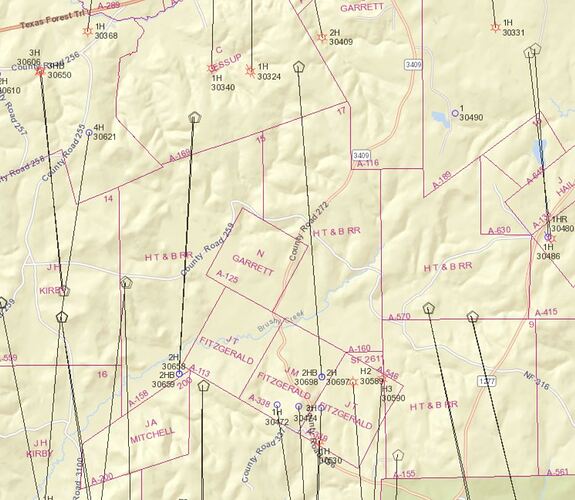

I am looking for map information on Ned Garrett Survey A-125, and J.W. Fitzgerald Survey A-0338. Also, if drilling has already commenced. If so, the well numbers and maps of the property would be much appreciated.

Below are the Railroad Commission map of the area you asked about and the unit plats for the BP Kanga and Roo units that include parts of the two surveys you mentioned.

Two wells have been permitted in each unit, and production reported from the Kanga unit starting in February. The permit and API numbers for each well are: Kanga (835778 and 405-30658 & 30659) and Roo (851518 and 405-30697 & 30698)

San Augustine Co. - BP Kanga Gas Unit.pdf (680.9 KB)

San Augustine Co. - BP Roo Gas Unit.pdf (713.2 KB)

Dusty1, thank you so much for the map and other information. Myself and others were presented with oil & gas mineral lease offers and this information is very helpful.

Hi Dusty1, I received a Oil & Gas Mineral lease offer from Ted W. Walters & Associate that is on 52 acres of land. The offer is a 5 year term, $500 per net mineral acre, 3/16" royalty with an up front one time fee of $89.89. Is this a good offer for Ned Garrett Survey A-0125 and A-0338 from Ted Walters & Associate on behalf of BP America Production Company?

Can you tell me what the going rate is for the San Augustine area?

Sorry I don’t have any idea what leases are going for there. Maybe somebody on here who is in that area can help you. If not I always suggest trying to contact your neighbors and see if they will share information with you or possibly negotiate as a group if they are also considering a lease offer. If you can put a few tracts together you will have more leverage to negotiate than you will with 52 acres.

It depends on the amount of activity and competition there, but 5 year lease terms have become pretty rare in a lot or areas, 3 year being more common. If nothing else I’d tell them a wanted a shorter lease term and higher royalty, say a 1/5th. They may come back offering a 3 year primary term with a 2 year option, but remember it is strictly the lessees option, not the mineral owner.

I’m curious about that one time fee of $89.89. Are you saying you would be charged a fee if you accept their lease offer? Never heard of anything like that.

Hi Dusty1, thanks for your response. In answer to your curiosity, the cover letter states,

“Attached please find an Oil, Gas and Mineral Lease on behalf of BP America Production Company, covering your interest in the above captioned land. When we receive the notarized and signed lease we will mail you a check in the amount of $89.89 for the bonus consideration within seven to 10 business days. The lease will reflect the following terms: (1) 5 year term, (2). $500 per net mineral acre, (3) 3/16th royalty”

Sorry I just found your response.

I thought you were saying BP was going to charge you $89.89 if you accept their lease offer. Based on the wording from BP’s offer that you quoted it sounds like the total amount of the bonus check they are going to send you if you accept their offer is $89.89.

If that’s correct and it is calculated based on $500 per net mineral acre then you must own a very small, fractional mineral interest in that 52 acres.

Yes, 3/16 of 52 acre’s.

Well then I guess Fter reading these others here about BP , that I did get a Pretty Good Deal on mine and My Check that I received already was a lot larger then theirs. However I was 1st offered only $250 per mineral acre, but I turned it down, started Notgating till I got a reasonable amount I was satisfied with, although I have read on some of these group forums where someone was getting $1000. Per mineral acre

Greetings to everyone! I’m trying to help a friend of mine who owns property in this area. The deal he received is similar to G_L deal. Dusty1 submitted a great suggestion - “contact neighbors and possible negotiate as a group”. Has anyone made an attempt to put a group together and negotiate with Ted Walters/BP collectively? I know it wouldn’t be easy to get a entire group working together but are the rewards worth it?

G_L - based on the land, mineral rights and potential profits, do you think it would make sense for the neighbors on this tract to have a law firm represent them or are the profits too little and attorney’s expenses too high to make that course of action risky?

Any help and/or answers??

Thanks

Having 2nd hand knowledge of BP’s plans in the area, they do not expect to drill anything in San Augustine in 2020

Hi OliverG. Thanks for the reply. I need to find out the reason why…

Anyone else have information to share regarding the Ned Garrett Survey A-125 area??

Given gas prices the current well economics is the reason why. They have leases in other ares which deliver a better IRR

It’s been awhile (year or 2) since I was on this forum. I just saw your question, and the short answer is, I paid a lawyer $500 to review the request from Walters Assocates on purchasing/leasing minerals rights to see if these people were scammer, and still got vague information. The lawyer also suggested family member group together and negotiate as a group, of course more money for the lawyers and no way of nothing if the cost of the lawyer would be more that what we would be getting collectively from Walters Assocates. P.S. Just received another letter this week from ENERLEX offering $150, and an additional $100 for sign on bonus, and promising $1,500 being paind upon final title examination. I would think they would have examine the title before evening making such an offer. This certainly scream SCAMMERS to me.

