Midland Basin maps will come up in search - keywords: tier map, midland basin, names of producing zones, etc. Sorry, but I found some along the way but did not save except for the last one in this post.

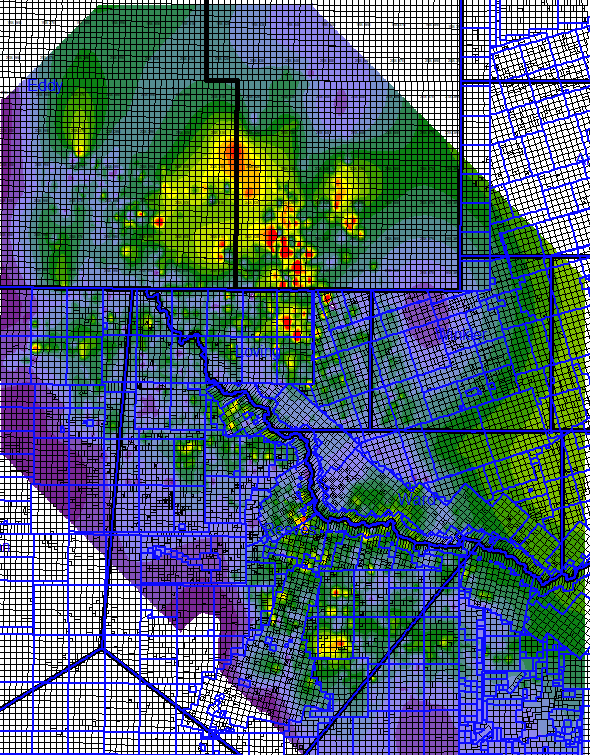

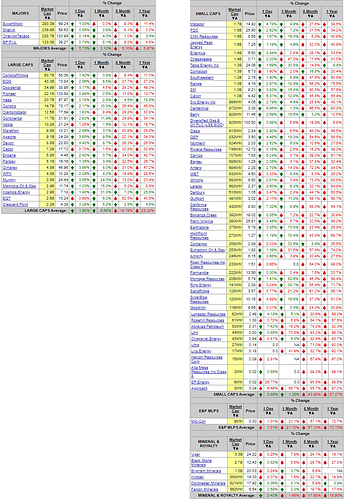

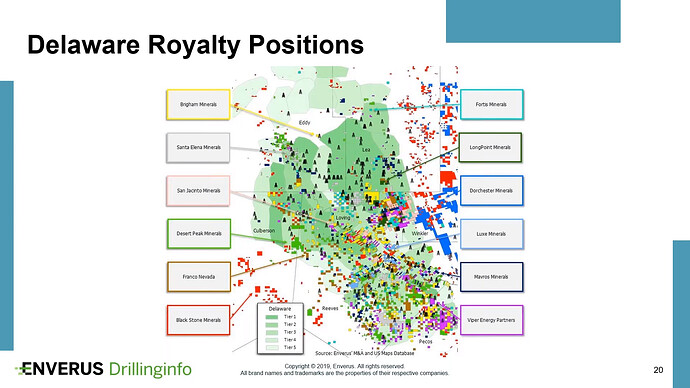

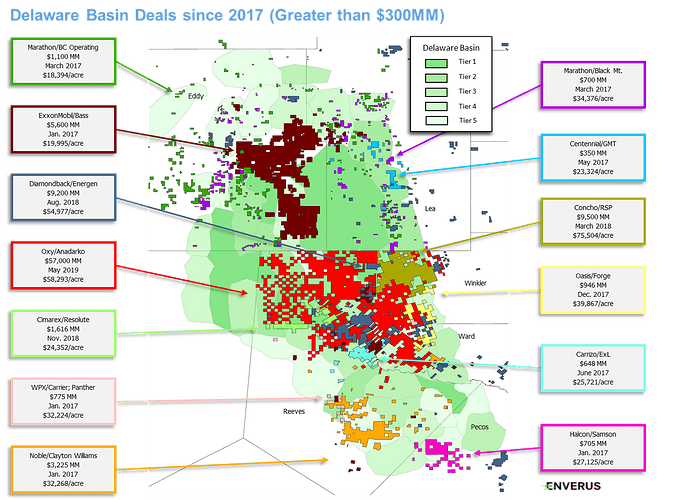

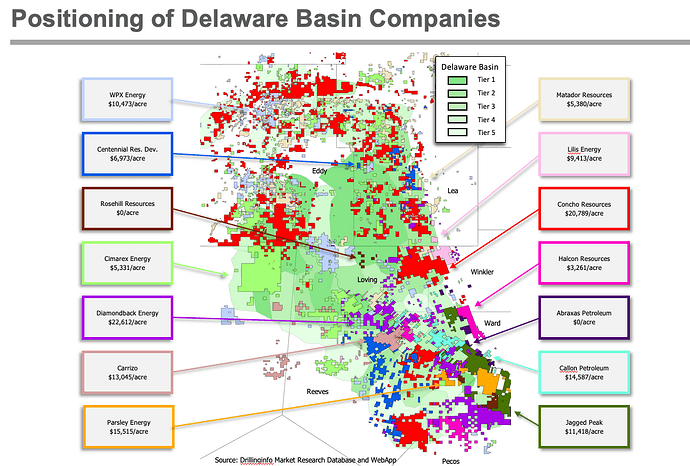

Here are two more Delaware Basin tier maps. They appear to be using the same base as the one Armadillo posted of Delaware Royalty Positions.

.

Thanks to all who chimed in on this question. I understand much more now. It does appear that an individual company’s tier rating is based on their best subsurface analysis combined on what they might want to present publically . . . this basin is so drilled out (at least in the upper Wolfcamp zone) probably their annual report of tier holdings can not be overstated too much.

I am assuming the maps we have seen are for Wolfcamp A and one might assume that what they are calling Phantom Wolfcamp would track closely to Wolfcamp A.

