My mother recently transferred her mineral rights in Garvin and Grady, OK to me and my brother. The Garvin County Clerk of Court recorded the deed transfer with no issues and quite swiftly. However, the Grady County Clerk of Court returned our deed transfer document advising that the document needs to include the exemption verbiage in order to proceed. The title deed our attorney prepared doesn’t include this verbiage. Is the request by Grady county to include the exemption on the mineral deed up to each county? I don’t want to pay for another deed to be drawn up only to include the exemption verbiage. Are there any suggestions how I can handle this without paying for an entirely new deed to be prepared? Thanks in advance for guidance.

You can hand write the verbiage on the deed and file.

Why are you not asking the attorney to perfect his or her work at no cost to you?

Thank you! I called the court and confirmed your guidance. I appreciate your advise.

What is the exemption verbage you are referring to. I am doing the same thing in multiple counties and don’t know if I have it on the new deeds.

Did the clerk instruct you to have the additional handwritten language notarized?

A notary is for signature purposes only. When ChaCha adds the new language to the document, I would put initial at the end of the language and it is good to go.

The person I spoke to didn’t say anything g about initialing but it’s probably a good idea. I wrote “exemption 4 parent to children”. I attached the list of exemptions provided by the Grady Clerk of Court As I mentioned I my original post, Garvin County did not require this, recorded the transfer quickly, and returned the original deed to me.

I am not an attorney. Since the grantor-grantee relationship is mother to daughter, there may be fewer to no concerns. Two minutes of internet research alerted me to the decision tree and the potential consequences of making a material correction (vs an immaterial one) to a deed. Best to all.

This is usually fixed by writing “Exempt 3202(4)” on the face of the document. . But only do so if it fits paragraph 4 below.

Title 68. Revenue and Taxation

Chapter 1 - Tax Codes

Chapter 1 - Tax Codes

Article Article 32 - Documentary Tax Stamp

Article Article 32 - Documentary Tax Stamp

Section 3202 - Exemptions

Section 3202 - Exemptions

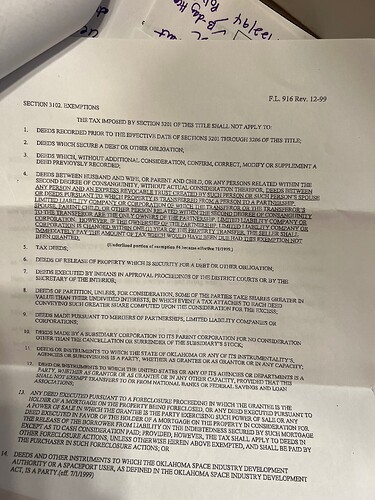

The tax imposed by Section 3201 of this title shall not apply to:

- Deeds between husband and wife, or parent and child, or any persons related within the second degree of consanguinity, without actual consideration therefor, deeds between any person and an express revocable trust created by such person or such person’s spouse or deeds pursuant to which property is transferred from a person to a partnership, limited liability company or corporation of which the transferor or the transferor’s spouse, parent, child, or other person related within the second degree of consanguinity to the transferor, or trust for primary benefit of such persons, are the only owners of the partnership, limited liability company or corporation. However, if any interest in the partnership, limited liability company or corporation is transferred within one (1) year to any person other than the transferor or the transferor’s spouse, parent, child, or other person related within the second degree of consanguinity to the transferor, the seller shall immediately pay the amount of tax which would have been due had this exemption not been granted;

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

Is this correct? “Exemption for grandmother to granddaughter.” “Exempt 3202(4)” Do I need both of these? Thank you.

Generally “Exempt 3202(4)” does the trick without explaining the relationship.

This post is not legal, tax or investment advice. Reading or responding to this post does not create an attorney/client relationship.

This topic was automatically closed after 90 days. New replies are no longer allowed.