NM OIL BOY These are some crazy times, hope all is well with you and yours was wondering if you knew if anything happening in Lea Co. 19S-32E Sections22, 23, 26, and 27. I know you’re the man to ask, thanks TimmyD.

Hey Timmy,

Just huddled in the bunker waiting out the zombie apocalypse. Nothing going on in 19S 32E right now. No permits. No signs of upcoming drilling activity.

Random musings/info:

There are currently only 48 rigs running in SE NM with most of them pulled down into the core area from 23S-26S and 29E to 34E. There are something like 1.5-1.75 million acres in SE NM to be drilled for BoneSpring or Wolfcamp, including northern areas like you are in. If that is divided into 1000 acre units (mile wide and mostly 2 miles long but some 1.5 mile or 1 mile), there are 1600 units. Let’s say all the rock is the same, and the rigs drill 4 wells a unit @ 1 well a month before moving on. But half of the rigs are drilling in tandem with other rigs. That means that 48 rigs would drill 8 wells in 72 units in a year. So on average it will take 11 years until rigs get to your unit. (would take 22 years for rigs to get to all the units, 1600/72, so average is half). But your acreage is not as good so chances are far less, they are more likely to drill > 8 wells per unit in the core before they come up to 19s32e.

In short, its likely a long wait until there is more activity at current prices and rig activity. People who sold minerals in 2019 should feel smart. People who bought minerals in 2019 probably don’t feel as smart. Feel free to interchange smart and lucky. I own some minerals in fringe places in Eddy County and did not make the smart/lucky choice.

Cheers

Well good to hear the Zombies have not got to you yet! I know the aliens are closer to you folks.I guess I had a sneaking suspicion you would say something like that but wanted to reach out anyway, I guess I was half lucky last year but hey I guess its money in the bank later into retirement thanks so much and always a pleasure chatting, Timmy D

great color here, are you in the business on a day to day basis?

curious to the rig situation in west texas looks like

also, what price does wti need to be for operators to bring rigs back online? i am hearing start bringing some on at $50, more at $55, full bore $60…i could see how that is more like $55 to start, and $65-70 full bore…appreciate your thoughts…

I look at the business on a day-to-day basis, but its more of a hobby than a job. Used to work Permian for a major in my past life.

I think it will, in my opinion, be very difficult to get to “full-bore” again for a while.

Now that shale oil is a viable production source (maybe not an economic one, but a huge one), the US sort of controls how much supply can get added to the market. In the past we were just cork on the OPEC ocean. Except here in the US there is ZERO control on anything. Everybody scrambling for their share, which can lead to unconstrained supply growth. So we go full-bore until we’ve upset the market and all of our full-bore investments start to look like crap. Which is what we just saw, with an added Covid bonus on top. We are the heavyset gentleman at the buffet. Eat until we get sick, then need to go puke up some of those peeled shrimp, then regret ever paying $14.99 for buffet. Maybe those are all bad analogies, but I think oil and gas companies will have difficulty getting lenders to finance full-bore again, because it looks like a terrible investment over the past 5 years. So companies will need higher prices to allow for some free cash flow to allow for some more drilling, eventually more cash flow, more drilling, etc. Should be a much more gradual process. Can’t just drill on credit anymore. I think that above $50/bo, more companies will have free cash and not just be hoping to survive and service their debt or their insane dividend policy. So that should be when the process starts. But the only real way to get oil to higher prices is to have there be more demand or less supply. US supply SHOULD be going down, which should push prices up towards $50. It may take a while. But ramping up is gonna stop that. And demand right now is terrible due to Covid, will that fully come back? Will people fly? Will they just continue to work from home? And who knows what OPEC+ will do, you’d think they will keep cutting supply to try to bolster prices.

It feels like prices should hover in the $50-60 range. Where its not so high that people go nuts and drill a zillion wells and crash the price. But not so low that people stop investing all together. But we like to rollercoaster between boom and bust so expecting what “should” happen is probably silly. I’d guess the Nov election is not going to go in a way that is favorable to the oil and gas industry and that may effect things as well.

That’s all I got. ![]()

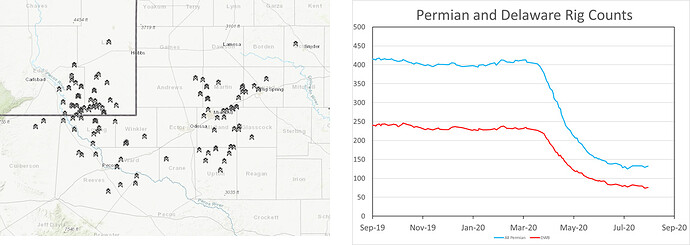

Oh, here is a graph of rigs in the whole Permian (blue) and in the Delaware basin (Red). And then a map of where those 130 Permian rigs are.

great post, ty.

are you familiar with the haynesville, decline curves, next gen well bores that have better results, shallow declines.?

Not as familiar, no. My prior employer has drilled Haynesville wells also, so I have seen some >20mmcfd IP results and some econs during shared presentations amongst technical staff. Circa 2018. That was all in San Augustine and Shelby Counties. And have done some basic mineral valuation calculations for friends in that area. But don’t know much.

This topic was automatically closed after 90 days. New replies are no longer allowed.