Has anyone heard if Oxy Royalty is having problems . I havent recieved my royalty payment and this is the first time

I have received a revenue check from Oxy this month. I have not heard anything going on with Oxy. Thanks,

Depending upon your revenue, you may have dipped below the $100 minimum, or wells may have been shut in nearby for fracking. Call them and see if they sent a check. Have your owner number ready (on the statement from your last check).

Thank you for this very helpful answer! I too have been wondering why I haven’t received a check from Oxy yet for this month. I will call them on Monday.

I’ll try calling also. If you get through ,let me know whats up… Thankyou

Always good to go the Division Order or Revenue department and ask if a check was cut. Then you know what the situation is. You can choose to change the minimum royalty down to $25 by sending a certified letter.

Good to know.

Thank you!

I’ll let you know what I find out if I can get through. Thank you!

You didn’t receive a deposit this month because the account was in deficit when the October check write process occurred. After check write, additional entries occurred post October check write, your account now has a positive balance and will be disbursed 11/27/2023. I have attached an excel copy of your payable account for your reference.

This is the answer… wonder why the defecit

I recently reached out to Oxy because I’ve been having issues with viewing my revenue statements on their website. According to owner relations at Oxy a new site will be launched in the first couple weeks of December. Also your owner number may be changing as mind did this month. website: https://www.oxyroyalty.com/login.aspx?ReturnUrl=%2FDefault.aspx Email: owner_relations@oxy.com

I didn’t get through on the phone so I logged into my account online. The last summary statement they show for me was September, so your answer explains a lot… and yes, why the deficit? Maybe the November statement will explain.

Thank you for your answer!

Thank you for this information.

We use Enverus/EnergyLink to view our OXY statements. Its free. Contact OXY at their email to inquire on signing up. Surprised that their actual website is having issues. It takes awhile for the statement to download on the site. Several minutes in some cases depending on the size of your statement.

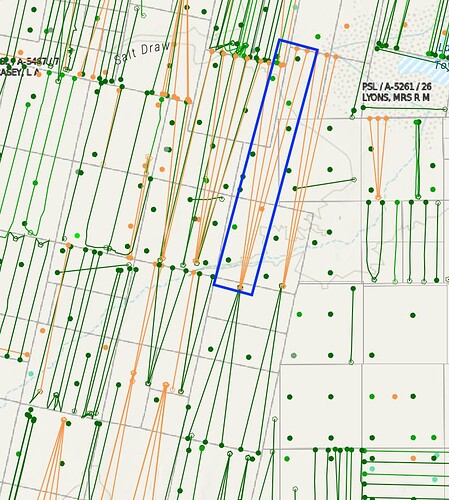

I didn’t get an OXY check this month either (Young wells in Reeves County). This is the first time I haven’t received a check and my royalties should be high enough to make the $100 cutoff. I think they are temporarily shut-in. There are newly spudded wells running north but from the same well pad.

Just FYI, my check from Oxy did arrive on schedule for November 2023. It included payments for both October and November. The documentation shows that the last payment was in September 2023, with no payment for October 2023, but beginning again in November.

In these days of mergers and buy-outs,Does any one have a professional opinion of the Callon takeover by Apache. Not much has been said about it except the business news on TV. Also , I’m wondering about those negotiating with OneOk for pipeline ROW. That’s what my lawyer is doing. The company seems to be in no hurry. February will make a year since I was contacted.I know a project this takes time. Thanks to the forum .Cj

I’m not an oil and gas professional however I’m interested as an owner because Apache has be active in leasing in my area last year. From news reports the APA Corp consolidation with Callon Petroleum is for $4.5 billion for 145,000 net acres. That comes to about $31,000 an acre. APA Corp will get 101,000 Mboe/d which is worth a lot of money. It appears that Apache has increased its position in the Delaware Basin in net acres by about 140%. APA Corp will retire $1.9 billion in debt and is included in that price.

The recent much bigger mega mergers deals of Exxon/Pioneer Natural Resources (about $70,000 net acre) and the Occidental/Crownrock (about $127,700 per net acre) in the Midland Basin come out a lot higher in dollar amount per net acre. Maybe a oil and gas professional can explain why there is such a big spread.

There is a difference between the rocks in the 2 basins. You can’t compare apples to oranges.

In general you need to separate out the producing boepd and the undeveloped acreage component. Say Pioneer has 600,000 boepd of production and, I don’t know…400,000 undeveloped acres or something. Average value of the production is say $65,000/boepd so thats $39B of the value, so they paid the remaining $20B for 400,000 acres , or $50k/net acre. Those are sorta made up numbers but that’s kind of the gist.

But…there is a difference between everything. The rock in any place vs another. The average NRI for each grouping of acres. The decline rates of the existing production. Etc. The per acre value tends to be very non-linear w.r.t. well production (i.e. the “goodness” of the rock")…a 1000 future breakeven well locations aren’t worth much. A thousand great wells is worth a lot.

Simple answer with no math is that Callon acreage is worse than Pioneer and Crownquest, and as far as math goes none of us know enough to do the actual math correctly.

First every asset is unique. And the price tag assigned by each company even for the same asset can vary too. This discrepancy is caused by the different forecasted production in the future, different field development planning, and the different potential cost savings resulting from the expanded or optimized operations after the acquisition. Hope that helps. ![]()