Received letter today from Raintree Energy, LLC offering to purchase my minerals in section 25 06 North 04 West.

Something must be a stirring. The offer is $5650. per acre, which I know the price could be higher. Although I am not interested in selling at this time. Just wanted to pass this info on.

For now the Whetstone well seems to be producing quite well. It would be really nice if Casillas would add another well.

We are in section 24, our offer got up to 9000. We said no, looks like something was found.

Received another offer at $7200 per acre to sell all or part of interest. This offer was from Pentex.

Can someone tell me why I’m getting offers, I mean the new well is producing. Do they know something is up, is that an indicator that another well might be added soon?

Sandra, for right there, they are hoping on future wells. Usually offers to buy mean they know something you don’t know and they are pretty sure they will make money in the long term at whatever terms they offer you. That offer is quite low to another one I heard for that section. Depends upon the royalty rate as well.

Future wells would make sense to me. So how far in the future? I mean really, I get about $400.00 a month. I wish the Whetstone was doing as well as the Indultado, then the offers would make sense. Yes the letter did state the royalty of at least 3/16 mine in 1/5. I know I could get more than the last offer but holding out to see if another well would be considered soon.

Only the oil company knows for sure on what “soon” means. Their strategy is to drill one well and hold the section by production. Then they come back into the good areas and drill the infill wells.

Casillas just got started drilling in this area, so they will evaluate their acreage, results from wells and then decide what to do. They received a big influx of money in 2016. They are a private company.

If you are older than 80 years old, have no children or grandchildren, and want to travel to Paris–then entertaining offers to purchase your minerals makes sense.

Otherwise, selling at less than insane prices doesn’t make much sense, IMHO.

I completely agree. I have mineral interests in 3 SE Oklahoma counties that have been in my family for 90 years. They were passed down from my grandparents, then to my dad and now to me. I have had offers to sell over the past 13 years. I have respectfully declined and will until I pass them on to my heirs, descendants, and legatees. Although some have been idle for several years, they are now setting up a drilling on one in Seminole Co., are also producing in Atoka and Coal counties. I have another in Seminole Co. which is loaded with fairly new infrastructure–tanks, pipeline, salt water disposal, etc. I quit receiving checks on that in mid-2015. When the economics are right, that lease will become active again. The story is the same with the minerals owned by my spouse, who I lost on September 24, 2017. Those are still being probated. Unclaimed Property Division, OK Department of Treasury, has already paid out a nice sum of money, both from leases that were force pooled and otherwise. There are a few thousand dollars still to be paid out, having been processed. Her minerals were in 10 SE OK counties, all producing counties. I am receiving monthly payments now from a goodly number of those, especially in Carter and Stephens counties, as is her daughter. Bottom line, DO NOT SELL, unless in case of very extraordinary circumstances. These offers are made knowing better what they are worth than do you in most instances. Frank is right.

Thanks Martha that would be great. Otherwise like I mentioned before, no company would shell out $30,000 or so to purchase my interest. No doubt it would take about 5 years or so to recoup that amount on what I am getting now. Not taking into account the decline. I’ve seen Grady Co have offers that are way beyond that but thats a different area. Getting offers in that ballpark would be a whole different story. I would never ever in my lifetime make that much off of this well or future ones. No doubt taxes would take a bit of that.

Frank….we are in our early 70’s, have grown children and five grandchildren. We have no desire to go to Paris or anywhere else out of the country but we do have a desire to purchase a new home without having to go into debt. Our children make more money than we ever thought about making and both have nicer homes than ours. They take very good care of our grandchildren. When we are gone our family will be left with what we have including some royalty and mineral rights. In the mean time we plan to enjoy the rest of our lives together with no debt. We have always advised our friends not to sell their minerals unless they need the money and still do. We felt like the offer of $16,250. Per acre was a fair offer as the royalty stands right now. We understand it could be very low should someone decide to drill a lot more wells there in the future but it’s a chance we decided to take. Appreciate your advice though and wish you well with the decisions you make with your minerals.

Linda- what section I’m 6n4w are you in. I am in 24 and the offer was for 15k that I said No too as I intend not to sell.

JD….we are in section 29 2n4w in Stephen’s Co. for the piece we chose to sell. There was one well drilled on it not too long after we leased and it was mainly a gas well for Continental. I figure there are more wells in the planning for the future but even if they started now it would be a year or two down the line before we’d see any funds and we would like to make an offer on a house and 20 acres that is on the market at this time. We built this house where we live now 38 years ago and have had it paid for about 36 of those years. We don’t like to owe anyone and we don’t want to start making any kind of house payment. (I tell everyone it’s against my husband’s religion to use credit….lol) We also have section 16 and 34 in 2n4w in Stephens and section 29 and 31 4n 3w in Garvin Co. We also have 80 acres in NE Oklahoma that my dad left us. We aren’t planning on selling any more of our minerals right now although we might consider an offer on the part in NE Ok. because there is NOTHING happening up there now. From your description you sound like you are in or very close to the STACK area aren’t you? If so I don’t blame you for not selling for 15K for that hot area. My husband was raised one of four kids very poor with a single mom. He’s always worked hard to make us a good living and he says he doesn’t think it’s good for most kids to be handed something that they don’t have to earn. Like I said in my last post our kids both make more than we ever did and take good care of the grandkids. We have helped them out when they first started and still do when we want to but like the fact they are independent now with good jobs. So, I said all that to say this we’re not worried about leaving them all our minerals because they will do well with or without them. Praise the Lord!

