I signed DO with XTO 1st Nov 2021 two wells, LOHAN 9-1 and 9-2 in Sec 9 T2N block 35 and have not received any money yet. Have small interest 1-2 nma. Now have offer to buy my interest. The company says the lease has recently been permitted for horizontal oil and gas well. What are minerals selling for in this area? J. Cram

See other answer. Depends a lot on the status of the acreage.

For BLANK acreage in this area (totally undeveloped white space) : $15k-20k per NRA.

For acreage with Permits or DUCs (wells drilled and waiting to be completed). $25k-35k+ per NRA. Depends on how many wells. If its 13+ wells per half mile wide unit, it’s up at the high end. If its 8-10 wells per half mile wide unit its near the low end.

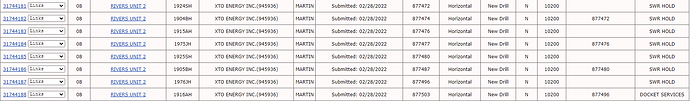

Yours has a new well and is likely going to get permits. Oh hey, look, XTO already applied for permits, ooops I didn’t check prior. So yours is probably around $25k/NRA

NRA not NMA. Hopefully you can convert back and forth (it’s easy).

I like math. I have a lot of time on my hands. I don’t know anything for certain.

thx for help. I take it the nra is your % on the DO you signed.

My other post on your other thread didn’t go through. Had a map and some more detail.

Your NRA is your NMA times the ratio of the royalty rate divided by 1/8th. That sounds complicated but its not.

i.e. its a measure of how many 1/8th royalty acres (12.5% roy) worth of revenue you have

So it you are leased at 25%, you have 2 NRA per NMA (25/12.5) Leased at 20%, you have 20/12.5 = 1.6 NRA per NMA etc

So if you are leased at 25% and some random schlub tells you its worth $25k/NRA, they mean its worth $50k/NMA.

So at most you would get $100K. Assuming no cost basis you’d net between $85,000 and $76,200. Those wells will produce an amount that is likely double the $100K at say $75 per BBL oil.

If $75K to $85K today can change your like or the life of a loved one in a dramatic and positive way, take the dough.

If the cash is going to sit in the bank, or be used to but something like a car or truck you don’t need (a fifth wheel w ii you’d be different for instance if that meant you could travel everywhere and experience life in a more expanded way…u get the drift).

But if money isn’t gonna be used “correctly”, then let it ride and soon you’ll be getting $4K to $5K a month for several years and you can then use that money to dollar cost average into another insetable asset.

My $.02.

Todd A. Engel

Thx for your help and insight. Will keep minerals and pass to heirs. J Cram

Glad to help. Been doing it for 34 years and now happy to offer up insights for free. I tell you if heirs are your time horizon, nothing better than to jump in and set up a vanguard account and having oil checks go straight to a few growth and value mutual funds that will go to heirs. Aassuming no taxable estate, otherwise gift now and structure so you can ensure royalties are invested and not spent. A good cpa can show u best vehicle to do that. But LLC or Trusts is the direction. But ONLY if facing taxable estate. Otherwise keep in your estate.

Cheers.

This topic was automatically closed after 90 days. New replies are no longer allowed.