Lea County is prime territory for leasing and drilling right now. Eddy County is also seeing leasing and production, but it depends where in the county your land is located.

I have ORRIs in 24S, 26E. My interests are southwest of Carlsbad. One new well is producing on my land in 24S, 26E, and a huge well came in about 780 feet south of my interests. Another well is currently being drilled on land that I have an interest in.

My brother sold part of his net royalty acres in 24S,26E for about $7,000 an acre earlier this year. I am holding out for more. NRAs are generally more valuable than working interest acreage, because the buyer doesn’t pay drilling costs.

You are 6 miles north and 1 mile east of my interests. My impression is that my land is sort of the northern and western edge of the Delaware Basin play, but you should get feedback from professionals. If you are part of the Delaware Basin play, $1500 is definitely low. 80 acres went for $14,000 an acre in 24S, 26E back in December, but that was federal land with only a 12.5% royalty.

I recommend you go to the New Mexico Oil Conservation Division website and search for wells in Section 18, T18S, R27E. You can search with those 3 parameters at:

https://wwwapps.emnrd.state.nm.us/ocd/ocdpermitting/Data/Wells.aspx

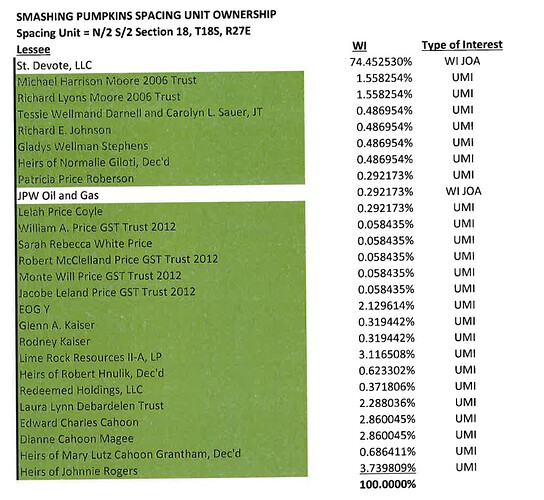

I did a quick search and turned up 27 wells or permits in section 18. The most recent was drilled in 2014, but it looks like Lime rock Resources has permitted 4 wells as recently as May.

I think you can reasonably ask for more money. If you’re part of that Lime Rock play you should be in a good position to negotiate. You may also want to reach out to other mineral owners to see what they got. All of the new wells in section 18 bear the name Leavitt. I’d talk to the Leavitts if you can.

Remember, though, the royalty is where the real money will come from. 25% is great. Best wishes.