Everybody has their own viewpoints. 55 7 Sec 20 has oil and gas under it. Mostly gas. It is not a hotspot.

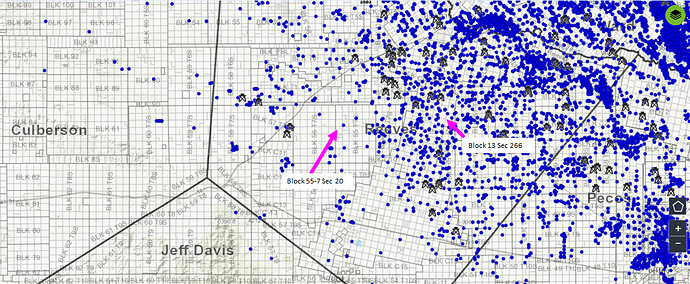

Here is 55 7 Sec 20 and then the aforementioned Block 13 Sec 266. Like Liz says I would expect to get $2-3k/acre to lease your minerals, and $2.5k to sell your minerals is a pretty lousy offer.

Personally the whole Apache thing seems a crapshoot. Apache has 400k acres in the Alpine High. And is running 6 rigs. 400,000 acres = 400 units = 6400 wells. 6 rigs drill about 70 wells in a year. So, that’s 90 years of drilling. Thats what happens when Delaware gas sells for less than $2/mmbtu. So yeah, its nice when your minerals get drilled up, but if someone is willing to pay you a reasonable % for things that may happen in the next 90 years, its not really insane to consider it. Especially as the mineral market is pretty hot/inflated right now. And that is the whole counterargument to the “never sell your minerals”…at some point you may want to diversify and de-risk your holdings and get paid upfront instead of over a long long timeframe.

But that is a lot more than $2k/acre. I would think you might be able to sell your leased minerals for $5k per net royalty acre. So IF you can lease at 25% for $3k, each mineral acre would be worth 3k + 2 * $5k = $13k. A $17.5k/acre offer seems pretty aggressive, but it is a bit further East which is better.

just my $0.02