Greetings, Very first post here, not too familiar with mineral rights leasing. Rights were inherited from my grandparents, on land where nothing has been active since before they passed, so this is our first journey on this road. There is an up front per acre bonus + royalty percentage. This sounds straight forward. I am confused how the net (20) vs gross (320) acres works… the oil company says net represents my “interest in the tract”. Does this play into the formula for the royalty? Also, 3 of us inherited the rights, so they have made the same exact offer to each of us in our own name. Is this standard? Is Eddy County an actionable area at the moment or near future? Thanks a lot!!

Never take first offer. Just depends where your minerals are in Eddy Co. to determine value. You need to post Township, section ect. for the forum helpers to chime in. Good Luck!

Welcome to the forum. I moved your question over to the Eddy County forum.

Thank you timmyd! Folks, here are the land coordinates of our tract in Eddy Co: Section 24 Twnshp 17S Range 25E, the following qtrs: E2SESENW, N2S2SENE, N2SESWNE, SWSWNE. Does anyone know…Is there negotiability here?

Ok thanks very much!

Apologies, I was in the process of wring the reply below… should I copy it over to the topic at Eddy County forum as well?

Morning,

Eddy, Cnty is in the heart of the Permian Basin with a lot of activity at present and for the foreseeable future.

In looking at that location there is a field of older wells (70’s & 80’s) operated by EOG to the west of you with quite a few still producing and a good amount of gas activity from the early 2000’s in the sections south of you. Your particular section only has a couple of plugged gas wells though.

We typically counter initial lease offers with a high bonus request (letting them negotiate us down), a 25% royalty, a specified shut-in payment/acre, a short term (2-3 yrs w/ no extension), royalties paid with no deductions for gathering, marketing, transport, etc (essentially allowing only req. taxes to be deducted) and specific Pugh clauses to ensure unproduced minerals are released if not part of a producing well. We always request to use our own lease document which we know has been written and reviewed with our best interest in mind. The operators then edit our document for content that is negotiated. We often get most, if not all, of our requested terms and more often than not meet in the middle on bonus.

Each of the individuals with mineral interest will need to have a lease in their name but you can negotiate all three with the same terms, finalize the document and then create a unique version for each of you.

I would definitely seek advice and review of terms from an O&G attorney in the area to make sure everything is done correctly. Many lawyers, will have a standard mineral owner document that can be used as a starting point.

Good Luck!

Back to your original post:

The gross would be the size of the tract. The net would be your share of the tract. So if it’s half of a section (square mile) it is 320 gross acres, and if you own 1/16th of that, you own 20 net (mineral) acres. Not a specific 20 acres, just an undivided 1/16th of that 320 acres.

You would get a bonus equal to 20 acres times the bonus per net mineral acre. Your royalty rate would be whatever they offer…for that 20 acres. How much you would get paid in any given well would be equal to the % of your 20 acres in however much land was dedicated to the well times your royalty rate.

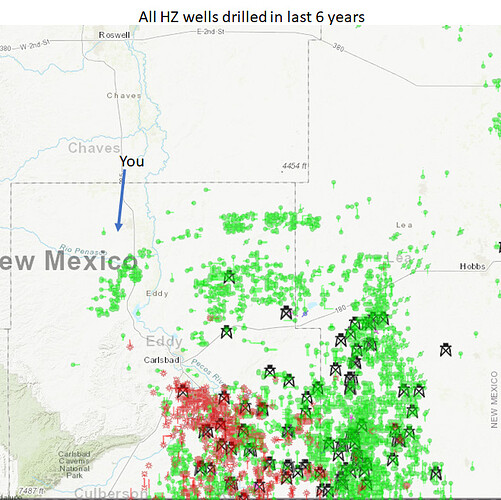

Its standard to make a separate offer to each separate owner. Eddy County is a big county. Some of it is fantastic. Some of it isn’t. Here is where the rigs (rig symbol) currently are in Eddy County and where horizontal wells have been drilled (green/red dots).

Simply put, you’re on the very edge of things at best. I’m a little surprised anybody is attempting to get you to sign a lease. But just to have realistic expectations, I would not expect much on bonus. But you can always try to get more than offered.

Amusingly (to me) this is about 1000m from my parent’s house.

First, understand what you own and then begin the process of negotiating the lease agreement (great way to learn for free). Remember, you do not have to sign an agreement unless you chose to. Make sure you understand what you own, evaluate at least 2 or 3 different offers, and work with a group or person that you enjoy. Online you can find many helpful tools on mineral ownership and lease agreements. The attorney route isn’t always the answer, just saying.

Many individuals suggest calling or using an attorney right away, I find this flawed when dealing with mineral interest. Every situation is different and there is not a blanket answer. Attorney’s run a business too and they will lose out on business if they do not have you as a client. Determine the cost associated with using an attorney and find out if it’s beneficial. Remember, If you sell, the attorney will no longer be able to bill you for the work performed because you are no longer a client. So, why would they ever advise you to sell even if it’s beneficial? They run a business, do not forget this point. If you own numerous mineral interests, then have a landman or attorney review the group. Do not miss out on the opportunity to maximize your asset by either selling or leasing. Be smart and many times attorneys are not the answer, but a lot of times they are the answer.

Thanks to everyone for the great information you have shared here with us! Very informative!! We will spend some time this weekend combing the contract over more closely… I also have O&G attorney friend ( in unofficial capacity from OK) looking everything over. Once again thanks for sharing the wealth of knowledge here!