Yes, in general, the first check will take six months or more to be cut. With hundreds of owners in each section, tracing their title back to patent takes months of work. If they do not pay within six months, send a certified letter return receipt (and keep a copy) of your request for payment and interest. They do owe interest by state statute, but you sometimes have to ask for it. With staff working from home for months now, things can get delayed.

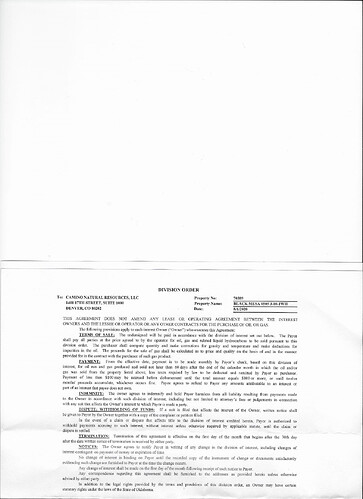

Today is a day I thought would never come! ![]() I received division orders today. At the top of the DO is the statement “This agreement does not amend any lease or operating agreement between the interest owners and the lessee or operator or any other contracts for the purchase of oil or gas”. Is this the same as the statement you on this site advised me to add to the DO which is: (No terms of the lease are to be changed)? Thanks.

I received division orders today. At the top of the DO is the statement “This agreement does not amend any lease or operating agreement between the interest owners and the lessee or operator or any other contracts for the purchase of oil or gas”. Is this the same as the statement you on this site advised me to add to the DO which is: (No terms of the lease are to be changed)? Thanks.

Martha,

This is the DO I received from Camino. Do you have any suggestions or is this good to sign? Thanks

The OK attorneys on the site have recommended not signing the DO as they are not required in OK. If the decimal on the DO is correct, then you can return your W-9 (or they will take out federal taxes) and send a letter confirming the name of the well, your name and address and the decimal amount and also stating that no terms of the lease are to be changed in paying the royalties.

I would recommend that you add a line that says the minimum royalty be set at $25 instead of $100.

If this division order is late past the 180 days from first sales, then also add a line in your letter asking for the statutory interest.

Send you letter and W-9 by certified return receipt mail and keep a copy of everything!

I am typing a letter to return to Camino in lieu of the DO. I just noticed that on the DO they have listed Products: and to the side have 200-Gas No mention of oil. How can that be?

Thanks

I would request payment on all products. Iron Horse midstream is the reporting company for gas and NGLs. Coffeyville Resources is reporting on oil. They may send a separate DO, but claim all products for now with the operator.

Martha you have been a rock since you got on this site. Want to thank you for all your help. I am sure I am not done asking questions yet though. Every time I think I am about to get a check in the mail it seems something else comes up. A separate DO for gas and oil for the same royalty interest? Does this happen very often? Thanks again!

Yes, you can get a separate DO for oil and gas, but the operator is ultimately responsible (in OK). I have some very old leases from my grandfather that have oil at 3/16ths and gas at 1/8th. Confused me to no end when I first started.

Oklahoma Tax Commission for the Black Mesa has gas production listed up through June and oil listed through April 2020. What are they doing with the oil produced from April through June? Storing it and waiting to sell?

The tax commission data is historically running about four months behind. You will just have to wait and see when they post new months.

