I have a mineral interest in sec 34 T8N, R4W which is part of the multisection pool for the Charles 0334 1H well which reached TD in mid Dec. 2018 (surface location sec 2 T7N, R4W).

Native Exploration operating LLC acquired operations from EOG right before the well was spudded around 11/13/18. I was very disappointed this happened. EOG is one of the best operators around and I got a small independent with no track record.

Since it is a new private company, I can’t seem to get any news about when they plan to complete the Charles well, if they plan to drill additional wells in the Charles pool (sec 3 and sec 34) before moving the rig off location. Does anyone have a contact person and phone/e-mail to this company?

Anyone out there have interests where NEO LLC is the operator? If yes, any comments about your experience with them? I don’t think they have completed any Scoop Woodford well yet with results. If they have, I’d like to know how it went.

Any comments on the company and their management? Did they hire people from EOG or other companies with Scoop/Stack experience?

Wonder how much acreage the acquired from EOG in Grady and McClain county.

I’m worried they will screw up the well and have poor results…

It takes about four-five months to drill and complete a two section well, so if it hit TD in December 2018, it may not complete until April 2019. They have a lot to frac. The Division Orders usually come out five months after first sales and then first payments are not required until six months after first sales. They will determine the productivity of the first well and then make decisions about any future wells. I think you will not get any information if you call them now since the well is not completed.

Native has five wells permitted right now. Six if you count the Charles 0334 1H and maybe more I didn’t find yet. Grey Snow 14-1208 1MH was completed in August 2018. No completion is posted, but the OTC website has a few months of production. Gross Production.

Native has a permit for the Medicine Arrows 2-25-0704 which will go into section 35 from the same pad as the Charles. I suspect they will finish that well before making any decisions about the Charles section in 34. They are trying to save the leases and get them both Held by Production first. It spud Dec 12. The may wait until both are drilled and then frac them at the same time with a zipper frac.

Several more have spud, but I do not see completions yet.

2 Likes

Thank you for your informative information. Do you know anything about the company and their competence in the Scoop/Stack area? Or how big an acquisition they made from EOG? I have seen no news about this sale. EOG had some success, I have read, in the Scoop, why would they sell out?

http://www.nativeoilandgas.com/

This gives the background of the team. They have the experience.

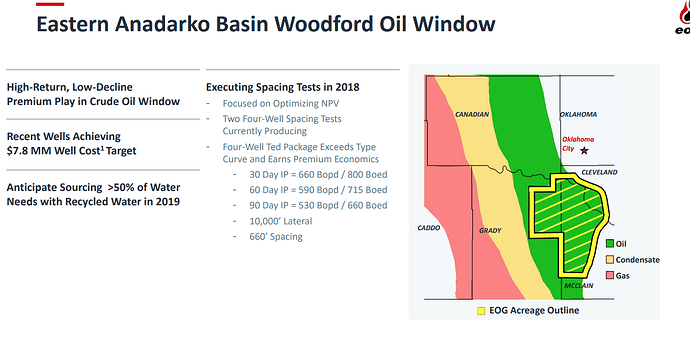

Do not know about the acreage. EOG is still in the Stack and Scoop. Companies sell their positions in wells all the time if they aren’t where their particular focus is. EOG has most of its focus elsewhere. You can look up their Q3 investor presentation. They have two rigs in the Woodford working and 11 in Eagle Ford and 19 in the Delaware basin.

M_Barnes,

Thank you for your posts on here. I have not found anything that (with my LIMITED understanding, and dated knowledge) that isn’t point on. I know it takes time for you to answer this many questions, but it really helps level the playing field.

I too, are in “talks” with Native and was looking for more “operational” information about them, I see they formed around a infusion of $170 million, last year, both partner having experience with large Okla producers. I have not seem many notes about how dealing with them has gone.

I have minerals in 19-12N-5w Canadian county, and am entering almost a year long conversation. I got them to offer $1,000/acre (28 net mineral) and 1/4 royalty. A birdie told me that in that area bonus are running from$2k to $9k per acre.

The continued back and forth is the 1) shut in royalty 2) not wanting to include surface (we own) lease with the minerals, 3) post production experience. They did not want to include my clauses for not transferable reclaim cost (had problems with a lower tier producer and closing the prior well) and 4) a guarantee clause that Native would not pay a higher royalty.

So any thoughts would be welcome. We have not hired a oil and gas lawyer…yet.

Thank you

Gerald Kelly

You are wise to ask questions of any lessee. The tract next door to you in 24-12N-6W had offers of $5300 3/16 $5200 1/5 $5000 22.5 $2000 1/4. Dec 2017. I think $9000 would be a bit out of line and would be for a lower royalty. I almost always go for the highest royalty and lowest bonus, since the royalties may be for multiple wells and the bonus is only once. Sec 25-12N-6W pooled for $6250 3/16, $6000 1/5, $2000 1/4 January 2018. I usually start with pooling ask them to match anything that is within the contiguous 9 sections. So your birdie at $2000 1/4 is pretty accurate.

The important clauses are: limit the shut in time to a very short two -three year cumulative time (not consecutive). I ask for $10/ac, not the $1.00/ac. Depth clause, no post production charges, not “enhanced” (most important), no liability, do not warrant title, Commencement of drilling, no option to renew, no top lease clause. Hard to get the “favored nations” clause (no higher royalty). Caveat: I am not giving legal advice, just information that I have found helpful.

If you have surface, lease it completely separately as that is a different kind of lease. Might need an attorney for that one.

Gerald: In 2012 Vanguard Natural Resources, LLC purchased Antero properties in Oklahoma for $445 million in cash. On February 1, 2017 they filed bankruptcy.

The point is, being able to raise large sums of public money does not always translate into being able to establish viable production.

Frank,

Thanks, My point was they are working with others monies-might not be ‘drillers’. But more rolling leases for quicker profits.

Herence looking for folks with field experience with them.

Again thank you for taking the time to respond.

Gerald

Thank you for taking the time to respond. I understand you are not providing legal advice.

Thank you for taking the time to respond. I understand you are not providing legal advice.

I’m with your thinking about choicing the highest royalty, is a larger royalty (then 1/4) even offered?

My lease version (that was rewritten by Native, for the most part) had a shut in royalty of $1k/ac; their response wa $1/ac. I don’t want shut in (95% probability of drilling on our surface. We are closest suited area to access under old Yukon proper, including existing hp gas collection pipeline). Thanks for a ’market rate’ for shut in. Will include the total/cumulative language, had not thought of that.

Native gave and will warrant title and any cost defending it, provided a liability clause, no option, provided a depth clause and agreed to my ‘rig capible of drilling to completion on site to start secondary term.’ Pleased with all most all the clauses.

Just the post production clause/‘Leasor will not receive a price greater then Leasee’.

Again thanks for your time, knowledge and experience.

Gerald

You are suggesting a binary choice; “drillers” and “rollers.” There is [at least] a third choice, those operators who drill with other people’s money with the primary goal of making a profit off of operating the well as opposed to making most of their profit off of the sale of oil and gas.

1 Like

Frank,

Thank you for being much more complete, and thorough then I was.

There are not just several different types of “plays” (ie, participating interest, working interest, producing interest) and some large actors, can do all three at different times.

Thank you again for your insight.

Gerald