I own 1/14 mineral interest in 320 acres in Township 16S Range 37E, the SW 1/4 of Section 10 and SE 1/4 of Section 22. I have received an offer of $10,000 total for the mineral rights. Is this a fair offer?? I’d like to sell, but it is not an emergency to do so now. Any help would be appreciated!!

Hey Sharon. That’s a tough one for me. You are off the beaten path. On the Central Basin Platform and not in the Delaware Basin. Nothing is going on near you. At some oil price, people might go back here and try to drill Strawn/Penn wells. There is some oil under your property. It’s just deep and doesn’t look very economic for someone to drill without a major upswing in oil price. Thus, I would guess the most likely answer is that expected cash flow from your mineral rights (in the next 10-20 years) is worth zero. But things can change. People were leasing folks in 2018 in 16s37e. If that happens again, the odds that you might see revenue from production is higher and your rights might be worth $25k or something. If people actually start drilling wells in 16s37e, your rights might be worth $50k. So probably > 50% chance that this isn’t worth anything. But some chance it’s worth 2-5 times what you are being offered. I’m just spitballing here. I would guess somebody offered you $10k on this same general math…if they get lucky its worth a multiple of what they paid, if not…well then its not worth anything but maybe they could flip it to somebody else looking to make that same bet in the future and recoup some of their money. Or maybe they have a whole bunch of better acreage already in NM and they could just add this to that pot and when they sell it all together (to a bigger fish) this will get valued at more than they paid you.

You have 320/14 = 22.9 mineral acres. $10k is $438 per mineral acre. That isn’t a whole lot.

If you got lease offers in the past I might try to contact those folks and see if they would lease you. That might get you a few thousand and you’d still have the rights to see if anything changes in the future. If not, selling it isn’t insane IMO, though I would still ask for a few thousand more just on principle of not taking somebody’s first offer.

Not Gospel, just Friday morning $0.02.

Cheers

That’s all very helpful information, thank you!!

NMoilboy, How did you determine Strawn/Penn prospectivity for this parcel? At what price is Strawn/Penn vertical production economic? If she is getting an offer out of the blue, could someone know something about future development plans for the area?

AJ11

There are old Strawn/Penn wells in that area, this is on the East side of the old Lovington Field. So there are lots of deep vertical wells in this area with logs and production. I’m a bit lazy so I just looked at production numbers. There were some > 100kbo vertical wells. Including one in Sec 10. P&A’d now, but there is some oil down there. I don’t know if its purely structural and this is off structure.

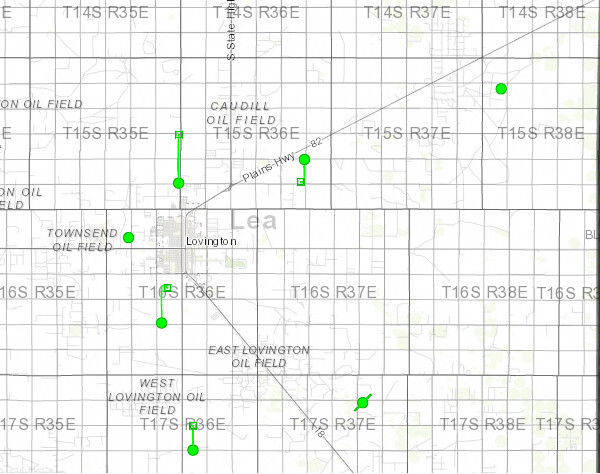

It looks like there were 4 attempts to drill a Penn horizontal in this general area post-2017. I’m not convinced that any of those would be economic without $100 oil, maybe the Manzano one would be ok at $60-70. See map below (green lines are Hz wells). All of those wells got big hydraulic fracs which would suggest that they are not chasing something limited to structural highs.

Again it would not be too hard to load logs into Petra, pick tops, and make structural maps and go through all of the old wells and try to see what was up. But that is WAAAAAY too hard for these purposes.

So there are Permo Penn wells there. In 2017-2019 people tried drilling HZ wells around here. Oil price was not $100 or anything in that time range, so maybe if prices go up, people will try again. Though those past tries don’t look like they were a very good idea at $50 oil, but if oil goes to $100 again Lord knows.

Most people who know something non-publicly available about future development plans are operators, not mineral buyers. Operators tend to go and sign leases, not buy minerals. Normally mineral buyers don’t know anything other than what is permitted, or what is going on nearby. There is nothing permitted or anything going on nearby.

Ramblings while semi-watching the NFL

NMoilboy, Thank you for the detailed explanation. One map I saw in a paper showed some NM Strawn vertical wells as being hit or miss in individual sections–maybe dry holes only a couple of hundred feet from economic wells. I know very little about any of it. Was just curious.