I need to know if 500.00 NMA for T17S, R37E Section 13 NW/4 3/16 Royalty is a reasonable offer? Thanks…

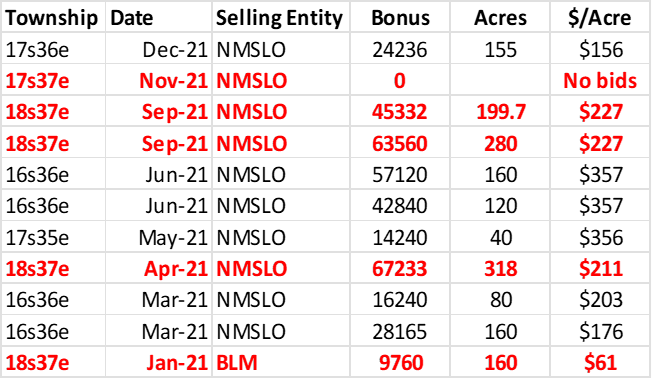

Regurgitating from another thread, here were results I found for state/fed lease sales near this area in the past year. Those are 20% roy (state) and 12.5% roy (Fed). So, yeah, I’d say its a reasonable offer. I have zero insight into what somebody would be trying to develop there.

Thanks MNoilboy I appreciate your information.

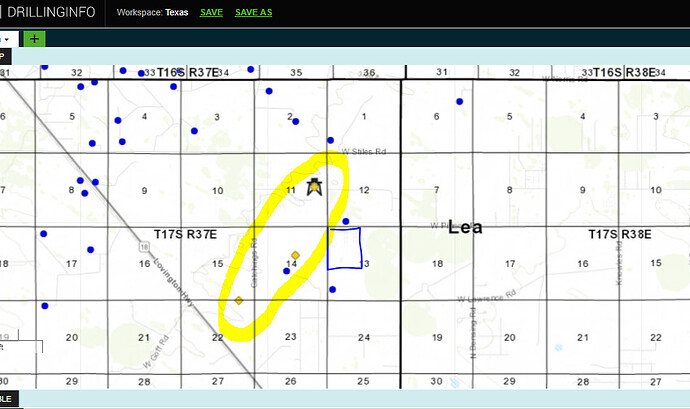

I would not accept less than 25% in the Permian Basin. It appears Matador is doing a lot real close to your tract, which is the area I circled. The Nov/Dec 2021 U.S. Lease Price Report says the most common lease bonus for N/2 of Lea is $350/acre, so $500 may be fair. Hopefully someone else has personal experience in the area.

Yup. Huh. Don is correct, Matador is drilling a Penn Shale (I assume Strawn) vertical well in Sec 11. Old school exploration/extension drilling in the age of HZ wells seems an odd thing to do, but learn something new every day. $88 oil and all.

The blue dots in Sec 13 and 14 are old Humble City Strawn wells operated by Fasken.

Can always ask for more royalty or bonus, but based on Yeso experience sub 25% is pretty standard on the sketchy northern margins in New Mexico.

Thanks Donald_Skotty I will go back to him with a little higher ask for royalty.

Thanks again NMoilboy You guys are a big help to those of us who know very little about minerals.

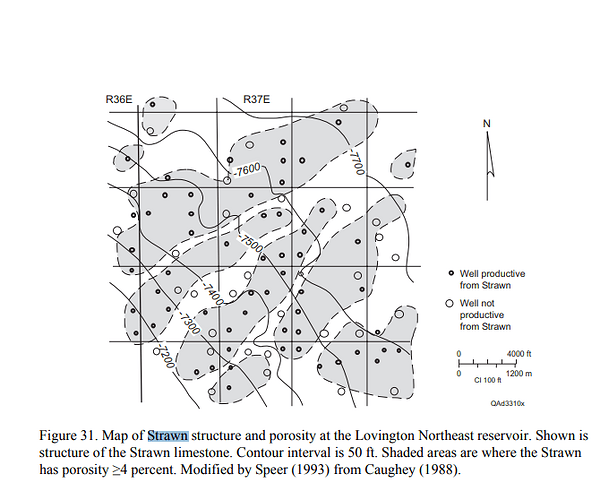

“Matador previously completed a successful vertical test of the Strawn formation in the eastern portion of its Twin Lakes acreage in 2016. This well, the Olivine State 05-16S-37E TL #1 (Olivine State #1) well, has an estimated ultimate recovery of approximately 250,000 BOE (80% oil). Matador estimates that vertical Strawn wells—like the Olivine State #1 well—can be drilled and completed for between $2.5 and $3.0 million in this area, resulting in strong investment returns. Matador has previously booked and maintains proved undeveloped reserves associated with a number of Strawn locations in the eastern Twin Lakes asset area. The Company is evaluating the potential for additional vertical well drilling in the Twin Lakes asset area in the future, although with a secondary focus to its primary asset areas in the northern Delaware Basin.” Matador Resources Company Announces Plans to Reduce Drilling Activity and Provides Operational Update

Could vertical wells be being drilled because the targets are like golf greens on golf courses and unlike a resource play the tee boxes and fairways would be expected to be non-productive? “The larger Strawn reservoirs are internally complex and exhibit intricate porosity variations (fig. 31).” Image and quote are from "Play Analysis and Digital Portfolio of Major Oil Reservoirs in the Permian Basin: Application and Transfer of Advanced Geological and Engineering Technologies for Incremental Production Opportunities Final Report Reporting Period Start Date: January 14, 2002 Reporting Period End Date: May 13, 2004 Shirley P. Dutton, Eugene M. Kim, Ronald F. Broadhead, Caroline L. Breton, William D. Raatz, Stephen C. Ruppel, and Charles Kerans May 2004

I’m impressed, nice find

Is this an offer to “buy” or “lease”? Your original question reads like an offer to buy, but the responses read like comparing offers to lease.

It’s a lease. I have asked for a little better offer…we will see what they think.

I would counter with 25%, see what they come back with — 20, 22.5 or 25.

I did counter with 25% or a better bonus. They are going to see what they can do and get back to me. I don’t mind waiting. Thanks for your input!

This topic was automatically closed after 90 days. New replies are no longer allowed.