For Wolfcamp B, C and D; we know D has a basal unconformity and is actually not Permian but Pennsylvanian however from there up it is all conformable and since basin influencing tectonics was the same until the end of the Wolfcamp one would assume the tier maps we are looking at for the upper A sequence would be tracked by the lower sequences . . . I guess if and when more of the deeper B is drilled we shall begin to see.

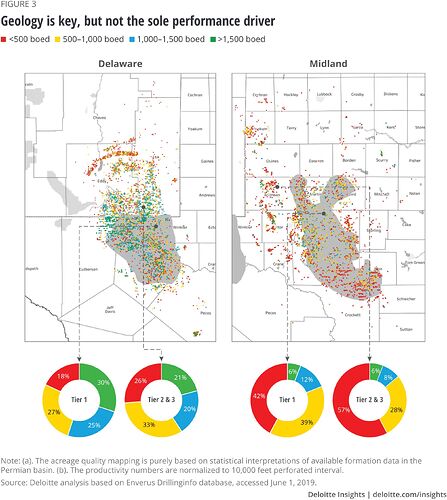

Regarding if a mineral owner is out of luck by not being under a Tier 1 location, this is from a Deloitte report dated, 23 October 2019:

" Formation matters, but how much? Superior formation quality is a notable value-add but not the sole performance differentiator in the basin—45 percent of wells in Tier 1 zone had a well productivity <1,000 boed per 10,000 feet perforated interval."

and,

" No straight answers: A better combination of formation type and engineering design seems to explain the Permian’s superior performance, but shale’s nonlinear response to completion parameters makes it challenging to pinpoint answers."

So, according to Deloitte, those not in Tier 1 areas may still have as good a well as one in a Tier 2/3 area. Here is the Deloitte map to support that statement, it shows, by their analysis, that Tiers 2/3 statistically have made quite a few nice wells.