My sister in law told me that they are non-participating mineral rights owners, but that they don’t have a say in how the minerals are leased. Does that sound right? They have received royalty interest payment because Browning Oil has decided to start drilling. Can someone please educate me on this?

Im sorry she said its a non-executive mineral interest.

Generally, NPRI rights are entitled to a portion of the royalty revenue but not the other rights associated with the mineral estate. The executive rights holder executed an oil and gas lease that established the royalty rate for your interests. Should that lease expire and a new lease be negotiated, your NRI decimal could change. Most operators have the NPRI owner ratify the lease for pooling purposes if that is necessary as I believe some case law establishes that NPRI owners cannot be pooled without their consent. You should review the division order against your records to ensure your NEI is calculated correctly. Let me know if you have any questions!

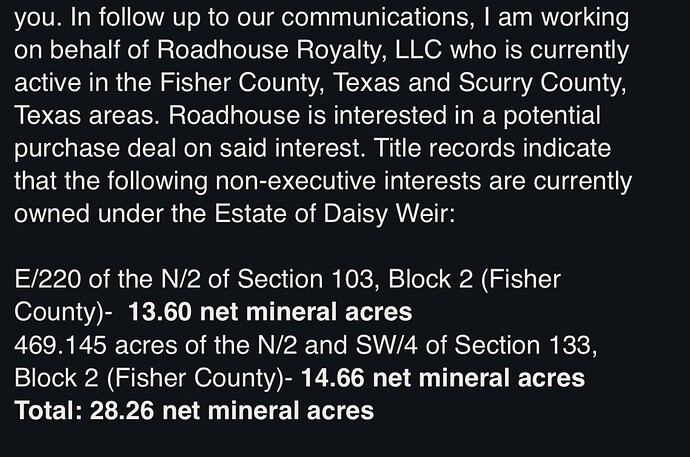

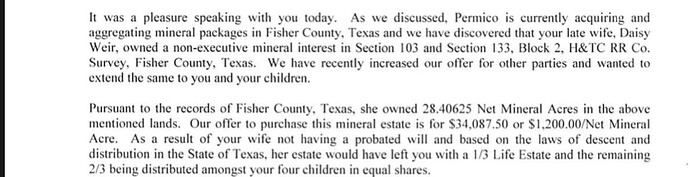

This is all of the information I have. However, this was an offer given 3 years ago. The information I have picked up from reading some of these forums is that they can negotiate rates as they are the heirs of these mineral rights, not the land. Am I understanding this correctly? I’m sorry if I sound lost, truthfully, I’m not too aware of how these things work. I never even knew that such thing existed. Pardon my ignorance. Any and all help is greatly appreciated Jimmy!

I found this, but nothing is in any of their names! Drilling Permit (W-1) Query (texas.gov)

Not a lawyer, but my understanding is, in Texas, if you own a non-participating mineral interest you have the right to receive royalty payments if there is production, but the ability to negotiate the mineral leases and to receive any lease bonus payments is held by the party who owns what are called the executive mineral rights.

Mineral rights start out as a “full package” that includes both the leasing (executive rights) and the royalty rights, but through sales or other transfers of interest the rights can become separate, just like 100% mineral interest can end up divided into many fractional interests.

Use the Looking Glass feature at the top of the page and you’ll find lots of previous discussions about non-participating mineral interests.

Dusty1 - I am a Texas lawyer and your post is correct. NPRI owners share in royalty payments but do not sign Oil & Gas Leases or receive Lease bonus payments.

Appreciate the confirmation.

What if the person who owned them passed away? If you look at the pictures I uploaded… my mother in law passed away back in 2013, but her husband and my husbands 3 other siblings inherited those royalty rights! So just to confirm they have royalty rights if they are producing, but not to the mineral rights?

I think you should find the deed that created the NPRI. You can search the county clerks website or use Texasfile. The language is very important to know what % was retained, if it is fixed or floating. I recently had an encounter where a non-participating (aka non-executive) interest in 1/2 the bonus monies was retained. You can search under NPRI on this blog to learn more about it, and especially about if/ when you would want to ratify a lease.

@DanDaMan I’m sorry for your loss by the way. I used a Parcel ID and legal property description to find my records. If you have any tax records, that information will be on there.

The lease documents your looking for might be in the name of an Estate or Trust. It could be in the deceased’s name still. If the property passed through probate, the records would likely be filed in court. You could search the court records in the jurisdiction where probate was filed or call the clerk of court, maybe ask the person who started the probate proceedings.

Yes, it would be both. A mineral owner holds a sort of property ownership in subsurface hydrocarbons, and the right to obtain payment for the use of those minerals.

First of all, 1/3 interest is better than nothing. I have done lots of probate work in Florida, and I just closed probate of my grandmothers estate in Texas. What was indicated to you might not even be true. intestate is a lot more complicated and depends on many factors-including the age of the children, whether they were children of you and your wife, and their interests in the mineral rights. They might agree to disclaim their interests while you’re alive so that there’s a higher %, increasing your negotiation strengths.

For the mineral right powers, it all depends on the terms of your mineral lease agreement with the Oil Company. I would reach out to them (or the Texas State Offices in Dallas) and see if they can provide you with a copy.

The term “non-participating” generally indicates a lack of management or voting power, but it really all depends on the contract terms. If I learned anything from law school, it’s that there’s always potential for negotiation.

Still, from what I have seen, it’s common for the lease operator to hold wide discretion in leasing or assigning the lease to other companies. I am a surface owner and majority % mineral rights owner, and my lease is frequently transferred between operators without notice.

As noted above, if you want to negotiate your income, the division order is a great place to start. This is the document that allocates your distributions while the lease agreement provides the legal rights and duties of the parties. The last time I checked, there are regulations that require division orders to be updated within a certain time period.

In oil and gas law, the mineral property is composed of five essential attributes: (1) the right to develop (the right of ingress and egress), (2) the right to make decisions affecting exploration and development of the mineral estate, (3) the right to receive bonus payments, (4) the right to receive delay rentals, and (5) the right to receive royalty payments. These rights are either retained or transferred at the time of sale and are identified in the transfer deed.

The Executive Right is the right to make decisions affecting exploration and development of the mineral estate. This includes the right to execute an oil and gas lease, which is both a contract and conveyance of the subsurface mineral estate. The Executive Right owner has a fiduciary relationship with all the other mineral interests owners and cannot obtain a personal benefit that is not shared with the other owners.

A lease is a contract with negotiated terms. A division order" is an agreement signed by the payee (interest owner) directing the distribution of proceeds from the sale of oil, gas etc.

In Texas, a division order does not amend any lease or operating agreement between the interest owner and the lessee or operator or, any other contracts for the purchase of oil or gas. You cannot negotiate new terms that are outside of the original agreed to lease. Complete leases are typically not not filed in Texas deed records. Many companies file only a memorandum to protect the negotiated terms.

In Texas, Division orders are binding for the time and to the extent that they have been acted on. If notice is given that settlements will not be made on the basis provided in them, they cease to be binding. DOs are terminable by either party on 30 days written notice. They are generally updated only when the payee’s interest is changed. As an example, until production ceased in 2015, our family was receiving payments under the original DOs signed in 1974.

This topic was automatically closed after 90 days. New replies are no longer allowed.