Got an offer to purchase my minerals in Block 55,Township 7, T &P RR co. Survey Section 20,S2 for $450,000.00 for 174.5 mineral acres. Does anyone know if that would be considered a fair offer. I have heard that there are some companies offering more than that. Wasn’t sure is this area is considered a hot spot or not. Thank you

Janet, we own minerals in Bl 55, Twp. 7, Sec. 16. A couple of months ago, we were offered $1500 an acre to lease our minerals. We turned it down - there have been close-ish acreages that leased for $3000 an acre. It seems to me that $2578 an acre to buy (not lease) your minerals is a pretty lousy offer. That said, I am not an expert! And our area is not really hot yet, though Apache has done some drilling nearby and there is some decent activity a few miles to the east of us.

According to a report last month by the USGS, our area has many layers of recoverable oil. We are being patient. Best luck!

Janet, We turned down $17,500 per acre in section 26, block 55-7. Apache is starting a well in this section this month and calls it Wolfcamp instead of Alpine High.

Just wait. They will be offering $25,000/nma in that area soon…hold out for the $4.5 Million offer.

Not sure where your property is in relation to mine, but thought I would offer my recent experience with mineral interests that I own in Block 16, Section 266, Toyah Valley Grape & Alfalfa Co.,Subdivision, Block 13, H&GN RR Survey. I recently leased the property for $11K/nma, and was able to get some concessions with regard to the “standard” lease. I no longer live in Texas (unfortunately), and I really don’t know what the “hot” areas are. However, I had a number of lease hounds asking about this property and three were bidding against each other at one point. I could have leased it for $12K/acre, but that company had some things in the lease which were seriously to my disadvantage, and they would not budge, so I didn’t lease to them.

I also had someone call a few days ago who wanted to buy my mineral rights. I told him I had just leased the property, and he said that they would buy it and I could keep the lease bonus. I told him I was not interested, and he offered me $25K/acre to buy it. I repeated that I was not interested and he indicated that they could go higher. At that, I thanked him for his interest and hung up.

That said, my philosophy is NEVER sell mineral interests. Over the years these mineral interests where wells have been drilled are like the gift that keeps on giving. And in some cases where I received a really good lease bonus, wells were not drilled and I was later able to lease them again. Sort of like found money. I have a couple of cousins that had similar interests and they sold them. As a result, they lost out in a big way, not only from the bonus, but from subsequent production on the properties. Of course, if someone offered me $450K for my 5 acres, I would certainly have to think about it…LOL.

Everybody has their own viewpoints. 55 7 Sec 20 has oil and gas under it. Mostly gas. It is not a hotspot.

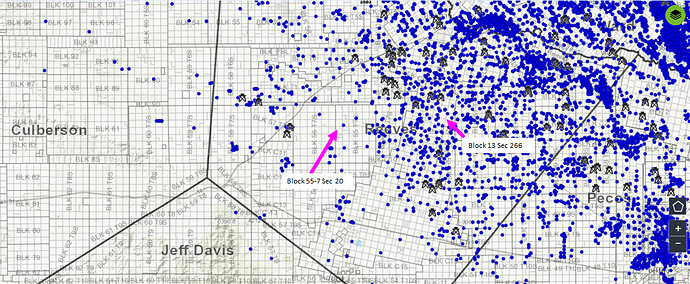

Here is 55 7 Sec 20 and then the aforementioned Block 13 Sec 266. Like Liz says I would expect to get $2-3k/acre to lease your minerals, and $2.5k to sell your minerals is a pretty lousy offer.

Personally the whole Apache thing seems a crapshoot. Apache has 400k acres in the Alpine High. And is running 6 rigs. 400,000 acres = 400 units = 6400 wells. 6 rigs drill about 70 wells in a year. So, that’s 90 years of drilling. Thats what happens when Delaware gas sells for less than $2/mmbtu. So yeah, its nice when your minerals get drilled up, but if someone is willing to pay you a reasonable % for things that may happen in the next 90 years, its not really insane to consider it. Especially as the mineral market is pretty hot/inflated right now. And that is the whole counterargument to the “never sell your minerals”…at some point you may want to diversify and de-risk your holdings and get paid upfront instead of over a long long timeframe.

But that is a lot more than $2k/acre. I would think you might be able to sell your leased minerals for $5k per net royalty acre. So IF you can lease at 25% for $3k, each mineral acre would be worth 3k + 2 * $5k = $13k. A $17.5k/acre offer seems pretty aggressive, but it is a bit further East which is better.

just my $0.02

Liz Appreciate the info. I was thinking it seemed low after reading of some of the other offers. If I could get the right amount I would sell them cause I’m 71 yrs old & I would like to have some cash just in case I live longer than planned for. Plus your not gonna take any of it with you so I thought I might as well spend a little of it if it’s a sizeable amount. Lol Thanks again Janet

I can see your point! The general wisdom is not to sell but everybody’s circumstances are different. And though your offer isn’t very good, it may be the only one you get anytime soon. If you think you might want to sell, I hope you consider getting a good oil and gas attorney to look out for your interests. He/she might even be able to get that offer increased. Whatever you decide to do, best luck!