I was sent a letter giving an amount of money with W-9 for a forced pooling bonus. Is this a lease???

No, Your election of committed your property to the unit. (or if you failed to elect, the default option applies)

You are required to give your tax identification number (TIN) to prevent the “backup withholding” per IRS requirements @ the current rate of 24%. The proper way of submitting your TIN is on a W-9.

I recommend submitting a W-9 at the time of the pooling election. Some pooling orders will have the language requesting it.

This pooling bonus is for a new well 1 mile east of a lease that was started in 2013. I signed a 3 yr. with 2yr option lease in 2013 for a location 1 mile away that was pooled. They extended the lease in 2016. They haven’t drilled yet. The lease expired today on that location. This letter is the first and only contact that I have received for this new location. Thanks for the help.

The information you are providing does follow the normal process.

The bonus will be tied to a pooling order.

The new well 1 mile away may are may not be servicing your acreage.

You should have been named in a pooling order to receive a pooling bonus.

You should have made an election if named in a pooling order, or a default election was selected for you.

“The owner”, you should have received notification of the application for pooling and the subsequent order at the official address of record, or address they may have located for you through other means.

If you were leased, they USUALLY will not name you in the pooling application. Sometimes they will, if they were not able to negotiate a lease or lease extension in good faith.

There could have been errors on the applicant’s part.

Something is missing but I don’t have all the info.

We could go on and on for hours with hypothetical situations of ifs and buts and waste considerable time.

Give me more info and I may be able to explain. Application and/or order number on the letter or check stub. The name of the party on the check, if “inherited” property of unknown marketability status, the name of the owner(s) just above you in the chain of ownership. Section Township and Range of the new well and the one your lease is located in.

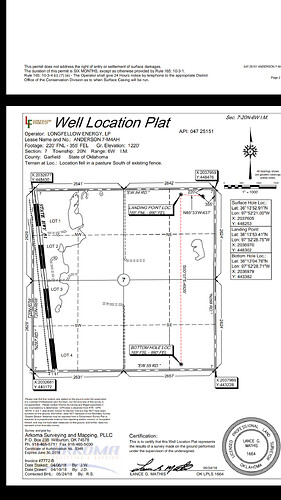

This is concerning a horizontal well in Garfield County. The Surface hole is in 07-20N-06W with the landing hole in 08-20N-06W and bottom hole in the sw corner of 08-20N-06W08-20N-06W. There was a notice of well spud on May 18th. Permit to drill that was approved 5-30-18 with expiration of 11-30-18. I am confused where the pooling signing bonus of 800.00 per acre comes from. The last bonus that I received was to extend my lease by option and was 400.00 per acre in 5-25-16. The lease was up on June 19th of 2018. There was a pooling order with my old lease for Section 08-20N-06W which the pooling bonus is being offered. . I have nothing in writing of where the poling bonus comes from??? I have been receiving calls concerning my mineral rights in 08-20N-06W and 07-20N-06W. I just received a notice that I am being forced pooled for my minerals in 07-20N-06W from a different company. Thank you for your help.

Your dates don’t match exactly with what I see. The ANDERSON 8-M1AH has a surface location of 7-20N-6W and will be producing from 8-20N-6W only.

The Permit showed to have been approved on 5/8/2018 and expires on 11/8/2018 rpt_ITD_Permit

It was Spud on 5/19/2018 http://imaging.occeweb.com/OG/Well%20Records/1DD79F91.pdf

If your lease expiration is correct, the well being spud holds your lease.

You are not named in the Pooling order for section 8-20N-6W Application 201801627 order 676236 The terms on this one was $750 3/16 or $400 1/5.

I don’t see your name in the pooling application in section 7-20N-6W Unless it is under a different name. Application 201804350 It has gone to recommended status but no order has been issued.

I don’t know why they want pay me 800.00 an acre when I have an active lease. My lease bonus was 400.00 per acre and 3/16. Maybe they are making a mistake offering the pooling bonus of 800.00 per acre now. This is the part I am confused about. Where are they coming up with the pooling bonus. I haven’t had any new paperwork. I have minerals in both sections. 40 in section 8 and not sure in sec. 7. Thanks for all your help!!!

My lease royalty is 3/16. Then do they use my lease if I’m not pooled?? Thanks for your help!!