I own land and minerals (.075/320 acres) at Block 36, section 26,T2N in Martin county. I would so appreciate anyone that can give me “straight up” talk regarding this area.

- Going lease bonus/acre?

- Selling price /acre?

- Average volume comparison between vertical and horizontal wells and the deletion rate (esp horizontal)?

- Are offers to buy higher with no lease, leases or current drilling?

Thank you …Ginny

I honestly don’t know what current lease rates are. I’d guess sub $10k/acre for 25% lease. But that is a guess.

On the buy side. If you are under a ton of permits, which happens in some places nearby, probably selling price is $20k/acre at 1/8th royalty ($40k/acre at 1/4th royalty, etc). 36 T2N is mostly a blank slate. If you are not under permits, and you are under someone viewed as a slow developer, likely 60% of that. I’d say yours is closer to the lower end because it looks like Pioneer is the operator of Sec 26, and they have so many wells to drill that its hard to feel optimistic that they will get to any particular spot very fast so I’d guess you’d get offered less.

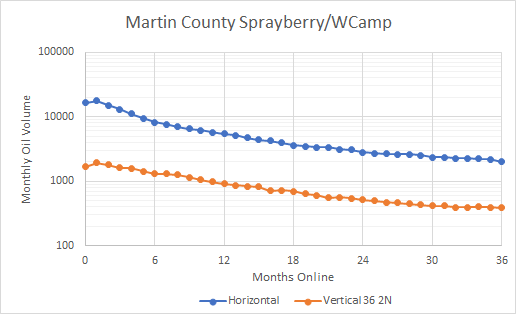

Volume comparison: Horizontal wells are 8-10 times as good, on average, at the start. They decline a good bit faster the first year or so and then decline at more or less the same rate as a vertical. Chart of average Martin HZ well vs the average vertical well in 36 2N. Semi-log scale so may be hard to read.

Unleased acreage should go for more than leased acreage. Current drilling should make things go higher also. Maybe I’m not following you, sorry.

Hope some of that helped.

Thank you so much for taking the time to respond! Yes, this is what I was searching for.