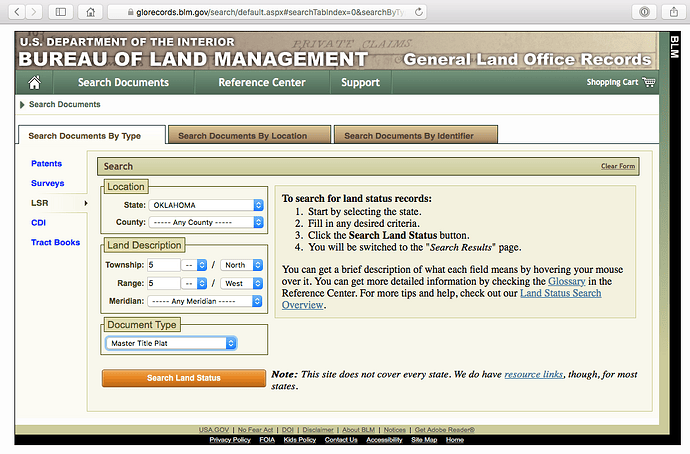

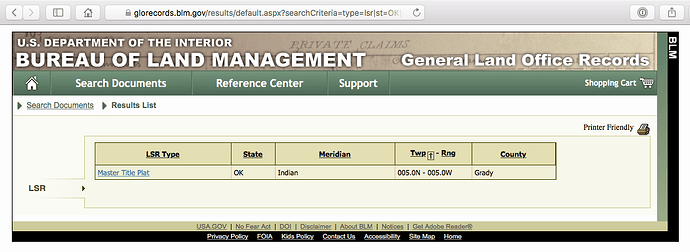

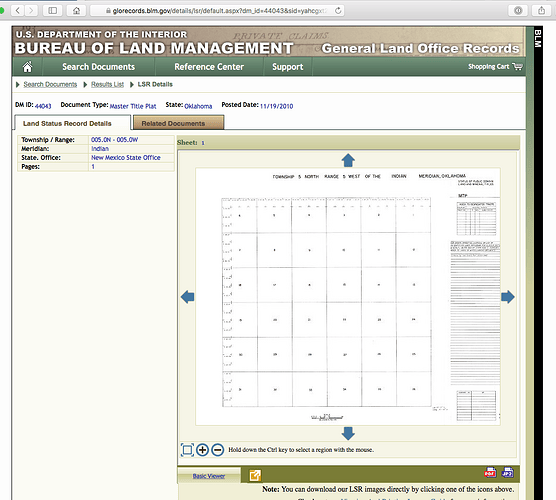

i received a division order on 4-5-5 today. The percentage interest listed is 0.00086606. My deed says, “An undivided 5.00667/120.14th interest under Lot 4, the West Half of Lot 3, the Southwest Quarter of the northwest Quarter and the West Half of the Southeast Quarter of the Northwest Quarter of Section 4, Township 5 North, Range 5 W.I.M.” How do you know how many acres the way this is worded??? Any help is so much appreciated!! I tried to search it on the BLM website and had NO luck. ![]()

The equation for the decimal amount is: net acres/actual spaced acres x royalty x % perforations in your section (if a multi-unit horizontal well).

walking through your description -Lot 4 has 40.06 acres, so your gross is 40.06 acres

-Lot 3 has 40.20 acres, so you have the west half- 20.10 gross acres

-SW4 NW4 40 acres, so you have 40 gross acres

-W2 SE4 20 acres, so you have 20 gross acres.

The gross acres total is 120.16 acres. Somebody may have goofed a bit because your description says 120.14 gross acres. You have 5.00667 acres. Or something very close to that. (5.00667/120.14*120.16=5.00750347) Might have been a typo on the deed.

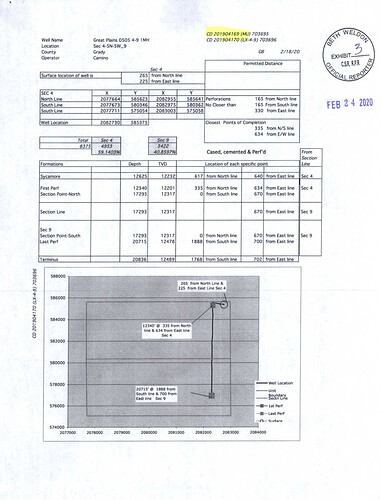

Assume that you have 5.00667 acres /641.04 actual acres for the whole section x your royalty x % perforation. The Great Plains well is in section 4 and 9. The splits on the well are located in CD201904169. The split is 59.1403% for section 4.

I used your deed acres. 5.00667/614.04*.1875*.591403=0.00086606. Which is on your Division Order. I prefer to send the NARO Division Order form or a letter in lieu that says my owner name, address, email, confirmation of the Division Order decimal and a phrase that says the royalties are to be paid according to the lease terms with no changes. I also send the W-9 properly filled out. Make sure it is the most recent available-not the 2014 one. A few companies are not using the current one which may cause trouble later.

Wow! Thank you Martha! I don’t have a lease agreement to determine the percentage. I think it’s 3/16ths but don’t know for sure. Are these leases filed of record or do I need to Contact Camino for a copy?

You do have 3/16ths because the math works. The lease should be filed in Grady county. You can find them on www.okcountyrecords.com under the name of the person who was the owner at the time. The digital files only go back so far, so if it is too old and not digital, then Camino should have a copy. Or you can go to the courthouse in person (if it is open) and get a copy for a small fee. Call ahead. Many are closed right now. okcountyrecords is free to look and a small fee to print.

FYI - The Division Order I received from Camino for the Great Plains only covered Oil vs. Grace’s DO only covering gas. As recommend, I’m returning a current Form W-9 vs. the 2014 form they sent. This forum referenced returning a letter in lieu of Camino’s DO. Where do I find an example?

Thanks for your time.

For Oklahoma, Each person sends their own letter, but make sure you send it by certified return receipt mail and keep a copy of the letter and the return green card. Include the following: Your name (or name of the entity owning the minerals), your address, name of well that was listed on the Division Order, API if listed, Description of your minerals, Decimal amount-if you agree with it (and a paragraph about why you don’t agree if relevant), a statement saying you are attaching a W-9, a statement that says the royalties are to be paid according to the lease terms with no changes and request payment on all products. If you are due interest under the statutory conditions, then request it. I also ask that the minimum royalty payments amount be set to $25.

I sent my letter over two weeks ago and no return receipt yet. My post office says my letter is in Denver but that is all they know! Apparently the PO is having problems now…

Not unusual – those Return receipts sometimes take weeks to get back. You can do a trace on the letter and see if it was delivered. Eventually I have received them – don’t give up — they are encouraging us to use the electric form – maybe for good reason. I hear the White House is slowing down the mail??

Thanks Bud. I think it will get there just didn’t realize it would take so long. Maybe there is a shortage of postal workers…

Received my first Mailbox Money from Great Plains today.