Is there an agency I can contact to protest oil & gas production payment amounts?

Your payments are based upon the contracts that your operator has with the transportation company, the volume of the product sold, your net acres and your royalty. The price may not be anything close to the WTI price you might see. That is a spot price and is for the future based on a number of criteria.

If you think the Division Order is wrong, first contact the operator’s revenue or Division Order department for clarification.

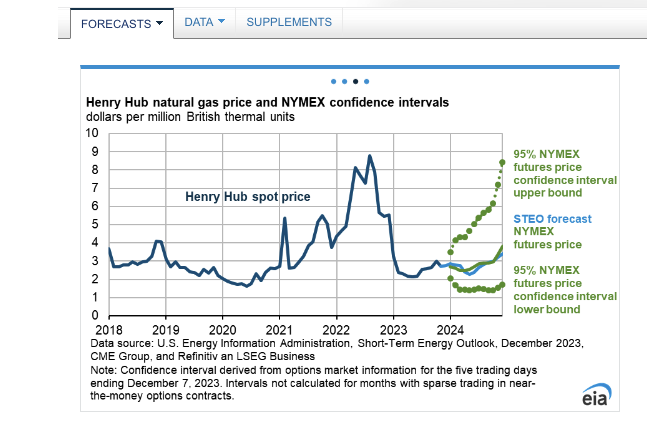

Prices for 2023 were much lower than in 2022 due to market conditions.

Do you have a particular reason that you think your checks are incorrect?

Your oil and gas lease should control some of that IF it was done properly when it was leased by you or someone that it was acquired from. Start looking at your oil and gas lease for your interest. Good Luck.

I have property in 2 separate drilling units. They have been in production since 2016. Things have been going pretty well until 6 months ago when on my production statement I noticed that the price for my natural gas was about 50% of what it should have been. So I called the the production company. They are supposed to get back with me next week.

That is about the same time that prices plummeted. 2022 was extremely high due to the LNG sent to Europe due to the Ukraine war and the need to stockpile for the winter. When the winter was warmer than expected, the prices dropped rapidly back to more normal ranges. This is the graph for Henry Hub which is a LA blend, but widely used for forecasting. Your area will be controlled by local contracts with transport companies.

The increase in projected prices for late 2024 and into 2025 is for the new LNG trains coming online and ready to ship to overseas markets.

Contact the oil company you have your lease for. Also check your statements that come attached to your checks. Currently Continental Resources is deducting 60 to 80% of the Royalties claiming “Post Production” costs. Then deducting almost 50% of what Royalties they are willing to pay for taxes and more undefined “Deductions”. My oil interests are still consistantly producing the same amounts they were before Continental Resources took over yet our checks are 1/3 what they were. Natural Gas is not the culprit in my lower checks nor are oil prices, we checked those. Company spokes lady confirmed it was their “post production costs”.

Yes, check your lease as post production charges can eat up a good bit of royalties, especially with gas production as time goes on.

Hess deducts about 25% from my royalties & SO&G only deducts a little over 1%.

Check your lease language to see if you allowed deductions or not. In some cases, a lease is very clear that no deductions for post production charges are allowed and you have to remind the company of your lease terms. The accounting department often has software that is set to default to deductions and they don’t talk to the legal department unless you demand that they abide by the lease. Even then, it can sometimes be difficult to get them to do so.

Certain companies have had class action suits over this very issue.

This topic was automatically closed after 90 days. New replies are no longer allowed.