3/16 of 52 acres is 9.75 acres. A gas well which terminates in one of your abstracts has already produced >13,000,000 MCF. Maybe a pro member will offer his or her opinion on the value of almost ten acres if your minerals were included in a unit with one or more wells. NMOilBoy are you reading this?

Texas Natural Gas Industrial Price (Dollars per Thousand Cubic Feet) [ MCF = 1000 Cubic Feet: “M” as in the Roman Numeral for 1000 ]

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2001 | 9.34 | 6.35 | 5.24 | 5.36 | 4.80 | 3.89 | 3.45 | 3.43 | 2.62 | 2.32 | 3.10 | 2.66 |

| 2002 | 2.85 | 2.46 | 2.82 | 2.95 | 3.62 | 3.51 | 3.50 | 3.22 | 3.52 | 3.75 | 4.09 | 4.22 |

| 2003 | 4.95 | 5.92 | 8.29 | 5.16 | 5.38 | 6.53 | 5.39 | 4.94 | 4.87 | 4.47 | 4.44 | 5.01 |

| 2004 | 5.80 | 5.41 | 5.10 | 5.51 | 6.03 | 6.57 | 6.11 | 5.99 | 5.17 | 5.41 | 7.11 | 6.56 |

| 2005 | 5.88 | 5.87 | 6.21 | 7.10 | 6.65 | 6.44 | 7.08 | 7.68 | 10.08 | 10.96 | 10.79 | 8.92 |

| 2006 | 8.94 | 7.57 | 6.82 | 6.98 | 6.94 | 5.99 | 5.92 | 6.58 | 6.34 | 4.41 | 6.95 | 7.13 |

| 2007 | 6.00 | 7.10 | 7.14 | 7.16 | 7.53 | 7.68 | 6.91 | 5.92 | 5.45 | 6.35 | 7.02 | 7.03 |

| 2008 | 7.02 | 7.92 | 8.90 | 9.41 | 11.09 | 11.87 | 12.93 | 9.32 | 8.12 | 7.24 | 5.88 | 6.22 |

| 2009 | 5.47 | 4.13 | 3.77 | 3.80 | 3.46 | 3.78 | 4.09 | 3.66 | 2.97 | 3.97 | 4.45 | 4.98 |

| 2010 | 6.14 | 5.75 | 4.96 | 4.19 | 4.40 | 4.41 | 4.97 | 4.81 | 3.91 | 3.97 | 3.52 | 4.39 |

| 2011 | 4.35 | 4.53 | 4.01 | 4.47 | 4.50 | 4.56 | 4.39 | 4.64 | 4.17 | 3.92 | 3.63 | 3.45 |

| 2012 | 3.31 | 2.90 | 2.55 | 2.26 | 2.22 | 2.66 | 3.01 | 3.32 | 2.92 | 3.28 | 3.65 | 3.90 |

| 2013 | 3.58 | 3.48 | 3.65 | 4.27 | 4.48 | 4.38 | 3.91 | 3.77 | 3.80 | 3.75 | 3.83 | 4.11 |

| 2014 | 4.63 | 5.69 | 5.05 | 4.87 | 5.03 | 4.82 | 4.90 | 4.36 | 4.35 | 4.26 | 3.98 | 4.50 |

| 2015 | 3.38 | 3.11 | 3.01 | 2.88 | 2.82 | 3.04 | 3.08 | 3.13 | 2.95 | 2.78 | 2.29 | 2.38 |

| 2016 | 2.45 | 2.39 | 1.88 | 2.08 | 2.14 | 2.16 | 2.98 | 3.02 | 3.15 | 3.22 | 2.93 | 3.35 |

| 2017 | 3.84 | 3.43 | 2.81 | 3.34 | 3.37 | 3.51 | 3.40 | 3.19 | 3.21 | 3.11 | 2.98 | 3.21 |

| 2018 | 3.35 | 3.81 | 2.89 | 3.01 | 3.13 | 3.25 | 3.22 | 3.02 | 3.21 | 3.50 | 3.87 | 4.86 |

| 2019 | 3.92 | 3.27 | 3.05 | 2.95 | 2.85 | 2.84 | 2.61 | 2.40 | 2.55 | 2.56 | 2.78 | 2.54 |

| 2020 | 2.32 | 2.10 | 2.04 | 1.86 | 1.99 | 1.89 | 1.74 | 2.18 | 2.64 | 2.49 | 3.12 | 3.03 |

| 2021 | 2.76 | 15.81 | 3.06 | 2.87 | 3.31 | 3.45 | 4.05 | 4.40 | 4.81 | 6.11 | 6.20 | 5.57 |

| 2022 | 4.87 | 6.30 | 4.67 | 5.74 | 7.52 | 8.90 | 6.82 | 8.56 | 8.81 | 5.53 | 4.79 | 6.23 |

| 2023 | 4.49 | 2.87 | 2.47 | 2.09 | 2.10 | 2.35 | 2.77 | 2.71 |

We’ve been getting offers starting at $500 -$1250 net mineral acre bonus in San Augustine & Shelby county. We ask 25% cost free royalty, no extension, more bonus than they offered, then negotiate down.

Thanks J Walker for your information.