw something once about a different Spacing, but I can’t remember where I saw it.