Linda–I don’t disagree with your analysis. Houses can be good investments. The main point is, you have a good reason to sell some, and have analyzed the situation. Some folks just see what they perceive to be a big check, and don’t put much thought into their decision to sell.

Now if you said you wanted to buy a new flashy sports car that would loose 1/2 its value the minute you drive it off the lot, I might suggest that you re-think the situation.

Frank… I do know that houses are a good investment. We have bought, remodeled or redecorated and flipped a few houses. We still own and lease out the building we used to have our oilfield supply company in and have paid for it many times over with the rent. On our personal homes we have owned 3 in the 50 yrs. we have been married. Each time we sold one house we made good profits as I believe we will this one when we sell it. If my arthritis had not put a stain on my ability to walk and climb stairs the flip thing is the thing I’d love to still be doing. One of the houses we flipped we owner financed to a friend of ours who put a large sum down and named her own terms at 10% interest for 10 years which was much better than we could get in the bank at that time. Her x husband had ruined her credit. She paid on time and paid it off in about 3 years when she bought another house. This time we gave her an excellent credit reference and she was able to go through the bank because of it. She was very happy with the deal and so were we. That was about 20 years ago. Don’t know why I’ve rattled on like this but I just wanted to let you know that I agree that houses can be a great investment. I believe our accountant said we could buy it for a ranch investment if we got as many as 20 acres or 20 cows (the cow thing probably won’t be happening but you never know) lol Yes, those sports cars or any other car are terrible investments aren’t they? We get attached to our cars and drive them for long periods of time. We bought a 97 Lincoln Towncar and drove it off the showroom floor and I drove it nearly 300 thousand miles then sold it to a young guy with a pregnant wife through Craigslist who gave me $1500. cash and he drove it at least another couple of years. Now that was a good car! But, that’s one of the few cars we ever bought brand new as we usually opt for a nice low mileage.

Sorry I got off the oilfield subject. I’ll try harder to control myself! lol

I just got offered $7,500 per acre for Sec 13 9N 8W. Currently under a lease with Southwest Energy Partners

When is your lease up? Activity is picking up in your area.

you really put a lot of intellect and thought into that one.

1 Like

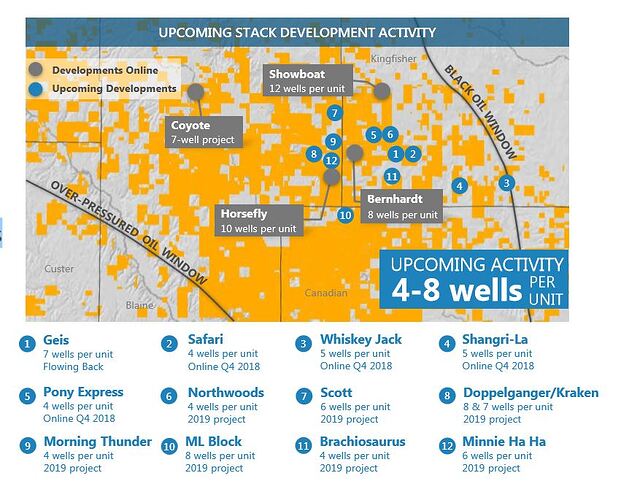

Per DVN’s Q3 operations report:

Pilots testing higher-density spacing not optimized — Showboat upside test underperforms vs. plan (12 wells/unit) — Horsefly delivered improved results (10 wells/unit) — Bernhardt rates limited by flowback strategy (8 wells/unit) — Lighter-spaced Coyote project delivers best results

Learnings from high-density infill tests — Initial results indicate spacing was too tight — Flowback approach key for oil recoveries — Upper Meramec delivered best well results — Vertical communication observed — Substantial D&C savings achieved (pg. 15) Reverting to “base case” spacing to optimize returns — Upcoming activity targeting 4-8 wells per unit — Well placement focused in Upper Meramec — Flowback adjusted to improve performance Project IRRs to benefit from less capital intensity — Utilizing tailored, more capital efficient completions — Projects to benefit from less infrastructure capital on centralized facilities

Similarly NFX was under pressure due to under performance in the STACK. This is not uncommon through out shale plays, but the midcon’s expectations were pushed pretty high, and still are pretty high. Companies simply can deliver their type curves across a tightly spaced multiple well unit consistently.

This will eventually impact mineral values in multiple ways. Not only will production projections be reduced, and hence projected cash flows go down, but the overall allocation of capital and velocity of development will start to pull back as companies look to allocate capital to higher value plays. Add in the dramatic retreat in oil prices from the mid $70’s to the low $60’s and there are many mineral buyers licking their wounds and crying tears of the winner’s curse for their overly optimistic estimates, and many mineral buyers that might have missed peak pricing as the buyer pool shrinks. Of course the pendulum can swing the other way on pricing again, and it will, but always remember there is only so much oil and gas in a formation, and as important, only so much formation energy available to produce those hydrocarbons.

DVN 2018 11 NOV Q3-2018-DVN-Operations-Report-FINAL.pdf (1.5 MB)

wonder what the value of minerals with 4 wells versus 8 or 10 will be…hmm

Three year lease signed March 2017.