Great information. Thanks

You’re welcome. The more information we all share, the better.

The initial offer we received is:

-$100/acre -2 year primary term -option to extend for 4 years @ $250/acre -20% royalty

I view the $100/acre for 2 years as essentially an option. Knowing that Key intends on flipping their leasehold, it’s a way for them to lock up the acreage for cheap and their purchaser would end up paying the extensions since it’s realistically not going to get developed in 2 years.

Does anyone else have additional info on other lease offers or negotiated terms received by owners in this area?

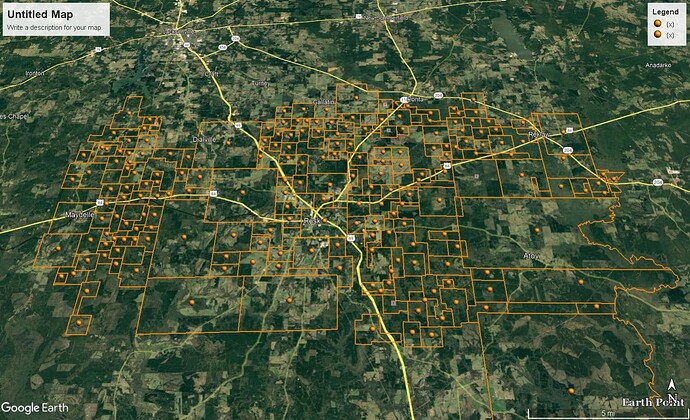

Key recorded 31 more lease memos on March 18. Only one new survey and about 767 acres, bringing their totals to 536 leases, 195 surveys, and just over 52,000 gross acres.

If the target is indeed Bossier/Haynesville, then perhaps this newspaper article provided an early indication:

Greetings,

I stumbled across this forum when doing a Google search of Key Exploration LTD. Apparently there is a parcel of land in Cherokee County that my family has had some connection with for many, many years. My father had 1/8 mineral interest in this land and when he passed a few years ago, his interest passed to my two siblings and I, as well as to my stepmother. We have all been sent letters from KEL requesting to lease our mineral interests of A-561, Jonathan Medford Survey.

I’m reading the contract to try to understand what this is about as I’m totally clueless here. I saw a recent post that seeks details of other lease contracts so I’m posting mine here.

- Bonus payment of $100 per net mineral acre for a primary term of 2 years being 118.50 (acres) x 1/36 (?) x $100 = $329.17

It includes the following additional provisions:

- 3/16 royalty

- Hard/surface mineral exclusion

- Pugh clause

- Primary term extension option of $250 per net mineral acre for an additional 2 years

- Surface damage clause

I’ve not signed this yet as I need to properly review the details first, but I’m book marking this thread to follow going forward. This is a little fascinating…

Thanks for the information you shared. As you could tell from previous posts several of us have been curious about what was behind all of the leasing activity but until recently had no direct knowledge of the terms being offered…

Couple of observations on what you posted…If your dad had a 1/8th mineral interest that is now divided into four equal interests it seems like each share should be a 1/32nd rather than a 1/36th. It’s interesting the offer you received didn’t start with a period covered by a geophysical permit before the lease term starts like many earlier leases Key recorded. A two year primary term with only a two year option to extend is also better than many others they’ve acquired. Since those options are one-sided, giving flexibility to only the Lessee, most mineral owners try to keep the potential lease term as short as possible.

If possible, each of you would probably be in a better negotiating position if your four family members agreed to negotiate as a group. You could also try to determine the ownership of the other mineral interests in your 118.5 acres, see where those folks stand on leasing, and if they haven’t committed possibly put a larger group together to negotiate with Key.

In any case, you might try countering that initial offer, say based on increasing the bonus to $250/acre during the primary term and 1/5th royalty. They may say no but you never know unless you try.

A similar leasing project seems to be getting underway in Freestone and Leon Counties. A friend of mine just received a lease offer involving mineral rights he owns in those counties. Similar terms to what we have seen in Cherokee: Two-year seismic option followed by a four-year lease.

The lease offer was written on Thorp Petroleum Corporation letterhead.

Interesting. If it’s connected to what’s happening in Cherokee, any guess why they are skipping over Anderson Co this time?

Key Exploration filed 37 more lease memos on April 12, bringing their estimated project totals to:

573 leases in 202 surveys covering 55,000 gross acres

In addition, to the 573 leases, Key has written 384 seismic options, so about 2/3 of the leases are subject to the two-year seismic options. However, that means that 1/3 of the leases filed so far are not subject to a seismic option, so the clock is now running on their primary terms. Quite a few of the leases filed on April 12 have two-year primary terms (and no seismic option), so it is quite possible we will see some drilling permit submissions within the next few months.

Since Key does not intend to drill or operate any wells and as I understand they are looking for a buyer to ultimately develop the leasehold, I would be looking for assignments of their leases filed of record. This would likely be a precursor to any permits filed as the leasehold would be assigned to a company that explores and operates wells. Last I heard from the Key landman, they had some companies looking at their prospect.

This topic was automatically closed after 90 days. New replies are no longer allowed.