I need advice on what wells I should be getting royalties from. My minerals are in the John Haley Survey A-291. Tracts 25A-25E in the Battery Gas Unit 747.779 acres. In Shelby County. I was getting paid for 1 well until I question the Producer and they started paying me for 2 wells drilled 2 years ago. They had to back pay. If I had not questioned them I dont think I would have ever been paid. When I look at the RRC GIS map of the wells in the area there are several more that seem to be in that Gas Unit I am not getting paid for. My question is how do they pay? Is it by who is in the unit or if the well is under your property? Any and all help will be appreciated.

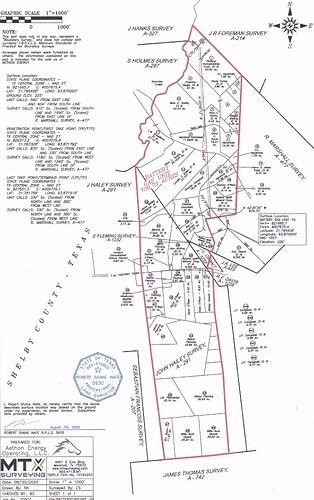

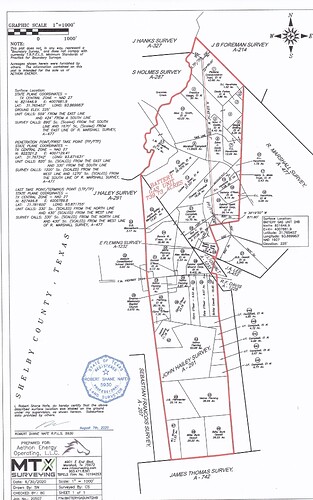

In case you haven’t seen it I’m attaching the plat showing the boundaries of the Battery Gas Unit. So far Aethon has completed the 1H and 2 HB wells. On the plat those wells appear to run along the same route because they are stacked laterals, one on top of the other.

In January Aethon got permits approved to drill two more wells there, the 3HB and 4HB. Can’t tell from RRC whether they have been drilled but completion reports haven’t been filed. Those two plats show that drill site all the way at the south end of the unit and the laterals extending further west than the first two wells that were drilled from a site much further north. If those wells are drilled they would cover a much larger part of the unit. It is a pooled unit so if more wells are drilled within the boundaries of the unit you should share in those also. Other wells you are seeing on RRC’s map are in separate units so you wouldn’t share in those.

The plats for the first two wells show the unit originally covered 739 acres but the two plats approved in January show the acreage as 747 like you mentioned, so another piece must have been added after the original permits were approved.

This topic was automatically closed after 90 days. New replies are no longer allowed.